Marriott International, Inc. (MAR) just released its fourth-quarter and full year 2017 financial results, posting adjusted earnings of $1.12 per share and revenues of $5.88 billion. Currently, Marriott is a Zacks Rank #2 (Buy) and is down marginally to $142 per share in after-hours trading shortly after its earnings report was released.

Marriott:

Beat earnings estimates. The company posted adjusted earnings of $1.12 per share, beating the Zacks Consensus Estimate of $1.00 per share.

Beat revenue estimates. The company saw revenue figures of, topping our consensus estimate of $5.63 billion.

Marriott’s revenues jumped 8% from the year-ago period. On top of that, the resort giant’s adjusted earnings surged 32% year-over-year. For full year 2017, Marriott noted that it repurchased 29.2 million shares of common stock.

Bethesda, Maryland-based company now expects to post full-year 2018 earnings between $5.11 per share and $5.34 per share. “As a result of U.S. tax reform, we expect our effective tax rate in 2018 will decline meaningfully to approximately 22 percent,” CEO Arne Sorenson said in a statement.

“Not including incremental asset sales, we expect to return roughly $2.5 billion to shareholders in share repurchases and dividends in 2018.”

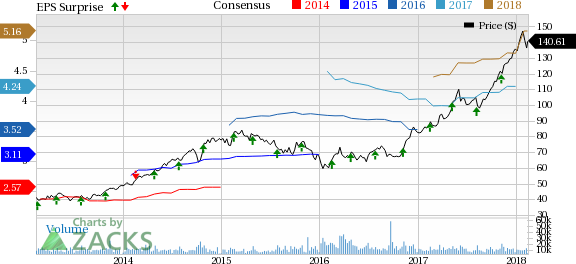

Here’s a graph that looks at Marriott’s Price, Consensus and EPS Surprise history:

Marriott International, Inc. operates and franchises hotels under the Marriott, JW Marriott, The Ritz-Carlton, Renaissance, Residence Inn, Courtyard, TownePlace Suites, Fairfield Inn, SpringHill Suites and Ramada International brand names; develops and operates vacation ownership resorts under the Marriott Vacation Club International, Horizons, The Ritz-Carlton Club and Marriott Grand Residence Club brands; operates Marriott Executive Apartments; provides furnished corporate housing through its Marriott ExecuStay division; and operates conference centers.

Check back later for our full analysis on Marriott’s earnings report!

Don’t Even Think About Buying Bitcoin Until You Read This

The most popular cryptocurrency skyrocketed last year, giving some investors the chance to bank 20X returns or even more. Those gains, however, came with serious volatility and risk. Bitcoin sank 25% or more 3 times in 2017.

Zacks has just released a new Special Report to help readers capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 4 crypto-related stocks now >>

Marriott International (MAR): Free Stock Analysis Report

Original post

Zacks Investment Research