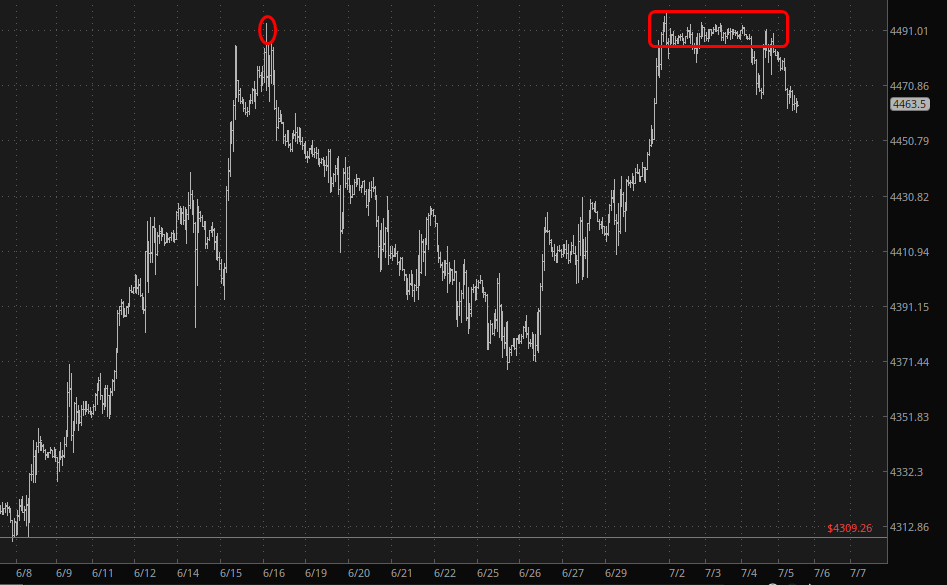

It is heartening, to be sure, to see a bit of weakness in the market in spite of the ceaseless interference of that despicable vermin queen Yellen. A couple of days of not-lifetime-highs is no cause for celebration, but dear God in heaven, at least the AI-crazed and BTFP-unhinged lunatics have taken a breather following Independence Day (now THERE is some irony). Thus, here in the wee hours of the morning as I type these words in the western wilds, the S&P 500 Futures has turned away from its June peak.

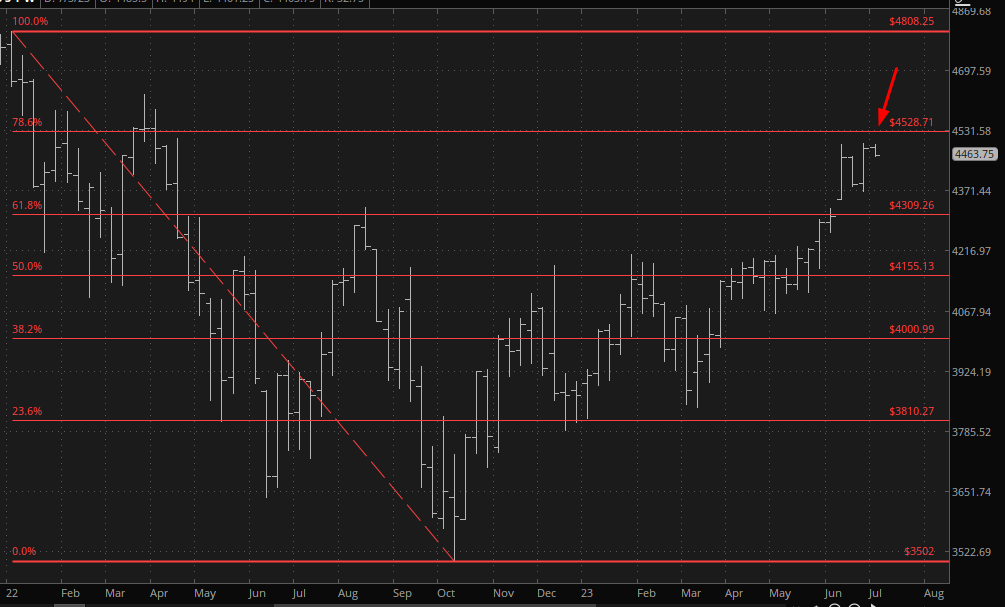

What is more significant about this longer-term is that the Fibonacci we were approaching has held. By no means have the Fibs been iron-clad walls during this post-Rolo-low ascent. Instead, the Fibs have represented more of a stalling point. It’s all we’ve got to go on right now, however, so we’ll just keep relying on this Fib level as key. It also means that, should the weakness continue, that 4300 represents important support (and, importantly, also happens to be a Big Round Number).

I’m presently in position with my surviving twelve January 2024 equity puts and my single ETF put (on GDX (NYSE:GDX)). Battered, yes, but not beaten! I’m going to try to get a bit more sleep, if I can……….