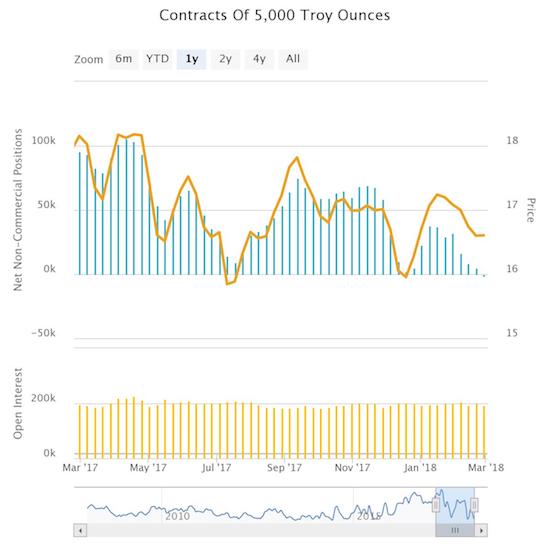

For the first time since at least 2008, speculators flipped bearish on silver.

Speculators actually flipped bearish on silver with a net -1,508 contracts.

Speculative net contracts have trended downward for about a year and approached zero in December around the time the Federal Reserve last hiked rates. Yet I did not think it was “possible” for positioning to go net short since it has not happened since at least 2008.

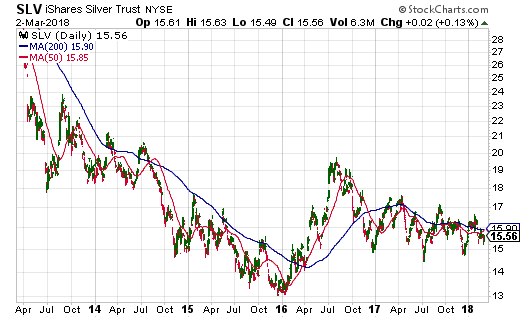

So now I am wondering whether this extreme represents “maximum” bearishness on silver or is the negative sentiment just getting started? This bearish positioning comes at a time when U.S. interest rates are on the march higher and the iShares Silver Trust ETF (NYSE:SLV) is languishing in a near 2-year trading range.

The iShares Silver Trust (SLV) is in the middle of a 2-year trading range after bottoming in early 2016.

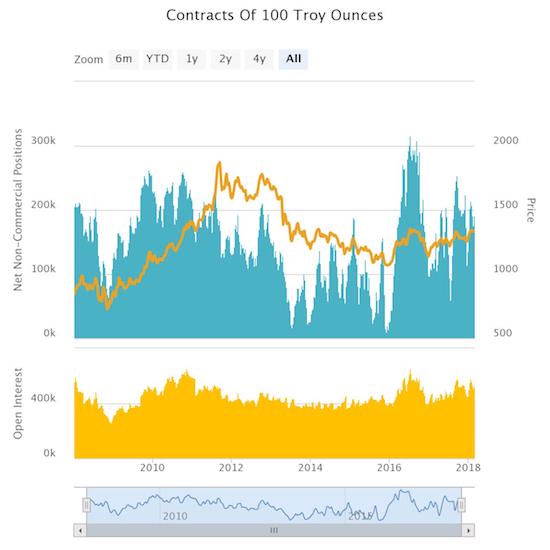

What makes the change of sentiment on silver particularly stark is that speculators are still quite bullish on gold.

Gold speculators are in the middle of another very bullish cycle on gold.

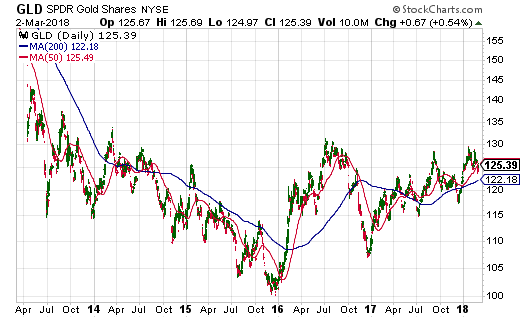

The SPDR Gold Shares ETF (NYSE:GLD)) is also faring better than SLV. GLD bottomed in late 2015 and is trading just a bit off its recent highs.

The SPDR Gold Shares (GLD) is still trending higher since the late 2016 low. But the 2016 high has been tough to crack.

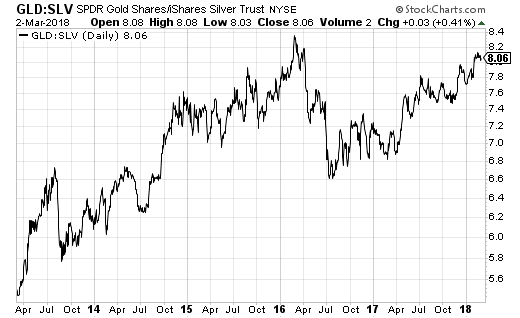

The result is a GLD/SLV ratio that is reaching a 2-year high.

The GLD/SLV ratio is reaching a level last since in early 2016.

At this point, I think a pairs trade is in order going long SLV and short GLD to layer on top of my core positions in both ETFs. While I am loathe to short gold in any form, I think a pairs trade makes sense given the abiding uncertainty around how traders and speculators will position precious metals versus all the macro catalysts in the market: trade wars, rising rates, stronger inflation, stronger global growth, tightening monetary policies, and elevated volatility in financial markets. If the big move is to the upside for precious metals, I think SLV will play serious catch-up and offer outsized upside potential.

Be careful out there!

Full Disclosure: long GLD and SLV shares