Marriott International, Inc.’s (NASDAQ:MAR) proposed takeover of Starwood Hotels and Resorts Worldwide (NYSE:HOT) continues to move further. We note that last November, Marriott had inked a definitive merger deal to purchase Starwood and create the world's largest hotel company.

Recently, both the companies announced that the Saudi Arabia and Mexican governments have given antitrust clearance to their pending merger. Interestingly, Marriott and Starwood have already received the green signal from antitrust regulators in the European Union, United States, Canada and other regions.

Marriott and Starwood now await approval from the Chinese regulatory agency (MOFCOM) and will close the deal as soon as they receive authorization from China. Notably, stockholders of both the companies approved the proposed acquisition at their individual shareholders meet in April. While 97% of Marriott’s shareholders voted in favor of the proposal, 95% of Starwood stockholders approved the merger.

Per the approved deal, Starwood’s shareholders will receive 0.8 shares of Marriott along with $21.00 in cash for each share they hold. In addition, they will receive a separate consideration from the spin-off of the company’s timeshare business – Vistana Signature Experiences. Vistana Signature Experiences was acquired by Interval Leisure Group, Inc. in May this year.

On completion, the combined entity would operate or franchise about 5,700 hotels with 1.1 million rooms globally, bringing together 30 brands catering to all lodging segments.

Marriott’s move to buy Starwood shows that the hospitality industry thrives on such blockbuster deals that are critical to their success at a time when online booking is becoming important in the lodging business. Larger hotel companies, boasting economies of scale, can bargain with online travel agents like Expedia Inc. (NASDAQ:EXPE) , TripAdvisor Inc. (NASDAQ:TRIP) and The Priceline Group’s Booking.com for better fees.

Meanwhile, until the merger is legally complete, the companies will keep on operating as separate and self-governing entities.

EXPEDIA INC (EXPE): Free Stock Analysis Report

STARWOOD HOTELS (HOT): Free Stock Analysis Report

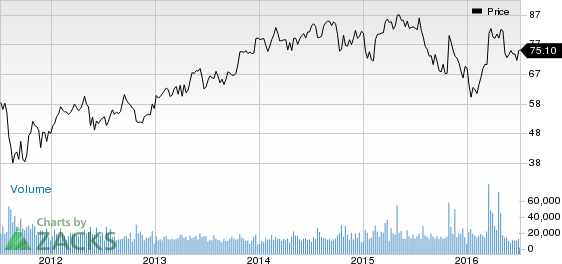

MARRIOTT INTL-A (MAR): Free Stock Analysis Report

TRIPADVISOR INC (TRIP): Free Stock Analysis Report

Original post

Zacks Investment Research