Market movers today

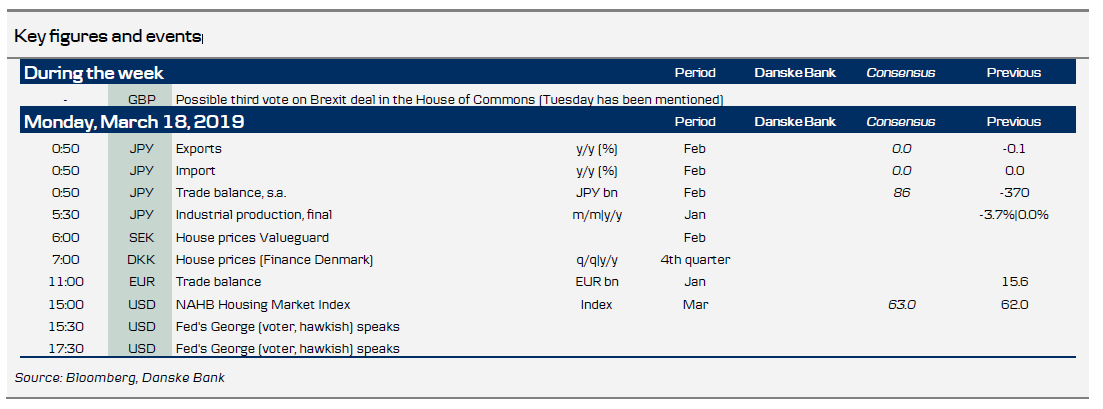

The week starts out on a fairly quiet note with regards to economic releases. Instead markets will be looking for new signals from Brussels with regard to the extension of the triggering of Article 50 in relation to Brexit

Later in the week, central banks will dominate the agenda with the BOE, Fed and Norges Bank concluding their policy meetings.

On Wednesday, the Fed is on hold while lowering the 'dot' signal for 2019 to one hike (from two), and hence we think the most interesting meeting will be the Norges Bank meeting on Thursday, where we expect a rise in its policy rate by 25bp to 1.00% and to signal one further rate hike this year.

Selected market news

The Asian equity markets have been grinding higher this morning, while bond yields have remained range-bound as the market are looking for support from the Federal Reserve meeting on Wednesday. Here, the Federal Reserve is likely to revise its forecast for rate hikes down to one rather than two. This will continue to suppress volatility in the markets and support a flat yield curve going forward.

In the UK, PM May has been trying to get more support from the Eurosceptics in her party for her deal, which is expected to be put to a vote on Tuesday. However, if she does not have strong chance of getting the deal accepted, then she is not likely to put it to a third vote according to media reports quoting ministers in her government. Otherwise, PM May will go the EU summit on Thursday to seek an extension on the Brexit process. Hence, there will be plenty of uncertainty regarding the Brexit process during the week. GBP has remained fairly range-bound versus both the USD and EUR this morning.

Scandi markets

Valueguard just released house price data for February showing a monthly rise of 0.4%, with flats +0.3%. Seasonally adjusted they were up 0.2 and 0.3%, respectively.

Fixed income markets

There was some positive rating news on Friday: Firstly, Moody’s kept the stable outlook and rating on Italy unchanged despite the current growth crisis. This should be supportive for BTPs this morning and the IT-DE 10Y spread is expected to converge slowly towards 225bp. Secondly, Portugal was upgraded from BBB- to BBB by S&P. The outlook is stable. The main reasons for the upgrade was a combination of solid growth, a surplus of more than 3% on the primary deficit and a downward path for the government debt and lower funding costs.

On Friday, we have Spain up for review by S&P (A-/positive outlook). Spain could potentially be the next periphery country to see an upgrade, but due to the current election uncertainty, S&P might choose to wait another six months. For more see Government Bonds Weekly (GBW) https://bit.ly/2TKoFgQ In our Government Bonds Weekly we argue that we are still in a “hunt for carry” environment and repeat our long 5y Spain, long 1y Italy and long 10Y semi-core (Finland) vs core. However, we also recommend - partly as a hedge - to position for a wider Bund spread, which is currently trading in the lower end of the 50bp to 60bp trading range we expect to prevail in 2019.

Belgium kicks off the EGB supply week today with taps in the 5Y and 10Y and the 15Y green bond. This is the first time Belgium will tap the Apr-33 Green OLO since it was launched in February 2018. Note that Belgium will see EUR13.7bn in redemption and coupons next week, and we estimate the ECB holds EUR2.6bn in the maturing bond.

FX markets

EUR/USD has settled around pre-ECB levels and the continued drop that we have been looking for has yet to materialise. The Fed this week will be important in determining whether we can see another dip lower: we expect the Fed to lower its ‘dot’ signal to one rate hike in 2019 (down from two) and would not be surprised if it signals that it will be ‘one and done’; this would likely be seen as dovish and support EUR/USD even if the Fed has begun downplaying the importance of the dots. We still look for two hikes due to our overall positive outlook for this year; this should hold a hand under the USD further out - but not necessarily this week. Friday’s PMIs from either side of the Atlantic could what send EUR/USD lower yet again though: we are looking for a decent US manufacturing reading while the euro-zone one could be set for another drop, highlighting that the cyclical picture still favours the USD. Further, a US-China trade deal now looks delayed until April. Also note that we have published new FX forecasts this morning, see FX Forecast Update.

EUR/DKK rose above 7.4630 towards the end of last week – the highest level since early February. The annual dividend flow from the largest Danish corporations ise coming to the market these days, which could help explain the move. In that case the move should prove temporary. We forecast EUR/DKK at 7.4570 in 3M (NYSE:MMM).

Last week EUR/NOK returned to the 9.60s primarily driven by external drivers in improved risk appetite and a higher oil price. This week all eyes will be on Norges Bank’s monetary policy meeting on Thursday. This morning we published our preview for the meeting where we explain why we expect both a rate hike and a lower rate path, see Reading the Markets Norway, 18 March 2019. Meanwhile, crucially we do not expect the rate path to be lowered as much as markets currently expect and we therefore expect yet another “hawkish” surprise, which could finally change the market perception – from especially foreign investors – that Norges Bank always is dovish. At least in 12 out of the last 13 extended Norges Bank monetary policy meetings EUR/NOK has ended the session lower. We think that will turn to 13 out of 14 and still see prospects for an even lower EUR/NOK in the coming months.