Financial and economic yabadabadoo continues to litter the headlines, extolling solid future economic results with complex explanations and esoteric formulas that give credence to no more than an economic mirage. Then we must also be ready to deflate the potential inflationary environment which is not reflating because all the “ations” are misbehaving, further complicated by the inability to comprehend how the various “ations” actually develop. Buy gold, sell silver, buy oil, sell land, buy snails, sell spinach… Argh!

The truth is that most of us identify with Dino: give me a steady meal, a happy life and simple talk. I used to get lost in my own words, putting most people in a snoring state until my daughter told me “to dumb it down,” not because people are stupid, she emphasized, but because people yearn for simple and honest answers to seemingly complex problems, and do not have the time or patience to digest all the jargon and often baseless, conflicting and questionable assertions. As it stands, it’s hard to consolidate the varying opinions and solutions emanating from official sources, while their words continue to affect markets in ways not seen in recent memory. One minute the market shoots up on a three syllable word, then it tanks on a sneeze, and we still don’t know where we are. That’s the reality!

Now that we have a new Fed chair, Janet Yellen, I can only add one thing: Despite her good intentions, she’s a dove living in a pigeon hole. Taper talk in its various tones hasn’t subsided, but the messaging is extremely confusing to Fed members, never mind us. The last Fed minutes indicated a fear of higher rates, a loss of credibility, a conveyance of economic pessimism, and it all boiled down to ongoing economic weakness and new risks on the horizon. In short, the Fed identifies much better with short-term traders than long-term economic planners, and I can sympathize. After all when I choose to sink my teeth into something that I don’t understand, it is extremely nerve wrecking, especially when I was taught that certain methods, models and theories work flawlessly, and then they don't.

Narayana Kocherlakota, the head of the Minneapolis Fed, opined that the “Fed Should Work More Aggressively to Battle Unemployment.” How? Double the Fed’s balance sheet? What happened during the last 5 years? The logic was simple: flood the market with cheap money, drive inflation and economic activity up, and then slowly turn the money spigot off as normalcy returned. But this time is truly different, wouldn’t you say? Another Fed member had this to say regarding QE and interest rates:

The two things "are very loosely connected," said New York Fed President William Dudley. "The amount of time that can pass between the decision to begin to taper and actually raising short-term interest rates could easily be a number of years."

Years? Maybe so, but the Fed doesn’t really control interest rates; the free market does. In addition, Chicago Fed President Charles Evans said “that U.S. economic growth has been disappointing this year and the current situation gives him ‘great pause.’ ‘U.S. growth is not nearly strong enough and it has been weaker still.’” Then Eric Rosengren, President of the Boston Federal Reserve Bank, added the following:

The Federal Reserve ‘s easy policy stance, including its bond-buying program, could last for “several years” to make sure that the economy is on track for solid growth and moderate inflation

Years, again. What no Fed member states is that the Fed’s policies are a failure. Instead they tell us that we need more of the same, a tweak here and there, and everyone knows by now what the definition of insanity is. One can lead a horse to water, and when it fails, one can throw the horse into the ocean, or one can continually water a plant that shows no sign of improvement, and at some point one will have to pluck the unintended weeds and yank the plant out of the ground before a drainage problem emerges. But in hindsight, postponing the “taper” was the right thing to do, according to some Fed members.

Top Federal Reserve officials said on Friday their decision not to reduce the pace of stimulus was wise given the crippling U.S. government shutdown, while admitting some recent troubles in getting their policy message across.

Yes, professional excellence at work! The problem with that assessment is that the Fed’s statement from the last meeting did not mention a government shutdown or the debt ceiling, and the only relevant reference to government was actually positive.

Taking into account the extent of federal fiscal retrenchment, the Committee sees the improvement in economic activity and labor market conditions since it began its asset purchase program a year ago as consistent with growing underlying strength in the broader economy

To bring perspective to the unemployment situation, I add an excerpt from a WSJ article.

Through analyzing about three decades of census data—from 1980 to 2012—the study found that on average, young workers are now 30 years old when they first earn a median-wage income of about $42,000, a marker of financial independence, up from 26 years old in 1980. About a third of adults in their early 20s work full time, a proportion that rises to about half of adults in their late 20s. The labor-force participation rate for young people last year declined to its lowest point in about 40 years, according to the report.

The trigger that led me to write this article was the Reuters’ piece: “U.S. data gives conflicting signals on economy's health.”

Contracts to buy previously owned U.S. homes fell for the third straight month in August but fewer Americans filed new claims for jobless benefits last week, giving conflicting signals on the health of the economy. Another economic report on Thursday showed a worrisome decline in consumer prices during the second quarter.

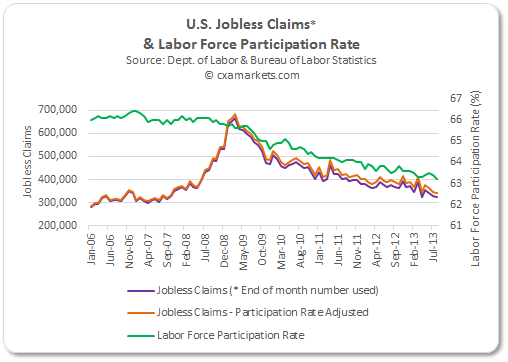

Yes, confusing and multi-directional to say the least, and the housing market was already addressed in “Distorted Housing Market Gives False Hope.” Then another article emphasized that “U.S. jobless claims show job market healing but service sector slows.” But is the job market truly healing? The chart below shows the labor force participation rate and jobless claims for the last eight years or so, and there are a few points that need to be emphasized.  First let your eyes feast on the fact that both data series have been on a downward slope since 2008-2009, and jobless claims are still above the pre-crisis time period. If the job market was healing, the labor force participation rate should have stabilized while jobless claims declined. As highlighted numerous times in the past, if it wasn’t for the continually descending labor force participation rate, the official unemployment rate would have been stagnant since 2009, with the current official rate of 7.3% a far cry from reality. In addition, what we have is an increasingly smaller pool of workers that qualify for jobless benefits, and if jobless claims were adjusted to reflect a lower labor force participation rate, the weekly number would be about 20,000 higher than the official number (orange line). So where are these people? The chart below highlights the growth in government expenditures on Welfare and Social Services (red) and SNAP (green), also known as food stamps.

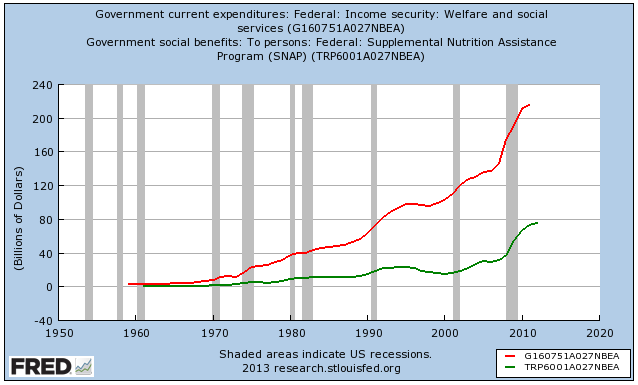

First let your eyes feast on the fact that both data series have been on a downward slope since 2008-2009, and jobless claims are still above the pre-crisis time period. If the job market was healing, the labor force participation rate should have stabilized while jobless claims declined. As highlighted numerous times in the past, if it wasn’t for the continually descending labor force participation rate, the official unemployment rate would have been stagnant since 2009, with the current official rate of 7.3% a far cry from reality. In addition, what we have is an increasingly smaller pool of workers that qualify for jobless benefits, and if jobless claims were adjusted to reflect a lower labor force participation rate, the weekly number would be about 20,000 higher than the official number (orange line). So where are these people? The chart below highlights the growth in government expenditures on Welfare and Social Services (red) and SNAP (green), also known as food stamps.  Politics aside and no excuses are given to anyone, one must understand that the chart above emphasizes a much bigger economic structural deficiency, and although government welfare expenditure shows a parabolic expansion over the last five years, the process started in earnest after the dot.com debacle. And that brings us to the discussion of the day: Fiscal policy and the debt ceiling. I certainly do not want to become part of the political circus, and look at our condition from an unbiased perspective, but default will not happen because neither political party can run the risk of being blamed, regardless of technicalities. It’s always about political power, not the people. Moreover, default is not about a simple recession or global economic pull-back, but a redefinition of risk as we know it for generations to come, and to contemplate the U.S. not paying its bills as a possible outcome is silly at best! I believe that even the often fallacious and dubious political wisdom comprehends the ramifications.

Politics aside and no excuses are given to anyone, one must understand that the chart above emphasizes a much bigger economic structural deficiency, and although government welfare expenditure shows a parabolic expansion over the last five years, the process started in earnest after the dot.com debacle. And that brings us to the discussion of the day: Fiscal policy and the debt ceiling. I certainly do not want to become part of the political circus, and look at our condition from an unbiased perspective, but default will not happen because neither political party can run the risk of being blamed, regardless of technicalities. It’s always about political power, not the people. Moreover, default is not about a simple recession or global economic pull-back, but a redefinition of risk as we know it for generations to come, and to contemplate the U.S. not paying its bills as a possible outcome is silly at best! I believe that even the often fallacious and dubious political wisdom comprehends the ramifications.

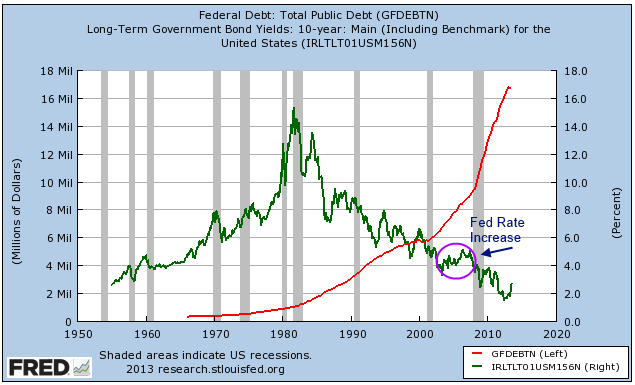

The chart that follows provides us with a clear picture of government debt and 10-year interest rates, and we can track the problem to the dot.com era, with the terrorist attacks of 2001 and subsequent wars contributing to the pile of IOUs.  Please note the magenta circle, which roughly indicates the time period during which the Fed increased rates. From a macro perspective, the interest rate movement during that period would have been virtually unnoticeable, except that the underlying economic well-being of the nation was already fragile, living on steroids and borrowed time. Fact remains that the little interest rate blip on the big chart busted the housing mania, and, by extension, the economy at large.

Please note the magenta circle, which roughly indicates the time period during which the Fed increased rates. From a macro perspective, the interest rate movement during that period would have been virtually unnoticeable, except that the underlying economic well-being of the nation was already fragile, living on steroids and borrowed time. Fact remains that the little interest rate blip on the big chart busted the housing mania, and, by extension, the economy at large.

Without a doubt, the Fed Funds rate reduction was also driven by the fallout of the dot.com debacle and then 9/11, but, more importantly, the bigger problem lies with the erroneous Fed’s belief that they can pull the right levers at the right time to make it all economically better. Please stop, you’re killing us! Maybe a Myers-Briggs personality assessment should be developed for institutions (mine is INTJ), because beyond highlighting good traits, the test is far more helpful in determining shortcomings so behavioral modifications and corrective measures can be implemented.

If 10-year rates revert back to 5% or 6% (the Fed is extremely worried about it), government debt will increase without a doubt, even barring added expenditures, and creating a vicious cycle. Let’s keep in mind that the Europeans never saw it coming while believing in economic fairy tales, and the Chinese will soon realize that state capitalism is a paper tiger.

Some will say that we do not have a government spending problem, but rather a revenue shortfall, while others will offer the opposing point of view. The truth is that the damage has been done, and the answer lies somewhere in between because government debt cannot go on forever, and it takes several years to actually bring government spending under control. Regardless of opinion, the path we’re on is unsustainable, and here’s a word to the wise: even if a balanced budget is achieved, never mind an outright spending reduction without additional revenue, there’s an economic price to be paid. In addition and much like Europe, there are no painless solutions regardless of the daily political wizard. To hope that an economic recovery will address the debt problem is naïve at best, and the next decade will be marked as an adjustment period without immediate economic rewards.

I was watching an opinion show on TV with my teenage daughter and the debate centered on government spending. She quickly added that if one spends more than one earns, one has a spending problem. Then she concluded with an extremely informative term: Duh! She has her own checking account and debit card, and she solves her spending problem by using my credit card when she shops. She’ll excel in politics, if that becomes her chosen career path.

From a broader market perspective and on a monthly basis, the S&P 500 (SPY) has been in overbought territory since November 2012 -- eleven months without pause and including major drops -- and the last time it happened for an extended period of time was between October 2006 and October 2007. Although QE has added fuel to the fire, a wide bet on an economic recovery is the key driver, and the perception of a rosier future is baked in, with no room for disappointments.

The trick for investors with a wider time frame is knowing when to get off the gravy train, and when buying the dips becomes a failed strategy. It’s all about the somewhat hidden and underlying big picture and the timing of when perceptions meet reality. I wish that I could give a number, but that is not how it works, because the process, despite its flaws, is more of an art than a science and we’re constantly dealing with moving targets. Suffice it to say that the S&P 500 geometric picture -- literally -- continues to be pretty solid for the time being.

Eventually everything falls into place, and what goes around comes around, but I learned a long time ago that markets were invented to make fools out of the brightest, and the louder they scream “It’s all wrong,” the longer markets move in the opposite direction. Then markets eventually comply after the critics reach bankruptcy and dementia.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Markets See Beauty, Overlook New Ugly Normal

Published 10/13/2013, 09:46 PM

Updated 07/09/2023, 06:31 AM

Markets See Beauty, Overlook New Ugly Normal

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.