Stocks vaulted higher (once again) yesterday, with many indexes at or very near lifetime highs. There certainly may be gasoline left in this most recent rally, but I wanted to point out some important thresholds in emerging markets that could mark a point of exhaustion, since these markets will be hitting their own lead walls of overhead supply.

First, very broadly, there is the emerging markets. I’ve placed a marker showing where SlopeCharts indicates the point of resistance for the iShares MSCI Emerging Markets ETF (NYSE:EEM).

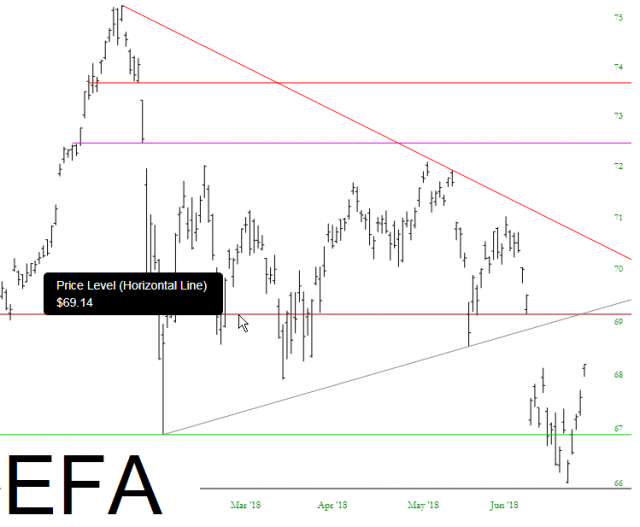

In a similar fashion, here is the fund representing the iShares MSCI EAFE Fund (NYSE:EFA) (basically worldwide developed markets without North America muddying things up):

Hand-in-hand with this is the iShares JPMorgan USD Emerging Markets Bond Fund (NASDAQ:EMB), which itself has been rocketing higher for weeks. It may well be that it has already reached its own exhaustion point, however. I’ve laid down the 50, 100, and 200 day exponential moving averages to smooth out the downtrend representation.