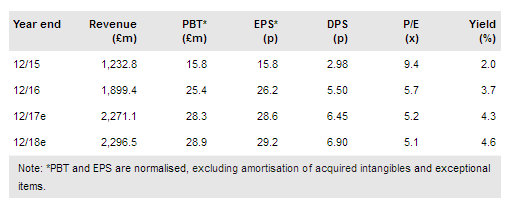

As indicated in the pre close trading statement, Marshall Motor Holdings PLC (LON:MMHM) made good progress in H117, outperforming a weaker UK new car retail market. While uncertainty remains over the direction of end market demand, management’s growth strategy is facilitated by the strengthened balance sheet. Our forecasts are unchanged and assume ongoing market pressure in the second half of the year, with the rating discount to its peers likely to unwind further on any signs of market resilience during H2.

Strong underlying growth in H117

Another record trading period was driven by a combination of both acquired and ongoing activities in Retail. Overall group revenues grew 6.7% like-for-like and Ridgeway’s contribution was in line with expectations. Revenues rose by 43.7% to almost £1.2bn and profit before tax increased 32.9% to £18.6m. Despite margin investment in the used car activities to increase throughput, progress in Retail more than offset the anticipated fall in profit in the smaller Leasing segment. Adjusted net debt stood at £35.1m at the end of the period, representing 0.7x 12-month trailing EBITDA. The freehold/long lease property portfolio of £112.5m represents 145p per share or 71% of net assets (£158.0m or 204p per share). The strong balance sheet allows management to pursue both organic and acquired growth opportunities, and the 19% increase in the dividend is a sign of confidence.

To read the entire report Please click on the pdf File Below: