Following the recent announcement of dealer portfolio adjustments and the completion of the strategic disposal of Marshall Leasing, we adjust our forecasts to reflect these events. As previously commented, the leasing deal eliminates Marshall Motor Holdings' (LON:MMHM) gross debt and lifts the NAV to £199.5m or 258p per share. It provides financial flexibility to implement the investment programme, including M&A to help mitigate the initial dilution that is seen in FY18e. The dealership closures eliminate losses and reduce turnover by around £40m. Overall, MMH is well positioned as it enters FY18 where market conditions are expected to remain unhelpful.

Balance sheet ungeared entering 2018

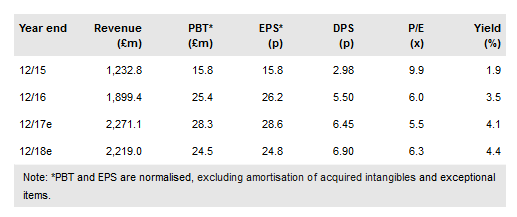

Our FY17 earnings estimates remain unchanged as a result of the disposal of Marshall Leasing (MLL) and the recently announced portfolio closures. However, the balance sheet should end the year debt free as both the asset backed loans of MLL and the £42.5m cash proceeds from the deal are received. Until this strengthened financial position can be put to work for shareholders through both organic investment and new M&A opportunities, the disaggregation of MLL from the financial statements is initially earnings dilutive from FY18. Our FY18e EPS drops 15% to 24.5p from 28.9p. Revenues forecast are 3.4% or £77.6m lower at £2,219m as the MLL sales and the dealership closures are both effectively deconsolidated with similar impacts. Our FY18 Retail operating margin is modestly increased as the dealerships being closed were loss-making. MMH is also now more focused as Retail is the only operating division. We now forecast FY18e closing net cash of £10m, and expect dividend progression to be as previously forecast.

To read the entire report Please click on the pdf File Below: