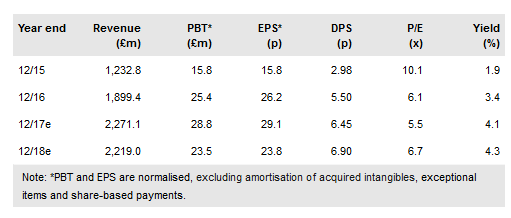

Marshall Motor Holdings' (LON:MMHM) pre-close statement indicates that the company continued its strong performance in 2017, despite challenging market conditions that are persisting into 2018. FY17 results are expected to be ahead of previously upgraded pre- and post-tax expectations, and we have lifted our PBT estimate 2% to £28.8m. We have reduced our FY18 PBT estimate by £1m to reflect slight additional margin pressures. The disposal of the Leasing business has strengthened the balance sheet and leaves the company well placed to implement its growth strategy.

H217 performance

In H1, MMH reported a marginal 0.4% decline in like-for-like new car unit sales to retail customers versus an overall new market decrease of 4.8%. While H2 continued to see declines, falling by 9.2%, MMH maintained its market outperformance largely by virtue of its brand portfolio. Working closely with its brand partners, MMH has been able to deliver to shared objectives. Following a 5.8% reported increase in used unit sales in H1, the company also performed well in H2 supported by a disciplined stocking policy. High-margin Aftersales revenues remained stable with H2 broadly consistent with the 2.3% like-for-like increase reported in H1. We now expect a small year-end net debt position.

To read the entire report Please click on the pdf File Below: