The markets seemed to be reversing the year moves in the first two days of trading in 2014. The Dow dived sharply by -135 pts to close at 16441.35, just after making record high of 16576.66 on January 2. S&P 500 also tumbled by -16.38 pts to close at 1831.98. Asian equities followed and are broadly in red while Japan markets are still on holiday. Hong Kong HSI drops over -400 pts, or -1.83% while Singapore Straits Times drops -24 pts, or -0.76%. In the currency markets, yen rebounds strongly on risk aversion with USD/JPY heading back to 104 handle for the moment. European majors are generally weak as the pull back against dollar extends. Meanwhile, Aussie also reversed some of year end's fall and breaches 0.90 handle. Technically, we'd be cautious on whether the reversal in markets would build up momentum.

In US, the Senate is set to vote on Janet Yellen's nomination as next Fed Chairman on Monday. The current vice chairman Yellen is expected to pass the vote easily and would become the first woman to chair Fed. She will take the reins on February first as Bernanke steps down on January 31. Before that, focus will be on the speeches of a number of Fed officials in an economics conference in Philadelphia. That include Philly Fed Plosser, Fed governor Stein, and chairman Bernanke. Richmond Fed Lacker will also speak today.

On the data front, Swiss will release KOF leading indicator and SVME PMIs today. Eurozone will release M3 money supply. UK will release PMI construction, mortgage approvals and M4 money supply. US will only release crude oil inventories and natural gas storage.

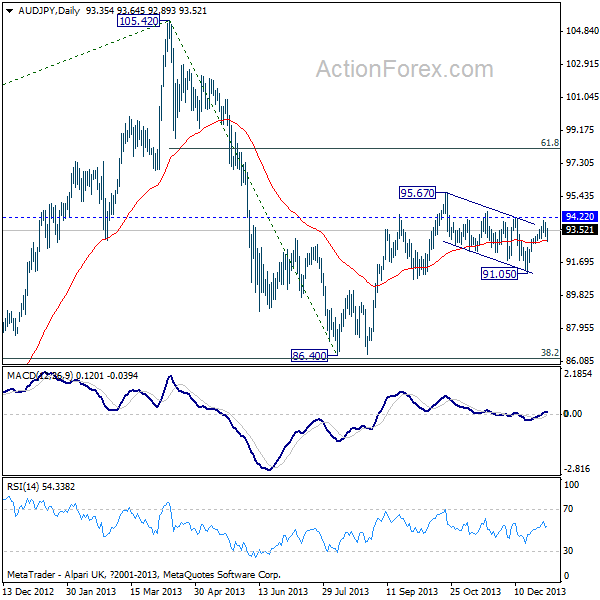

As noted above, Aussie and yen are both reversing last year's move. Comparing them, AUD/JPY is mildly bullish for the moment as it's staying above a flat 55 days EMA. Also the current development argues that the consolidation pattern from 95.67 might be completed at 91.05 already. Near term focus is on 94.22 resistance. Break will likely extend the medium term rebound through 95.67 resistance towards 61.8% retracement of 105.42 to 86.40 at 98.15. AUD/USD Daily Chart" title="AUD/USD Daily Chart" width="452" height="600">

AUD/USD Daily Chart" title="AUD/USD Daily Chart" width="452" height="600">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Markets Seem To Be Reversing In Beginning Of 2014

Published 01/03/2014, 02:31 AM

Updated 03/09/2019, 08:30 AM

Markets Seem To Be Reversing In Beginning Of 2014

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.