Marriott International Inc (NASDAQ:MAR) was downgraded by analysts at Vetr from a "strong-buy" rating to a "buy" rating in a research report issued on Monday, MarketBeat.com reports. They presently have a $78.19 target price on the stock. Vetr's target price points to a potential upside of 9.97% from the company's previous close.

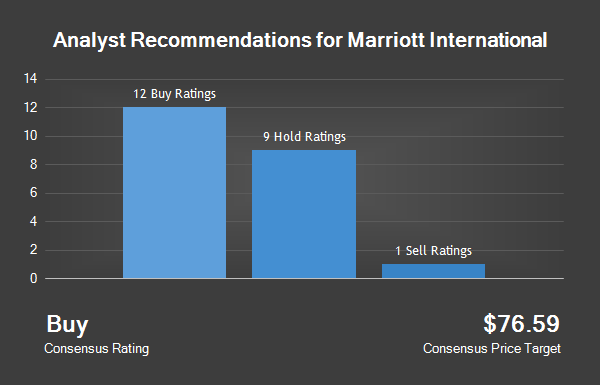

Several other analysts have also recently issued reports on the company. Telsey Advisory Group dropped their target price on Marriott International from $74.00 to $70.00 and set a "market perform" rating on the stock in a research report on Friday, September 23rd. Barclays PLC set a $80.00 target price on Marriott International and gave the company a "hold" rating in a research report on Friday, September 23rd. Zacks Investment Research cut Marriott International from a "hold" rating to a "sell" rating in a research report on Wednesday, October 26th. Sanford C.

Bernstein started coverage on Marriott International in a research report on Thursday, September 8th. They set an "outperform" rating and a $87.00 target price on the stock. Finally, Credit Agricole SA raised Marriott International from an "underperform" rating to an "outperform" rating in a research report on Monday, August 15th. Two research analysts have rated the stock with a sell rating, nine have assigned a hold rating and thirteen have issued a buy rating to the stock. The company currently has a consensus rating of "Hold" and a consensus price target of $76.68.

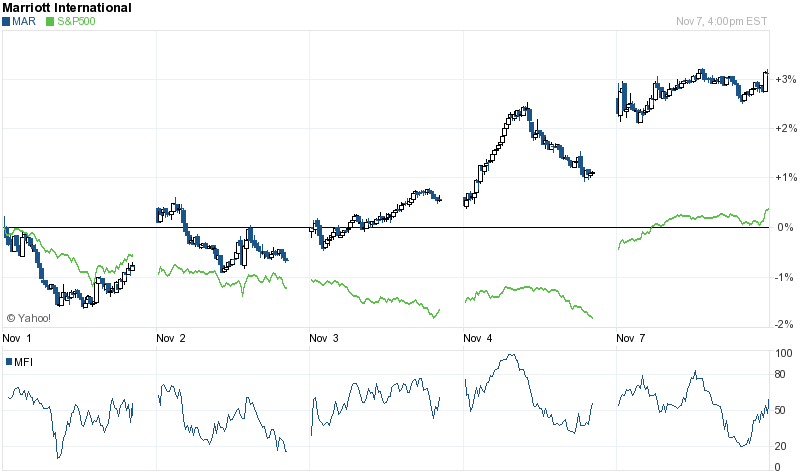

Shares of Marriott International traded up 2.14% during midday trading on Monday, hitting $71.10. Marriott International has a 1-year low of $56.43 and a 1-year high of $77.34. The company has a market cap of $18.09 billion, a P/E ratio of 21.19 and a beta of 1.23. The stock's 50-day moving average is $67.75 and its 200-day moving average is $68.73.

Marriott International last announced its earnings results on Monday, November 7th. The company reported $0.91 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.90 by $0.01. The business had revenue of $3.94 billion for the quarter, compared to analysts' expectations of $4.41 billion. Marriott International had a negative return on equity of 25.25% and a net margin of 5.87%. The business's revenue for the quarter was up 10.2% on a year-over-year basis. During the same quarter last year, the firm earned $0.78 EPS. Analysts anticipate that Marriott International will post $3.60 earnings per share for the current fiscal year.

In other news, major shareholder Richard E. Marriott sold 71,287 shares of the business's stock in a transaction that occurred on Thursday, September 22nd. The stock was sold at an average price of $70.14, for a total transaction of $5,000,070.18. Following the transaction, the insider now directly owns 12,223,365 shares in the company, valued at approximately $857,346,821.10. The sale was disclosed in a legal filing with the SEC, which is available at the SEC website.

Also, EVP Anthony Capuano sold 22,538 shares of the business's stock in a transaction that occurred on Friday, August 19th. The stock was sold at an average price of $73.60, for a total value of $1,658,796.80. Following the transaction, the executive vice president now owns 76,184 shares in the company, valued at $5,607,142.40. The disclosure for this sale can be found here. 17.07% of the stock is owned by corporate insiders.

Several hedge funds and other institutional investors have recently modified their holdings of MAR. Jennison Associates LLC boosted its position in shares of Marriott International by 1.4% in the third quarter. Jennison Associates LLC now owns 15,651,744 shares of the company's stock valued at $1,053,832,000 after buying an additional 214,904 shares in the last quarter.

BlackRock Institutional Trust Company N.A. boosted its position in shares of Marriott International by 10.1% in the second quarter. BlackRock Institutional Trust Company N.A. now owns 5,789,437 shares of the company's stock valued at $384,766,000 after buying an additional 532,473 shares in the last quarter.

Capital Research Global Investors boosted its position in shares of Marriott International by 39.4% in the second quarter. Capital Research Global Investors now owns 4,329,447 shares of the company's stock valued at $287,735,000 after buying an additional 1,224,450 shares in the last quarter. Bank of New York Corp boosted its position in shares of Marriott International by 42.2% in the third quarter. Bank of New York Mellon (NYSE:BK) Corp now owns 3,665,774 shares of the company's stock valued at $246,817,000 after buying an additional 1,087,597 shares in the last quarter.

Finally, BlackRock Fund Advisors boosted its position in shares of Marriott International by 1.0% in the second quarter. BlackRock Fund Advisors now owns 3,002,539 shares of the company's stock valued at $199,549,000 after buying an additional 30,517 shares in the last quarter. Institutional investors and hedge funds own 74.98% of the company's stock.

About Marriott International

Marriott International, Inc is a lodging company. The Company is an operator, franchisor and licensor of hotels and timeshare properties in approximately 90 countries and territories under over 20 brand names. It operates through three segments: North American Full-Service, which includes brands, such as The Ritz-Carlton, EDITION, JW Marriott, Autograph Collection Hotels, Marriott Hotels, Delta Hotels and Resorts, and Renaissance Hotels located in the United States and Canada; North American Limited-Service, which includes brands, such as AC Hotels by Marriott, Courtyard, Residence Inn, SpringHill Suites, TownePlace Suites properties and Fairfield Inn & Suites located in the United States and Canada, and International, which includes brands, such as Bulgari Hotels & Resorts, Protea Hotels and Moxy Hotels located outside the United States and Canada.