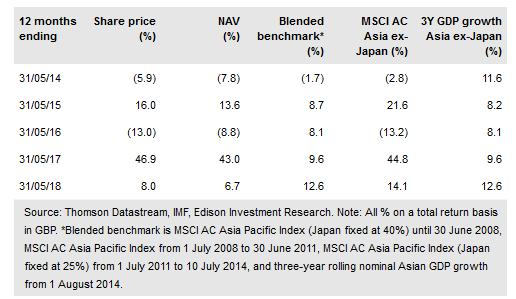

Martin Currie Asia Unconstrained Trust PLC (LON:MACP)aims to deliver returns in line with nominal Asia ex-Japan GDP growth on a rolling three-year basis. It aims to achieve this through a rigorous ‘forensic’ analysis, to build a relatively concentrated portfolio of c 30 high-conviction stocks. This strategy was adopted in August 2014 and has since delivered annualised total returns of 11.6% to end-May 2018, with lower volatility relative to the iShares MSCI AC Asia ex Japan (HK:3010). Following a change in dividend policy in April 2017, MCP’s 4.1% yield is one of the highest among peers, although its discount to cum-income NAV is one of the widest, suggesting scope to narrow over time.

Investment strategy: Rigorous bottom-up approach

The managers follow a rigorous approach, with an absolute-return mindset, to find companies with strong balance sheets, robust business models, and sustainable cash flow growth with reasonable valuations. Unconstrained by index considerations, the manager and Martin Currie’s Asian team conduct over 500 company visits pa and undertake detailed ‘forensic’ fundamental analysis, as well as corporate governance assessments, to help build high-conviction on its potential investments. The companies in the portfolio are typically less volatile than the market, and the strategy aims to offer downside protection.

To read the entire report Please click on the pdf File Below: