Markets stabilized a bit from recent violent moves, with the Dow recovering 72.44 pts to close at 15445.24 overnight. Treasury yields also ended the day mildly higher with 10 year yield at 2.624% and 30 year yield at 3.593%. Asian equities ex-Japan are mixed swinging between gain and loss while Nikkei is trading up nearly 200 pts after yesterday's -610 pts fall. The dollar index is flat slightly above 81.00 for the moment. In the currency markets, yen crosses' recovery continue today as risk aversion receded mildly but are kept well below key near term resistance levels. The greenback is also staying in tight range against other major currencies. Nonetheless, some volatility is likely today with a number of important data features, including Eurozone PMI services, UK PMI services, US ADP employment and ISM non-manufacturing.

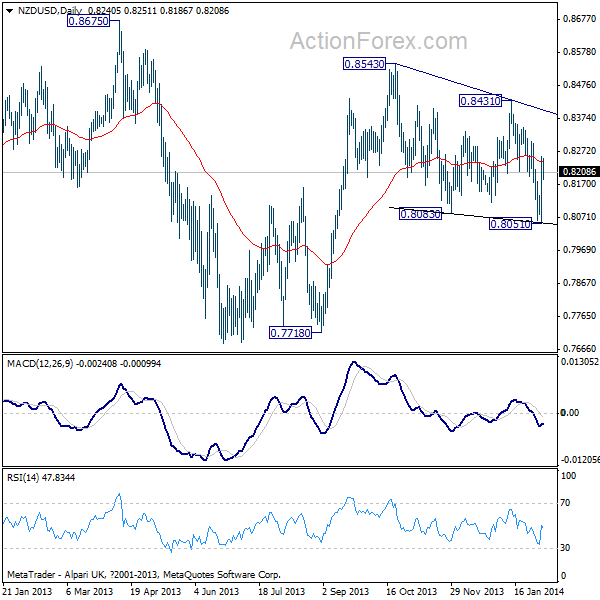

The New Zealand dollar jumped sharply after strong employment data. Q4 seasonally adjusted unemployment rate dropped to 6.0%, down from Q3's 6.2%, inline with expectations. Employment, grew 1.1% qoq, nearly double of expectation of 0.6% qoq, comparing to Q3's 1.2% qoq. RBNZ left OCR unchanged at 2.50% last week but governor Wheeler signaled imminent rate hike to curb inflation. And, "the scale and the speed of the rise in the OCR will depend on future economic indicators." The NZD/USD dipped to as low as 0.8051 earlier this week but quickly recovered. Overall outlook is unchanged as price actions from 0.8543 are viewed as a consolidation pattern. Upside breakout is anticipated and above 0.8431 will target 0.8543 and above. However we'd like to point out again that the NZD/USD is staying in converging range since hitting 0.8842 in 2011, possibly in triangle pattern. Thus, we'd expect strong resistance below 0.8675 (2013 high) to bring reversal to extend the long term sideway pattern.

NZD/USD Daily Chart" title="NZD/USD Daily Chart" width="474" height="242">

NZD/USD Daily Chart" title="NZD/USD Daily Chart" width="474" height="242">

Elsewhere, the UK BRC shop price index dropped -1.0% yoy in January. The UK PMI services is expected to rise to 59.0 in January but beware of downside surprise which could trigger another selloff in the GBP/USD and GBP/JPY. Eurozone PMI services is expected to be finalized at 51.9 in January. US will release ADP employment which is expected to show 195k growth in January. December NFP released last month was a big disappointment and markets are cautiously waiting for Friday's January NFP. The ADP number today will help gauge expectations. ISM non-manufacturing index is expected to rise to 53.9 in January. The ISM manufacturing released earlier this week sharply missed expectations and thus, beware of downside surprise in ISM services today.