- Divergent trading themes confuse markets

- EM Currencies print multi year lows

- China has reason to adjust its RRR this weekend

- Geopolitical worries supports safe haven demand

It’s relentless and there is no let up in sight anytime soon. Investors are trading divergent trading themes, which is resulting in volatile and confusing markets for all participants to navigate.

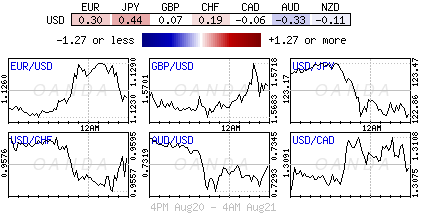

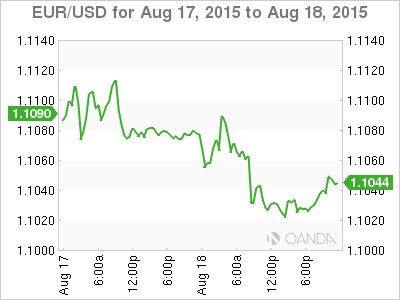

Asian currencies and the Australian dollar are weaker, ignoring for now the effects of U.S interest rate policies, as they focus on their own domestic fundamentals. These are being influenced, obviously, by China, while the EUR and other majors are advancing on the fading prospect that the Fed will not begin their rate normalization policy next month.

The single unit rallying +2.4% outright this week alone, would suggest that Asian concerns might be winning the battle. The pace of declining oil prices (WTI $41.06) and concerns over China’s devaluation of the yuan would suggest that the deflationary and slower growth camps are dominating trading.

On Thursday, investors stateside experienced the largest market sell off in 18-months, driven by the growing fears of a slowdown in China. In the overnight session, a six-year low in China’s flash PMI intensified risk aversion, causing a further drop in Asian stocks and regional currencies. The rise of the dollar has seen emerging market (EM) currencies decline towards new lows. Indonesia’s rupiah INR has fallen to it’s weakest level in 15-years, while the Malaysia’s ringgit MYR encroaches on its 17-year low outright. The Thai baht THB is at a six-year low, while the South Korean won KRW is looking to surpass its old three-year lows.

China Remains In Contraction

Overnight, China’s August preliminary manufacturing PMI missed consensus by over a point (47.1 V 48.2E), remaining in contraction for the sixth-straight month. The survey’s key output component fared even worse at 46.6 – the lowest level since late 2011. Other notable components revealed that both new export orders and employment also declined at a faster rate. The data again has led to market speculation of the need to reduce China’s growth outlook, perhaps targeting GDP rate of growth of +6.5%, rather that +7%.

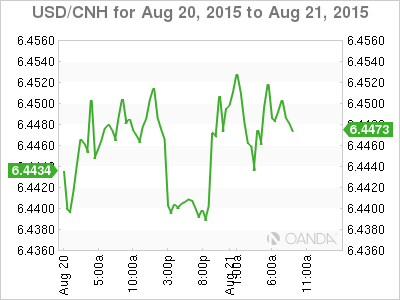

Earlier this week, the Shanghai composite index reversed a -5% drop on speculation that the People’s Bank of China (PBoC) might cut its reserve requirement ratio (RRR) this weekend. Today’s weak flash report will only heighten trader’s speculation that imminent Chinese monetary policy easing is in the cards. The yuan is trading weaker (¥6.3955), despite the PBoC setting the yuan mid-point at ¥6.3864 vs. ¥6.3915 stronger against the dollar for a sixth straight day, and the strongest setting since devaluation last week.

Even stronger Japanese data cannot sooth the investor. Japan’s manufacturing PMI rose to a seven-month high (51.9) as new order growth accelerated. With risk aversion dominating, regional Asian bourses continue to see red, while the Japanese yen (¥122.95) remains strongly supported with bids across the board on safe haven demand, similar to U.S Treasuries (10’s 2.09%) and the impressive gold demand ($1,150).

The U.S yield curve continues to flatten, a sign of growing uneasiness about the U.S growth outlook as the Fed is supposedly prepared to raise interest rates. The 2’s/10’s spread is trading around +142/143bps, the tightest level in four-months. One month ago it was at +180bps. With traders selling short-dated paper, while buying duration in anticipation of a Fed hike is very much a crowded trade.

Yesterday, the Fed announced that vice-chairman Stanley Fischer would be delivering a speech at Jackson Hole on August 29 entitled “US inflation developments.” It could provide traders with a heads up on the timing of rate liftoff in the U.S. Any negativity and these debt positions will be unwound rather quickly.

Heightened Geopolitical Concerns

It’s not all growth or deflationary worries that’s encouraging investors to seek sanctuary in historical safe haven assets.

Geopolitical concerns are adding to the bearish argument. North Korea’s Kim put his military on high alert and exchanged shellfire with the South overnight.

In Europe, after the announcement by Greek PM Tsipras yesterday to resign and call a snap election for September 20 if possible, opposition leader Meimarakis was said to receive a mandate to form a new government after meeting with the Greek President Pavlopoulos. The single unit seems unfazed with these developments and is up on the greenback (€1.1282) as the market reduces their bets of a September Fed hike.

It had been rather quiet, but tensions have been rising again in the Ukraine. Russia is feeling the pain of the collapse in oil and the RUB. They now see crude prices hitting $30-35 dollars a barrel and Putin needs a distraction.

Africa is feeling the pain of China’s slowdown and yuan weakness. Chinese demand for hard commodities and energy that Africa produces will be tested (in 2015 it was worth approximately $250b to the continent). The ZAR is trading at a 14-year low (12.96) and the world is beginning to question China’s “real” growth potential, especially since the PBoC has been tinkering with its own currency valuation.