Market movers today

It will be a rather thin calendar day ahead , flavoured by more Q2 19 earnings releases globally.

In Europe, consumer and economic sentiment data for France and Italy are due for release .

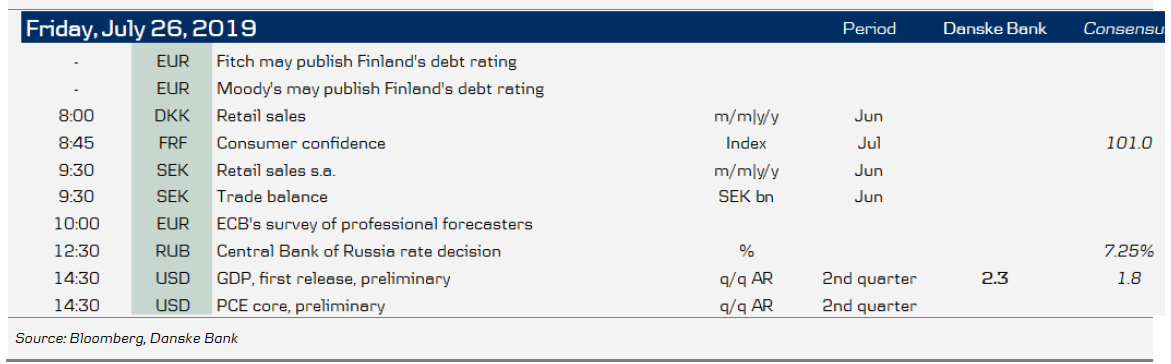

The US BEA will release its advance report on Q2 19 GDP. The Bloomberg consensus median expects a slowdown in annualised growth to 1.8% q/q from the previous 3.1% q/q, while we forecast GDP grew at an annualised rate of 2.3% in Q2 19, led by robust consumer spending and government expenditures. The latter component growth is likely to be derived from a rebound in federal government hours after the negative contribution of the long shutdown in Q1 19.

The Bank of Russia (the CBR) will announce its decision on the key rate. In line with Bloomberg consensus, we expect a 25bp cut today to 7.25%, as inflation has continued to decelerate closer to the 4.0% central bank target. The CBR has earlier joined the global monetary easing race and it is likely to deliver at least another 25bp hike in 2019 in order to support moderate economic growth.

Selected market news

At yesterday's meeting Mario Draghi sent a strong signal to the market that further stimulus is on its way to help the ailing economy. As we expected, the ECB adjusted the forward guidance as a first step, opening up the possibility of policy rates remaining 'at present or lower levels' at least through H1 20. In our view, this has set the scene for a deposit rate cut, which we expect to be announced at the September meeting (we expect a 20bp rate cut), paired with a restart of the QE programme and extended forward guidance. Markets are currently pricing 12bp of cut in September.

The ECB's assessment of the inflation and economic outlook and risks was broadly unchanged. While resilience is still apparent in the service and construction sectors, Draghi stressed the outlook was getting worse and worse, especially in manufacturing. This means the expected rebound in H2 19 is now less likely with incoming data. The risk of recession was seen as 'pretty low' (from 'very low' in June).

In a phone call with the newly elected UK PM Boris Johnson, European Commission President Jean-Claude Juncker slapped away hopes of a new Brexit pact by stating that the current one is 'the best and only' deal possible. Johnson assured that the British government is 'turbocharging' preparations for a hard exit.

The Turkish central bank delivered a dovish surprise cutting its policy rate by 425bp to 19.75%, while Bloomberg consensus expected a 250bp cut. As the prospects for the Turkish economy remain blurry for 2019, the turn towards bold monetary easing will bring some relief for Turkey's GDP and is thus marginally supportive for the TRY. We expect more cuts in H2 19.

Key figures and events