Marsh & McLennan Companies, Inc. (NYSE:MMC) reported fourth-quarter 2017 operating earnings per share of $1.05, beating the Zacks Consensus Estimate by 10.5%. Earnings improved 18% year over year on higher revenues.

For 2017, adjusted earnings came in at $3.92 per share. The figure not only surpassed the Zacks Consensus Estimate of $3.82 by 3% but also rose 15% from 2016.

For the quarter, Marsh & McLennan’s consolidated revenues were $3.7 million, up 10% (4% on an underlying basis) year over year. Revenues beat the Zacks Consensus Estimate by 3%.

For 2017, the company reported consolidated revenues of $14 billion that rose 6% (3% on an underlying basis) from 2016.

Total operating expenses of $3 billion were up 10% year over year.

The effective tax rate in the fourth quarter was 95.5% compared with 24.9% in the prior-year quarter.

Quarterly Segment Results

Risk and Insurance Services

Revenues at the Risk and Insurance Services segment were $2 billion, up 9% (3% on an underlying basis) year over year. Adjusted operating income also grew 12% to $473 million from the prior-year quarter.

A unit within this segment, Marsh, reported revenues of $1.7 million, up 9% (3% on an underlying basis) year over year. In U.S./Canada, underlying revenues rose 4%. Underlying revenue growth from international operations was 1%, reflecting underlying growth of 5% in Asia Pacific, and 9% in Latin America. This was partially offset by a decline of 3% in EMEA.

Another unit under this segment — Guy Carpenter — displayed revenue growth of 7% year over year on an underlying basis to $239 million.

Consulting

The Consulting segment's revenues increased 10% (6% on an underlying basis) year over year to $1.7 billion. Additionally, adjusted operating income increased 10% year over year to $330 million.

A unit within this segment — Mercer — reported revenues of $1.2 billion, up 9% (4% on an underlying basis) year over year.

Another unit, Oliver Wyman Group, reported revenues of $546 million, up 9% year over year on an underlying basis.

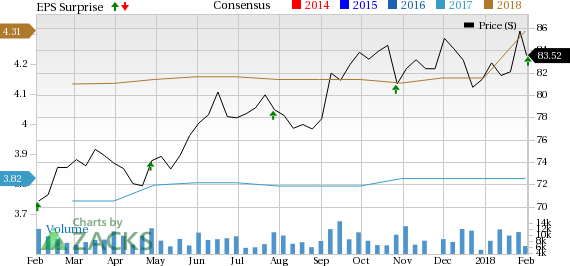

Marsh & McLennan Companies, Inc. Price, Consensus and EPS Surprise

Financial Update

Marsh & McLennan exited the quarter with cash and cash equivalents of $1.2 billion, up 17% from 2016 end.

As of Dec 31, 2017, Marsh & McLennan’s total assets were $20.4 billion, up 12.1% from year-end 2016.

Total equity was $7.4 billion, up 18.6% from year-end 2016.

Capital Deployment

The company repurchased 3.6 million shares of its common stock for $300 million in the fourth quarter.

For 2017, the company bought back 11.5 million shares for $900 million.

Zacks Rank

Marsh & McLennan carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Companies in the Finance Sector

Among other players from the insurance industry that have reported fourth-quarter earnings till now, the bottom line of Brown & Brown, Inc. (NYSE:BRO) , MGIC Investment Corporation (NYSE:MTG) and The Progressive Corporation (NYSE:PGR) beat the respective Zacks Consensus Estimate.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Marsh & McLennan Companies, Inc. (MMC): Free Stock Analysis Report

Brown & Brown, Inc. (BRO): Free Stock Analysis Report

MGIC Investment Corporation (MTG): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Original post