Equity markets and risk currencies continue to trade lower as global growth concerns are sending investors back into the US Dollar. Commodities have commanded a good deal of headline space, as Gold saw major declines (from $1715 per ounce at the Monday highs to new lows below $1570). Gold and Oil are both priced in US Dollars, so these latest moves, more than anything else, show us that the US Dollar is now being viewed as the primary vehicle for safe haven investments, as it is currently gaining against most commodities as well as the Japanese Yen and Swiss Franc.

Macro data from the Asian session helped fuel the negative trading tone as Chinese PMI has entered into contractionary territory and the Japanese Tankan survey dropped to -4 for the manufacturing component and this is adding to the main themes unraveling in Europe. Official comments from regional governments have expressed concerns over the likelihood that each individual parliament will be able to pass the budget proposals suggested at last week’s Summit meeting.

This is being compounded by the fact that mentions of French credit downgrades continue to circulate, but at this stage there is no evidence that there has been any official warning that this will occur. The French leadership (Sarkozy, in particular) does seem to be preparing markets for the worst, however, as it appears more and more likely that France will lose its AAA rating and be forced to absorb higher borrowing costs for its Treasury bonds. Yesterday, in New York trading, Fitch did complete credit downgrades for 5 of the largest private banks in Europe, so the main question will be whether or not this is a precursor to the sovereign ratings decisions that might come later.

In Norway, the central bank (Norges Bank) cut its base interest rates by 0.50%, which surprised markets, and this is indicative of the protective strategies that central banks outside of the Eurozone are looking to implement as a way of staving off potential contagion effects (and declining exports into Eurozone countries) into next year.

In the UK, unemployment data was the main driver during the London session and the numbers showed some improvements relative to the consensus estimates. For the month of November, the claimant count rose by 3,000 (the estimates were much higher, at 13,700) and the unemployment rate dropped to 5.0%. Average hourly earnings, however, were marginally lower than estimates (showing a rise of 2.0%). Overall, the numbers did show some improvements but, relative to historical levels, these numbers are showing the highest rate of unemployment in nearly two decades.

The GBP/USD continues to look heavy, with very little seen in the way of a rally and prices are now testing critical historical levels at 1.5430. There is very little to suggest that we will get a bounce from here and if we do see a clear break, the next target becomes the October low at 1.5270. Sell rallies if given the chance.

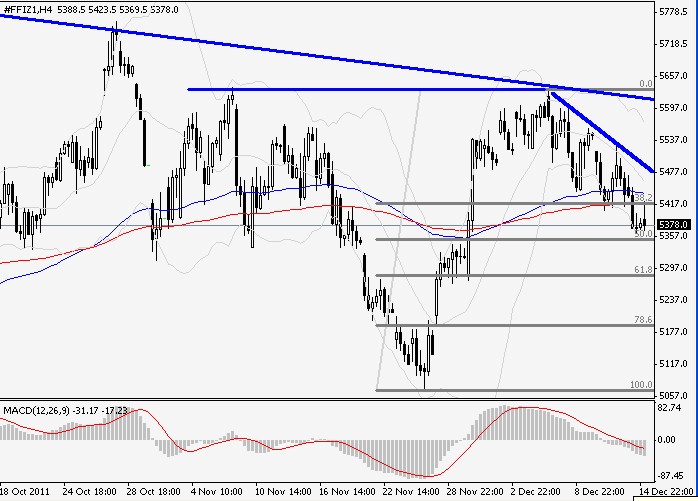

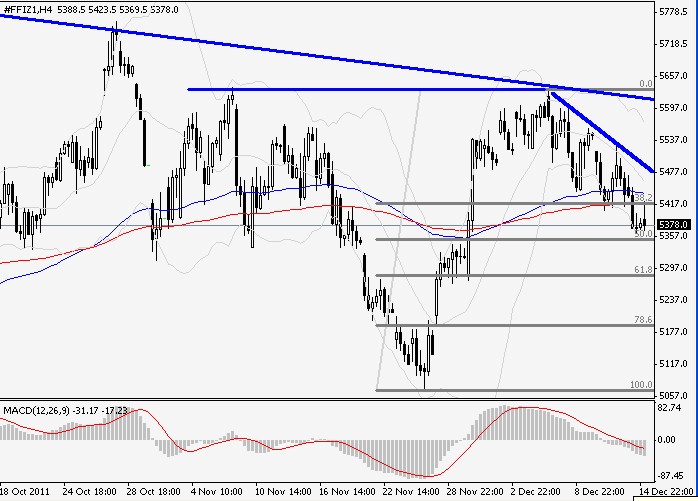

The FTSE is now caught in a nicely defined downtrend channel on the hourly charts and, longer term, the index is now dealing with Fibonacci support at 5360. A break here will test areas below 5300, so we expect the selling pressure to present itself again if prices manage to test resistance at 5420.

Macro data from the Asian session helped fuel the negative trading tone as Chinese PMI has entered into contractionary territory and the Japanese Tankan survey dropped to -4 for the manufacturing component and this is adding to the main themes unraveling in Europe. Official comments from regional governments have expressed concerns over the likelihood that each individual parliament will be able to pass the budget proposals suggested at last week’s Summit meeting.

This is being compounded by the fact that mentions of French credit downgrades continue to circulate, but at this stage there is no evidence that there has been any official warning that this will occur. The French leadership (Sarkozy, in particular) does seem to be preparing markets for the worst, however, as it appears more and more likely that France will lose its AAA rating and be forced to absorb higher borrowing costs for its Treasury bonds. Yesterday, in New York trading, Fitch did complete credit downgrades for 5 of the largest private banks in Europe, so the main question will be whether or not this is a precursor to the sovereign ratings decisions that might come later.

In Norway, the central bank (Norges Bank) cut its base interest rates by 0.50%, which surprised markets, and this is indicative of the protective strategies that central banks outside of the Eurozone are looking to implement as a way of staving off potential contagion effects (and declining exports into Eurozone countries) into next year.

In the UK, unemployment data was the main driver during the London session and the numbers showed some improvements relative to the consensus estimates. For the month of November, the claimant count rose by 3,000 (the estimates were much higher, at 13,700) and the unemployment rate dropped to 5.0%. Average hourly earnings, however, were marginally lower than estimates (showing a rise of 2.0%). Overall, the numbers did show some improvements but, relative to historical levels, these numbers are showing the highest rate of unemployment in nearly two decades.

The GBP/USD continues to look heavy, with very little seen in the way of a rally and prices are now testing critical historical levels at 1.5430. There is very little to suggest that we will get a bounce from here and if we do see a clear break, the next target becomes the October low at 1.5270. Sell rallies if given the chance.

The FTSE is now caught in a nicely defined downtrend channel on the hourly charts and, longer term, the index is now dealing with Fibonacci support at 5360. A break here will test areas below 5300, so we expect the selling pressure to present itself again if prices manage to test resistance at 5420.