There was a distinct lack of momentum yesterday for a second consecutive day and what little data we did have failed to whet the appetite. The game of musical chairs which EZ heads of state have been playing of late continued, as another round of visits ensued letting it be known that we’re all still one big happy family. Monti and Hollande pushed for progress at the upcoming October meeting (this month’s meeting will solely focus on bond buying) for Spain and Greece. While Germany urged on Greece to hang tough and stick to the game plan.

GBPEUR made good progress spiking above the mid 1.26 to where it now sits at 1.2660. Better than expected Services PMI 53.7 vs 51.1 sparked the rally gaining support along the way from tensions in Greece, bottomless bailout figures from the Spain banks and a very ill-timed announcement from Moody’s rating agency.

Moody’s dropped its EU ratings outlook to negative. With a full detail of data still due out this week for the EU the knock on effect on the member states could be deadly. As it stands the UK, France and Germany are on negative outlook and this announcement is a move closer to ratings being downgraded. The last thing we need is falling credit ratings of stronger core members as we embark upon the ECB bond buying programs in the coming days/weeks to help the weaker ones.

It now seems abundantly clear that the ECB will announce its plan to buy 3 year government bonds on Thursday. It is however important that it is done correctly. In the short term the plan will lower interest rates, raise market confidence, support risk and in turn improve liquidity. There are a few concerns that could potentially hamper longer term gains from the programme. The operation needs to be carried on out a big enough scale and there is an issue that buying 3 year debt isn’t long enough especially if the ECB isn’t prepared to roll it over upon initial expiry. The issue of debt seniority will be a point of concern and most importantly ESM support is key. As it stands the ESM will be unable to maintain or effectively control rising yields. Under current legislation direct involvement in buying sovereign debt is still prohibited and without a banking licence, it is without the necessary leveraging capabilities that will be required to buy debt on a large enough scale to influence yields.

An interesting report was doing the rounds yesterday, which saw Troika impose strict labour reforms on the Greece austerity plan including a 6 day working week amongst others. Likely to go down like a lead balloon with the Greeks.

US Manufacturing PMI came in lower than expected (49.6 vs 50 exp) prompting a mini jolt downwards in EURUSD and GBPUSD. These figures strengthened the greenback as it served to push the boat out a little further for QE this month.

Services PMI data due out today for the EZ, China and the US. We can expect more speculation and opinion in the build up to tomorrows ECB plan.

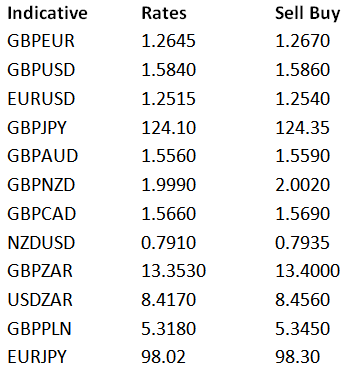

Latest exchange rates at time of writing:

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Markets Speculate On ECB Strategy

Published 09/05/2012, 07:26 AM

Updated 07/09/2023, 06:31 AM

Markets Speculate On ECB Strategy

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.