Mastercard’s chart isn’t perfect…But it’s pretty close.

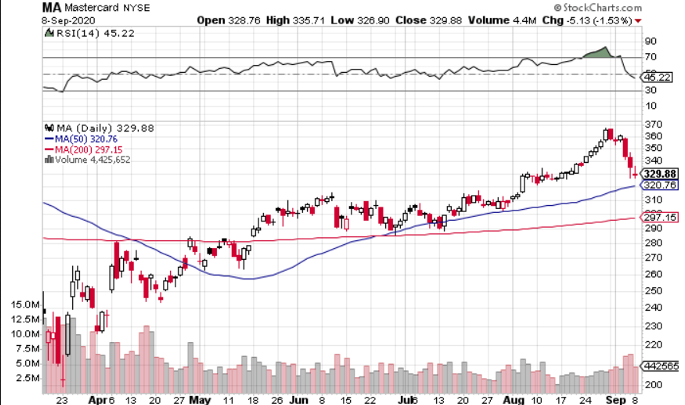

After basing between around $285 and $315 a share during June and July, Mastercard (NYSE:MA) broke out on above-average volume in early August.

The breakout pushed shares to around $330, where they took a breather for a little over a week. Then, MA embarked on an 11-session stretch with just one daily loss—it took shares to all-time highs of nearly $370 a share.

The 2+ week period took shares well into overbought territory on the RSI, so shares were due for a pullback. And with the general market, which was also due for a pullback, dipping over the past three trading sessions, it wasn’t surprising to see MA follow suit.

Now, Mastercard is trading right around the breakout point of the June/July base, just above the 50-day moving average. Yesterday, it traded into Friday’s range, holding the lows from the previous session.

This is a great buying opportunity because you can get in around $330 and place a stop-order around 10-15 points below, just under the 50-day moving average. That would give you a downside of just 3-5%.

My only bone to pick on the chart is the above-average volume on the first day of the dip. It was actually good to see higher volume on Friday, as you want high volume on a reversal day, even if the stock closes down.

But overall, it’s a great-looking chart. There’s a good chance MA holds around $315-330, and your downside is very limited if it doesn’t. And there is very little resistance overhead – particularly if shares can break above $370.

Mastercard’s chart is looking great, but how are the company’s prospects?

Tough Q2… But Better Days Ahead

Mastercard’s Q2 revenue came in at $3.34 billion, beating estimates of $3.25 billion, but down 18.9% YoY. Adjusted EPS were $1.36, beating estimates of $1.16, but down from $1.89 in the year-ago quarter.

There was good and bad in the report.

The good:

Mastercard’s “other revenue” category was up 12-14% (on a constant-currency basis). This category includes cybersecurity, data analytics, and other services. With the coronavirus causing a massive shift to e-commerce and contactless transactions—more on that later— Mastercard is capitalizing on the trends.

The bad:

COVID-19 killed international travel, which in turn, killed Mastercard’s cross-border volume. While it improved progressively through Q2, it ended the quarter down 45%.

On the plus side (relatively speaking), cross-border volume was down 35-37% each week in August.

2020 is a Blip on the Radar

Mastercard is trading at just under 50x forward earnings, which sounds expensive until you consider the company’s recent history of high-growth and projected return to high-growth in the near future.

Mastercard’s revenue grew 20% and 13% in 2018 and 2019, respectively.

And Mastercard is projected to record revenue growth of 19.2% in 2021 and 15.2% in 2022. EPS is expected to grow even faster, at 30.2% in 2021 and 21% in 2022.

The Trends Are Mastercard’s Friend

On its Q2 earnings call, President Michael Miebach said:

“According to our latest COVID-19 consumer impact study, over 70% of consumers plan to continue or increase their online purchasing, and approximately 60% believe they will use less cash even after the pandemic subsides. And we are providing digital-first solutions that leverage our tokenization and other digital technologies to meet these changing needs.”

COVID-19 is pushing the world towards a more cashless society, and Mastercard is a beneficiary.

The pandemic is also pushing people and businesses towards contactless transactions, which Mastercard noted “represented 37% of in-person purchase transactions, up from 28% a year ago.” MA is well-positioned to capitalize on this trend as well.

Mastercard is Recession Proof…In a Way

Obviously, Mastercard has seen declining revenues as a result of the pandemic-related economic contraction. But still, this is an unfavorable environment for Mastercard, all things considered, and the numbers still aren’t that bad.

And now is also a good time to point out how Mastercard’s business is recession-proof:

The company only acts as a payment processor, not a lender. So Mastercard is somewhat immune to the rising defaults that often occur during a recession.

The Final Word

With Mastercard, it’s important not to miss the forest for the trees. The company’s long-term outlook has only improved since the onset of the pandemic. And the short-term struggles, which are beginning to abate, can’t threaten a strong company like Mastercard.

When you combine the great-looking chart and the excellent fundamentals, Mastercard is a strong buy.