On the eve of the anniversary of the coronavirus “bottom” and the subsequent reversal to growth, positive sentiment prevailed in developed markets, but this had faded by early Tuesday.

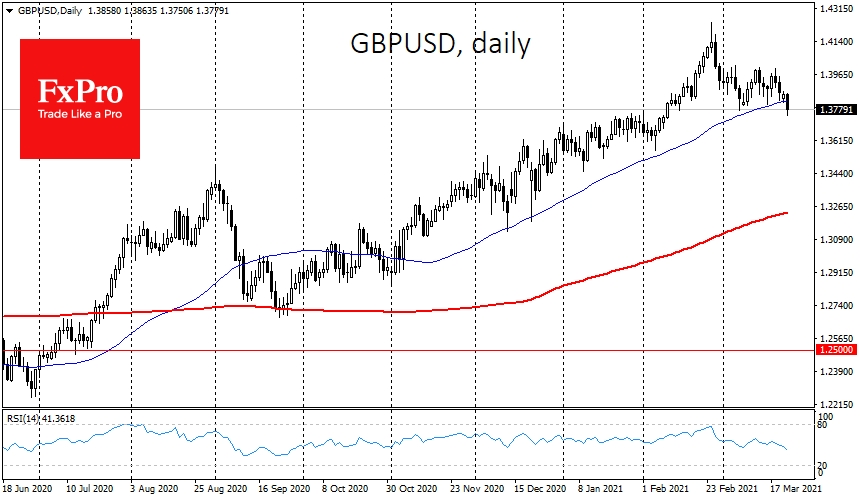

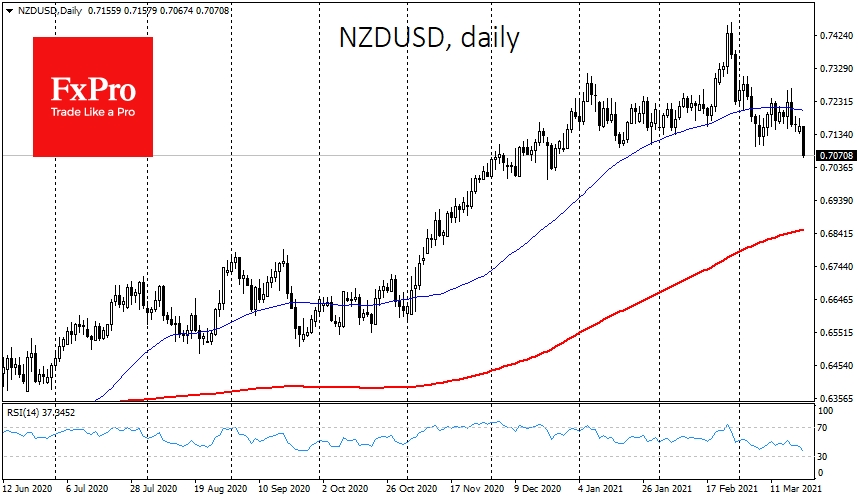

The currency market looks increasingly anxious, showing a bias towards safe-havens, which is often an early sign of risk aversion. There is pressure on risk-sensitive currencies. The Australian and New Zealand dollars are losing 1% and 2% against the US dollar.

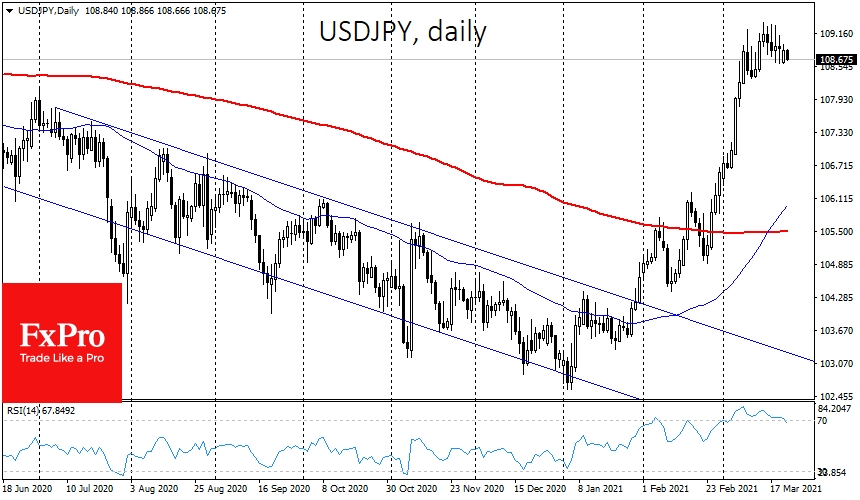

Simultaneously, the Japanese yen is strengthening against most of its peers, returning below 109 for the dollar and 130 for the euro.

An additional sign of the pull towards safety is the rise in the EUR/GBP pair, as investors see several Eurozone bonds as defensive.

On the US debt markets, long-term bond yields are falling.

All of these are classic signs of a comprehensive exit from risky assets in favour of defensive assets. However, the amplitude of this move is nothing compared to what we saw just over a year ago.

The drop in yields is not as positive as it has been in recent weeks, as it now reflects investors' concerns about the outlook for the economy. Markets are concerned about high-profile announcements of impending tax hikes for corporates and the wealthy.

Earlier, Trump's tax reform caused a higher performance in US equities, and threats to raise taxes promises to backfire, making US equities "worse than the market".

It would be too premature to predict a market crash, especially as movements in currencies and bonds are very subdued (only the direction and synchronicity are worrisome). However, it is worth keeping an eye on increasing correlations in different markets for a possible correction from now on.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Markets Wary On The Anniversary Of The Coronavirus 'Bottom'

Published 03/23/2021, 10:12 AM

Updated 03/21/2024, 07:45 AM

Markets Wary On The Anniversary Of The Coronavirus 'Bottom'

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.