*These are my thoughts on the SPY ETF

“The dreamers are the saviors of the world.” ~James Allen

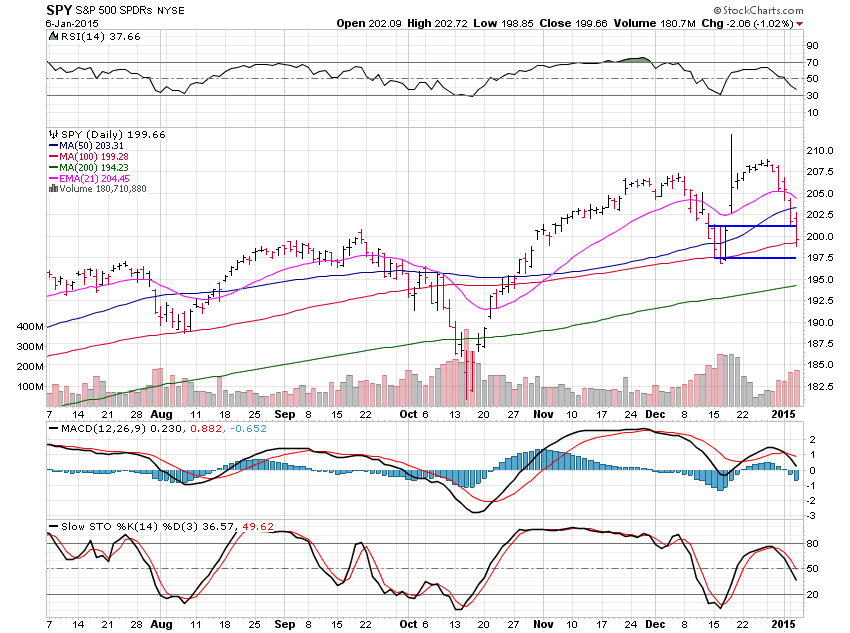

Markets held key support levels yesterday but I’m still not sure this correction is played out. A little more to the downside would be great but time will tell.

Volume is increasing nicely on the downside and although we did hold support yesterday, I still did not see the signs of a low I am looking for lsuch as a very strong volume push off lows for example.

I’m still really only an observer with the odd very tiny trade but that can change in a heartbeat if we get some buy signals.

Stocks and markets did weaken right into the close on heavy volume so that tells me we do have further to move lower.

SPY held the 100 day average pretty well yesterday but didn’t muster much of a bounce off it.

I have a suspicion that we will hit 197.50 shortly and perhaps even test the 200 day average which is major support down at 195. I’m not yet taking longs but it may not be too much longer at this rate for a nice correction. A move above the 201 area would tell me a low is likely in place.

I do expect a major hard and fast run once a low is in as we saw after the last correction in December but time will tell.

I’m not super happy about seeing two corrections within a month and it is something we have to keep an eye on since behavior may now be changing. So far I don’t have enough evidence to say that decisively.