Markets are trading in tight range as traders await the employment data from US today. Economist expect the data to show 150k job growth in January, down from December's 200k. Unemployment rate is expected to be unchanged at 8.5%. Looking at the leading indicators. ADP employment showed 170k growth in private sector, down from December's 292k. Employment component of ISM manufacturing dropped slightly from 54.8 to 54.3 in January. 4 week moving average of initial claims was largely unchanged at 376k. Conference Board consumer confidence dropped from 64.8 to 61.1 in January. Hence, the overall picture is inline with the view that job growth has moderated slightly in January.

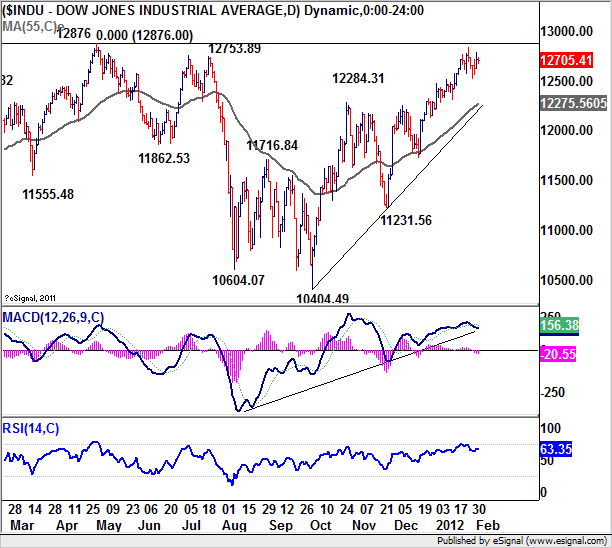

We'd like to point out again that DOW has being struggling in range below 12876 key resistance (last year's high) this week. Investors have been indecisive to either push stocks through this key resistance level, no did they commit to take profits and trigger a selloff. We believe that while the stalemate in Greece is a factor, NFP is the more major reason. Based on the current set of numbers, Q4's total job growth was at 412k, i.e. averaging 137k a month. Q3's number was at 147k per month average. The lowest number in the past six months was November's 100k. We believe that anything above 130k is deemed acceptable by the markets and would be negative if it's below 130k. A sub 100k number would be disastrous to markets. Stock markets' reaction would determine overall risk sentiments and thus the movements in dollar.

Fed Chairman Ben Bernanke testified before the the House Budget Committee overnight. He reiterated the dovish stance made at the January FOMC meeting. Bernanke acknowledged that 'over the past few months, indicators of spending, production, and job-market activity have shown some signs of improvement' but 'the sluggish expansion has left the economy vulnerable to shocks'. Concerning fiscal policy, he warned that 'there is going to be a massive fiscal contraction in 2013' and 'even as fiscal policymakers address the urgent issue of fiscal sustainability, they should take care not to unnecessarily impede the current economic recovery'.

Regarding the situation in Greece, Finance Minister Venizelos said that "one of the major outstanding issues that must be solved ... is to secure the terms of participation of the official sector, that is our European partners and the IMF ... in the effort to reduce the Greek public debt." He said that completion of a parallel "Official Sector Involvement", OSI, is required, that is participations from ECB and other European central banks, along with Private Sector Involvement, PSI. Venizelos said the agreement must be struck by Monday when Eurozone finance ministers meet in Brussels. Again, Germany expressed opposition to ECB involvement in the Greek debt haircut as Finance Minister Schaeuble said that he didn't see the need for "any extra contributions from the public sector; we're carrying everything anyway."

On the data front, China non-manufacturing PMI dropped to 52.9 in January. Eurozone services PMI, retail sales, UK services PMI will be released later today. Canada will release job data and is expected to show 24.5k growth in January with unemployment rate unchanged at 7.5%. US non-farm payroll is expected to grow 150k in January with unemployment rate unchanged at 8.5%. From US, ISM services is expected to improve to 43.2 in January and factory orders are expected to rise 1.5% in December.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Markets Tread Water ahead of NFP

Published 02/03/2012, 02:46 AM

Updated 03/09/2019, 08:30 AM

Markets Tread Water ahead of NFP

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.