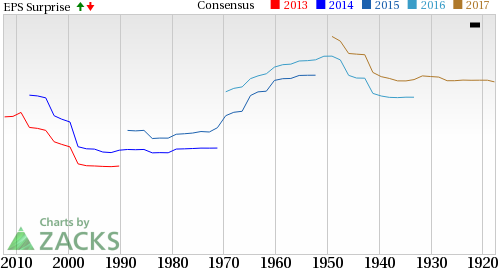

Mastercard Incorporated (NYSE:MA) reported second-quarter 2017 earnings of $1.1 per share, which surpassed the Zacks Consensus Estimate by 5.8%. Also, earnings improved 14.6% year over year.

The quarter witnessed strong growth in both top and bottom lines, fueled by strong transaction, higher cross border volumes and gains from the Vocalink acquisition.

Behind the Headlines

Mastercard’s revenues of $3.1 billion exceeded the Zacks Consensus Estimate by 4.0% and were up 13% year over year. The upside was primarily driven by a 17% rise in the number of switched transactions to 16 billion along with a 14% increase in cross-border volumes. These were partially offset by higher rebates and incentives, mainly due to new and renewed agreements and increased volumes.

About 2.4 billion MasterCard and Maestro branded cards were issued as of Jun 30, 2017.

MasterCard witnessed a year-over-year increase of 7% in total operating expenses to $1.4 billion owing to higher cost components like general and administrative expenses and advertising and marketing costs.

Interest expenses increased a staggering 77% year over year to $39 million.

Financial Update

As of Jun 30, 2017, the company’s cash and cash equivalents were $5.2 billion, down 22% from the year-end 2016 level. Long-term debt increased 2.8% to $5.33 billion from $5.18 billion as of Dec 31, 2016.

Share Repurchase Update

During the reported quarter, Mastercard repurchased shares worth $931 million.

Our Take

Mastecard’s results reflect its strong operating performance driven by continued efforts to provide superior service to its customers. Its acquisitions, investments in technology, a number of deals and partnerships signed with clients across the globe will continue to aid its transaction volume growth thus adding to the top line.

Moreover, increased use of plastic money to replace cash provides ample room for the company to grow. Its strong balance sheet and disciplined capital management strategy are the other positives.

Zacks Rank

MasterCard currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Financial Transaction Service Providers

Among the other financial transaction service providers that have reported second-quarter earnings so far, the bottom line at Capital One Financial Corp. (NYSE:COF) and American Express Company (NYSE:AXP) beat their respective Zacks Consensus Estimate by 3.16% and 0.68%. Discover Financial Services (NYSE:DFS) lagged the same by 3.45%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Discover Financial Services (DFS): Free Stock Analysis Report

Capital One Financial Corporation (COF): Free Stock Analysis Report

American Express Company (AXP): Free Stock Analysis Report

Mastercard Incorporated (MA): Free Stock Analysis Report

Original post

Zacks Investment Research