BP (LONDON:BP) Amoco is marking 5 years since the Deep Water Horizon explosion in the Gulf of Mexico today. A lot has happened since then. Crazy attempts to stop the leak. Horrible pictures of wildlife during the initial clean up. A CEO found lounging on yachts unconcerned gets the boot. And billions of dollars in fines.

Through this the stock collapsed initially and then recovered to a stable area. In 2013 it started moving back higher, only to peak in July and start falling back again with the collapse in oil prices. This company cannot catch a break. But that long string of badness may be about to end.

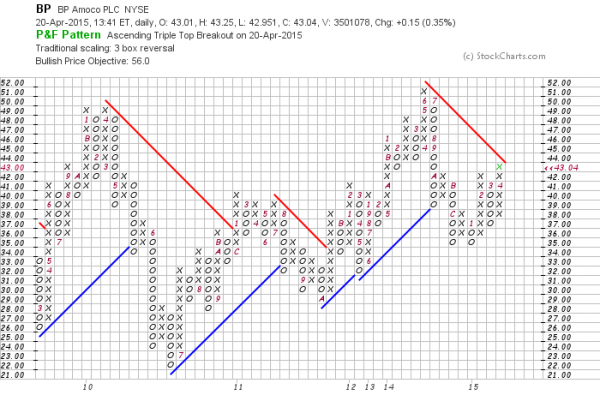

The chart above tells why. First the stock price moved above the 200 day SMA, a bullish signal, for the first time since August 2014. The stock price is also fast approaching the 50% retracement of the move lower last year, and with the 61.8% level at 46.33 above. The momentum indicators are bullish as well, with the RSI nearing overbought levels while the MACD moves higher. Finally there is the chart below as well. The 3-box reversal Point and Figure chart, shows that the stock is on the cusp of a break out. A print of 44 would push it over the falling trend resistance, towards the bullish price objective of 56.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.