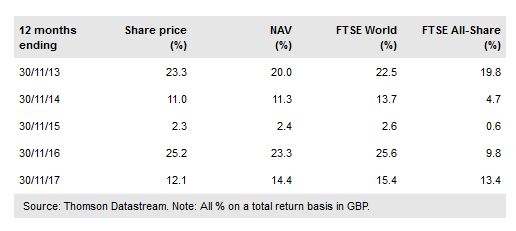

Martin Currie Global Portfolio Trust plc (LON:MNP) has been managed by Tom Walker since January 2000, aiming to generate long-term capital growth. He adopts a consistent, bottom-up investment process to construct a relatively concentrated portfolio of c 50 high-quality, primarily large-cap global equities, diversified by sector and geography. The manager stresses that MNP has lower volatility of returns compared to the average of its peers in the AIC Global sector. The trust adopted a zero discount policy in 2013 and has a progressive dividend policy; its current dividend yield is 1.7%, comparing favourably to its peer group average.

Investment strategy: Fundamental stock selection

Walker seeks companies with the potential for higher margins that generate strong cash flow and high returns, and are trading at a discount to their estimated intrinsic value. In essence, the manager aims to ‘pick winners and avoid losers’. He invests with a long-term view, avoiding the distraction of short-term volatility in the stock market. In terms of geography, the trust’s c 55% exposure to North America is broadly in line with the index, while it is overweight Europe and Asia Pacific and underweight Japan. Considering the three largest sectors in the index, MNP is broadly in line with the benchmark weightings in financials and industrials and overweight technology. Gearing of up to 20% of net assets is permitted, but MNP is currently not geared. The net cash position at end-October 2017 was 2.8%.

To read the entire report Please click on the pdf File Below: