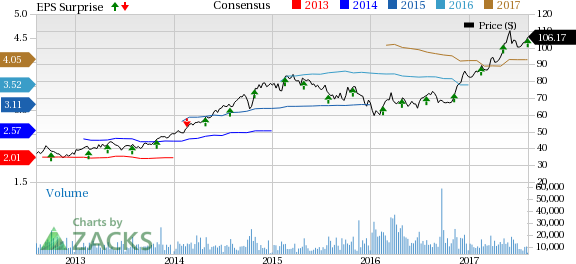

Marriott International Inc. (NASDAQ:MAR) posted better-than-expected second-quarter 2017 results wherein both the bottom line and the top line beat the Zacks Consensus Estimate.

However, the company’s shares dropped 3% in afterhours trading on Aug 7, mirroring investor concerns surrounding weak earnings guidance for third-quarter 2017.

We note that on Sep 23, 2016, Marriott had completed its acquisition of Starwood Hotels & Resorts Worldwide (NYSE:HOT) Inc. and became the world's largest hotel company.

Earnings and Revenue Discussion

Adjusted earnings per share (EPS) of $1.13 per share surpassed the Zacks Consensus Estimate of $1.02 by 10.8%. Also, the figure witnessed a 34.5% increase from combined adjusted EPS of 84 cents in the year-ago quarter. In fact, the bottom line came above management’s guided range of 99 cents to $1.03.

Notably, combined second-quarter 2016 results assume Marriott's acquisition of Starwood and Starwood's sale of its timeshare business that completed on Jan 1, 2015 along with some other adjustments.

Total revenue almost remained flat year over year at nearly $5.80 billion but topped the Zacks Consensus Estimate of $5.12 billion by over 13%.

Excluding the impact of Marriott's acquisition of Starwood and Starwood's sale of its timeshare business on second-quarter 2016 results, the top line in the quarter increased a significant 48.5% year over year. This, in turn, reflects the positive impact of Starwood acquisition on second-quarter 2017 revenues.

RevPAR & Margins

In the quarter, revenue per available room (RevPAR) for worldwide comparable system-wide properties increased 2.2% in constant dollar (up 1.4% in actual dollars), driven by 0.7% growth in occupancy and a 1.2% rise in average daily rate (ADR). In fact, the reported figure came within management’s guided range of an increase of 1% to 3% on a constant dollar basis.

Comparable system-wide RevPAR in North America grew 0.9% in constant dollars (up 0.8% in actual dollars). Though occupancy rate declined 0.3%, ADR witnessed an increase of 1.3%. Management had expected the same to be flat to up 2% for the quarter.

In constant dollar, international comparable system-wide RevPAR rose 5.8% (up 3.1% in actual dollars) in the second quarter of 2017. Both occupancy rate and ADR witnessed a rise of 3.1% and 1.1%, respectively. Also, the figure came above management’s guided range of a rise of 3% to 5% on a constant-dollar basis.

Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) was $834 million, up 8% year over year, from combined adjusted EBITDA in the year-ago quarter.

Worldwide comparable company-operated house profit margin increased 50 basis points (bps) in the reported quarter. The uptick can be attributable to higher RevPAR and synergies from the Starwood acquisition, including procurement savings. However, North American comparable company-operated house profit margins decreased 10 bps. Meanwhile, house profit margins for comparable company-operated properties outside North America rose 140 bps.

Total adjusted expenses decreased 1.4% year over year to $5.15 billion mainly due to lower general, administrative and other expenses.

General, administrative, and other expenses were $226 million, down 8.5% from the year-ago quarter, primarily due to general administrative cost savings. Notably, the figure was just above the management’s expected range of $220 million to $225 million.

Third-Quarter 2017 Outlook

Marriott's outlook for third-quarter, fourth-quarter and full-year 2017 is for the combined company and does not include merger-related costs.

For the third quarter, earnings per share are estimated between 96 cents and 99 cents. Notably, the Zacks Consensus Estimate of $1.02 is pegged higher than the guided range.

Marriott projects comparable system-wide RevPAR to be roughly flat in North America on a constant dollar basis. RevPAR for worldwide comparable system-wide properties is projected to inch up in the range of 1% to 2%. Outside North America, the company expects the same to increase in the 3% to 5% band.

Adjusted EBITDA is likely to be in the range of $770 to $790 million, reflecting tough comparisons caused by the Olympics and the shift in the Jewish holidays year over year. Meanwhile, the company expects fee revenues between $810 million and $825 million. Operating income is projected in the range of $595 to $615 million while general, administrative and other expenses are anticipated between $215 million and $220 million.

Fourth-Quarter 2017 Outlook

For the fourth quarter, earnings per share are estimated between 96 cents and $1.05. Also, the Zacks Consensus Estimate of $1.02 is pegged within the guided range.

Marriott expects comparable system-wide RevPAR to increase in the range of 1% to 3% on a constant dollar basis in North America and worldwide. Outside North America, the company expects the same to inch up in the 2–4% band.

Moreover, the company anticipates fee revenues between $804 million and $849 million. Operating income is projected in the range of $594 to $644 million while general, administrative and other expenses are expected between $229 million and $234 million.

2017 View Updated

For full-year 2017, Marriott now anticipates earnings in the band of $4.06 to $4.18 per share, up from the earlier guided range of $3.92 to $4.09. The Zacks Consensus Estimate for 2017 is pegged at $4.05.

Marriott expects comparable system-wide RevPAR to inch up 1-2% in North America (earlier 1-3% rise), climb 3-5% outside North America (earlier 2-4% increase) and rise 1-3% worldwide (same as earlier), on a constant dollar basis.

Additionally, the company projects fee revenues between $3,245 million and $3,305 million (earlier $3,225-$3,295 million). The increase reflects better-than-expected fees in the second quarter.

Operating income is anticipated in the range of $2,420 million to $2,490 million (earlier $2,405-$2,495 million), while adjusted EBITDA is projected to be between $3,131 million and $3,201 million (earlier $3,100-$3,195 million). Meanwhile, general, administrative and other expenses are still expected to be in the band of $880 million to $890 million.

The company also continues to anticipate net room additions of 6% in 2017.

Currently, Marriott carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

Wyndham Worldwide Corporation (NYSE:WYN) reported second-quarter adjusted earnings per share of $1.53, beating the Zacks Consensus Estimate of $1.50 by 2%. Moreover, the bottom line was up 9.3% year over year on the back of higher revenues and the company’s share repurchase program.

In second-quarter 2017, Hilton Worldwide Holdings Inc. (NYSE:HLT) posted adjusted earnings of 52 cents per share that outpaced the Zacks Consensus Estimate of 50 cents by 4%. Also, the bottom line soared 30% year over year primarily owing to higher revenues. In fact, the same came above management’s guided range of 47 cents to 51 cents.

Extended Stay America, Inc.’s (NYSE:STAY) second-quarter 2017 adjusted earnings of 31 cents per share lagged the Zacks Consensus Estimate of 32 cents by 3.1%. Meanwhile, the figure remained flat on a year-over-year basis.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Wyndham Worldwide Corp (WYN): Free Stock Analysis Report

Marriott International (MAR): Free Stock Analysis Report

Extended Stay America, Inc. (STAY): Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT): Free Stock Analysis Report

Original post

Zacks Investment Research