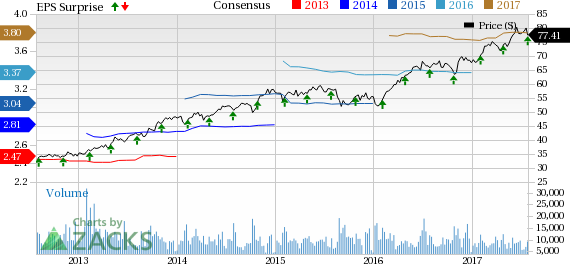

Marsh & McLennan Companies, Inc. (NYSE:MMC) reported second-quarter 2017 operating earnings per share of $1, in line with the Zacks Consensus Estimate. Earnings improved 10% year over year.

Adjusted operating income rose 7% to $788 million in the second quarter.

Marsh & McLennan’s consolidated revenues were $3.5 million, up 4% year over year on an underlying basis. Revenues beat the Zacks Consensus Estimate by 1.2%.

Total operating expenses of $2.7 million increased 3% year over year.

Segment Results

Risk and Insurance Services

Revenues at the Risk and Insurance Services segment were $1.9 billion, up 4% year over year on an underlying basis. Adjusted operating income also grew 9% to $535 million from the last-year quarter.

A unit within this segment – Marsh – reported revenues of $1.6 million, up 4% year over year on an underlying basis. Underlying revenues grew 1% year over year in international operations on 4% growth in Latin America, 3% in the Asia Pacific, and 2% in the U.S.-Canada region. However, the underlying revenues remained flat year over year for EMEA (Europe, Middle East and Africa).

Another unit under this segment, Guy Carpenter, displayed revenue growth of 4% year over year on an underlying basis to $293 million.

Consulting

The Consulting segment's revenues increased 3% year over year on an underlying basis to $1.59 billion. Additionally, adjusted operating income inched up 3% year over year to $298 million.

A unit within this segment – Mercer – reported revenues of $1.1 billion, up 3% year over year on an underlying basis.

Another unit, Oliver Wyman Group, reported revenues of $483 million, up 7% year over year on an underlying basis.

Financial Update

Marsh & McLennan exited the quarter with cash and cash equivalents of $966 million, down 6% from end-2016.

As of Jun 30, 2017, Marsh & McLennan’s total assets were $19 million, up 7% year over year.

Total equity was $7 million, up 13% from year-end 2016.

Capital Deployment

Marsh & McLennan spent $200 million to buyback 2.7 million shares in the second quarter.

The board of directors raised the quarterly dividend by 10% to 37.5 cents per share in May 2017. The dividend is payable on Aug 15, 2017, to shareholders of record as on Jul 27, 2017.

Zacks Rank

Marsh & McLennan presently carries a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Among other players from the insurance industry that have reported their second-quarter earnings so far, the bottom line at Brown & Brown, Inc. (NYSE:BRO) and Fidelity National Financial, Inc. (NYSE:FNF) beat the Zacks Consensus Estimate, while The Progressive Corporation (NYSE:PGR) missed the same.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaries," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Marsh & McLennan Companies, Inc. (MMC): Free Stock Analysis Report

Brown & Brown, Inc. (BRO): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Fidelity National Financial, Inc. (FNF): Free Stock Analysis Report

Original post