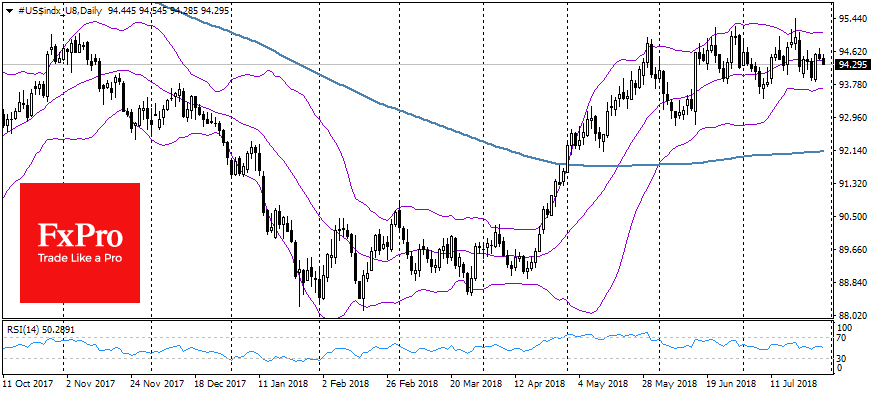

The currencies of developed countries are moving within a narrow range at the beginning of the eventful week. The dollar index is around the mark of 94.50 and has been trading for two months in a range of slightly over 1% around this level. This quiet trading environment can be broken this week after the announcement of the decisions took by the Bank of Japan, the Fed, and the Bank of England, as well as the publication of the U.S. employment data.

Developed markets currencies are experiencing a period of low volatility after the dollar growth period from the end of April to the end of May. The closest market focus is how the Bank of Japan adjusts its policy. More hawkish tone can push down the Asian markets at a time when they are vulnerable amid the fears of trade wars.

With the meetings of the largest central banks and important statistics, the week is able to open a period of increased volatility after a long period of summer lull. Earlier, the Fed’s head made it clear that the U.S. central bank is set to tighten its policy. Market participants will closely monitor if the Fed is set to raise its rates in September, while remaining committed to the 4th increase in 2018.

The Fed’s hawkish rhetoric can increase the difference in the dynamics of developing countries’ currencies. Unlike the major world currencies, in the EM there has been a noticeable differentiation in recent weeks.

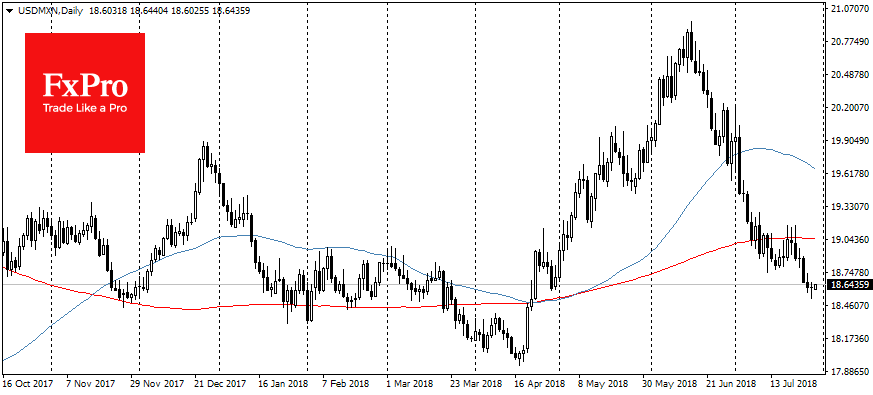

The Russian ruble enjoys the continuation of the high oil prices period. The Mexican peso adds after the elections last month and on the expectations of the profitable negotiations on NAFTA.

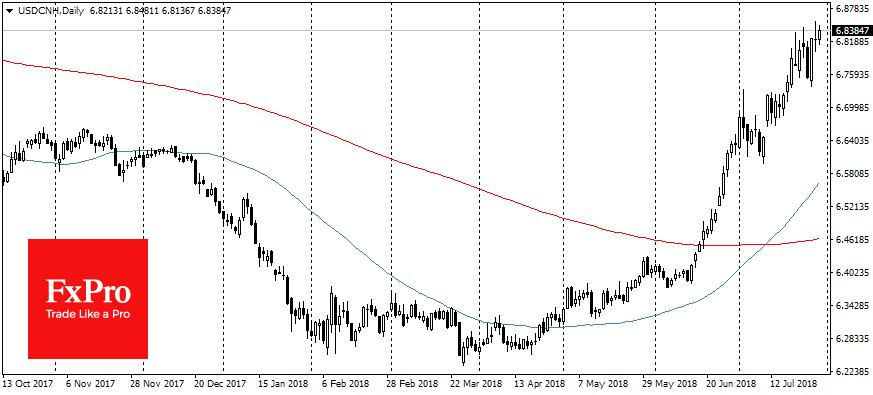

At the same time, the Chinese yuan has been falling for the recent two months at its highest rate in many years on easing the PBC policy and on fears about the consequences of trade wars with the United States. The Turkish lira declined to all-time lows due to the threat of the U.S. sanctions and after the Turkish CB had kept the rates against a widely expected increase last week, which was perceived as a loss of independence of the local regulator. The Argentine peso is also under attack, despite the assistance from the IMF to the country. The Indian rupee is close to the historical minimum to the dollar, in spite of the strong growth of the economy.

The dividing line for the currencies of developing countries became the balance-of-payments factor. Turkey, India, and Argentina have a significant deficit and are dependent on the inflows of capital from outside. China formally has surplus, however, the economy of the country’s regions depends on outward investment, requiring favorable investor relations.

Alexander Kuptsikevich, The FxPro analyst