Yen Holds Onto Gains

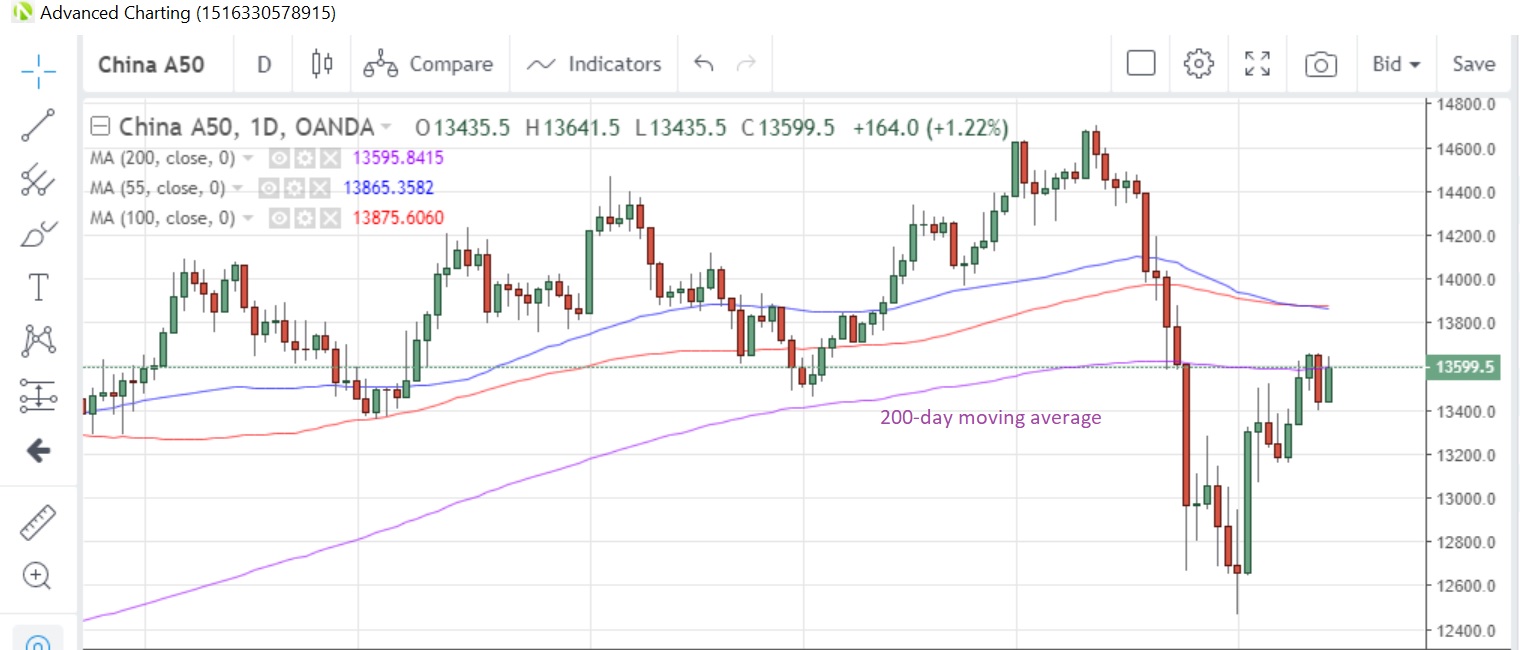

USD/JPY is little changed this morning, holding onto the 0.25% decline seen yesterday. Equities are trading generally higher during the Asian morning, more of a technical rebound that a reversal of yesterday’s declines. The China50 index is out-performing, rising 1.21% so far today and oscillating around the 200-day moving average at 13,596, while U.S. indices are between 0.18% and 0.30% higher.

Coronavirus Update

After yesterday’s shock update under new diagnosis methodology, the number of new cases reported today under the new criteria remains relatively high. As at 11.30am Singapore time, the total new cases reached 64,429 with the death toll at 1,383 with just three of those reported outside on mainland China; one in each of the Philippines, Hong Kong and Japan (Source: Johns Hopkins University).

Bank of Korea Governor Lee said the impact of the virus was starting to be felt by the manufacturing sector and the Bank is preparing financial support for those companies affected. Japan’s health minister said it might be inevitable that the virus will spread in Japan, though the Chief Cabinet Secretary Suga said there was no medical evidence to suggest it is spreading just yet. Japan plans to offload some passengers from the quarantined cruise ship today.

Chinese press is speculating that the country may consider a more pro-active fiscal approach due to the COVID-19 virus. A commentary suggests some tax a fee cuts may be introduced.

Europe’s Growth Data in Focus

The main event on Europe’s data calendar will be the release of Q4 GDP growth numbers for both Germany and the Euro-zone. Surveys suggest that both economies will register only a fraction of growth, bubbling along just above zero for the second straight quarter.

The German economy probably expanded 0.1% on a quarter-by-quarter basis, the same pace seen in Q3, and on an annualized basis, growth is seen slipping to just 0.2% from 1.0% in Q3. The Euro-zone economy is expected to grow 0.1% q/q as well, a slower pace than the +0.2% recorded in Q3.

For the US session, retail sales will be the magnet, which are expected to rise 0.3% m/m in January, the same rate as in December. Industrial production is expected to remain in negative territory last month with a -0.2% print, according to the latest survey while capacity utilisation is seen contracting to 76.8% from 77.0%. The University of Michigan provisional consumer sentiment reading for February completes the session, with an expected dip to 99.5 from 99.8 last month.