As is almost always the case, Brexit negotiators are at their best when more time is needed to reach an agreement. This time, the president of the European Commission and the British prime minister have decided to extend discussions on free trade.

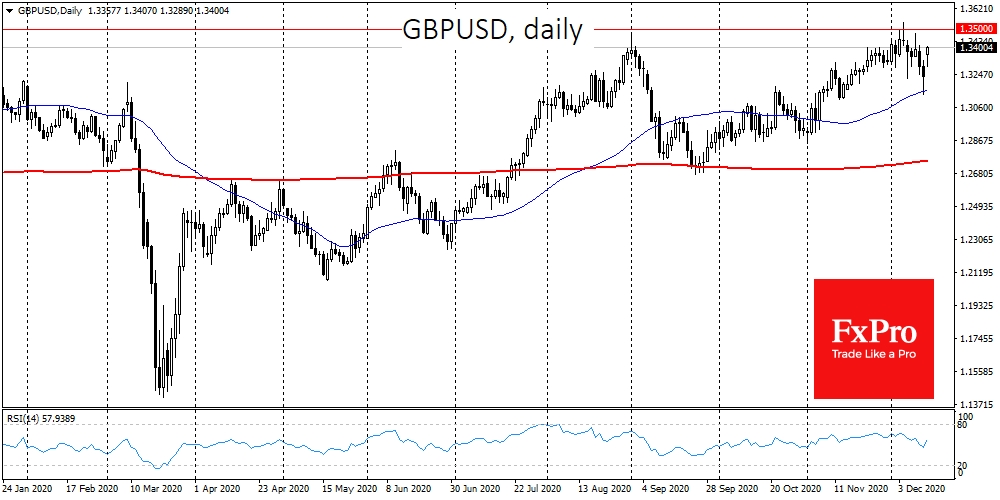

The postponement of the deadline is now seen as a ray of hope for an agreement rather than a harbinger of impending deadlock. Expectations of softer mutual trade terms between Britain and the EU gave a positive start to markets on Monday morning. GBPUSD was up 1.25% to 1.3400 by the start of the European session, more than two figures above Friday's lows of 1.3130.

Technically, GBPUSD gained support on Friday when it touched the 50-day moving average, the signal line of the short-term trend. Should the exchange rate remain above this level, it would be a confirmation that the upward trend will continue.

The development of positive sentiment also indicates that we will soon see new attempts of the pair to enter a higher trading range above 1.3500, without developing a deep correction to 1.27, as was the case in September.

Besides, the markets have heightened hopes of imminent fiscal and monetary stimulus in the US. Democrats at the weekend hinted at a willingness to compromise, and these comments breathed life into US index futures purchases.

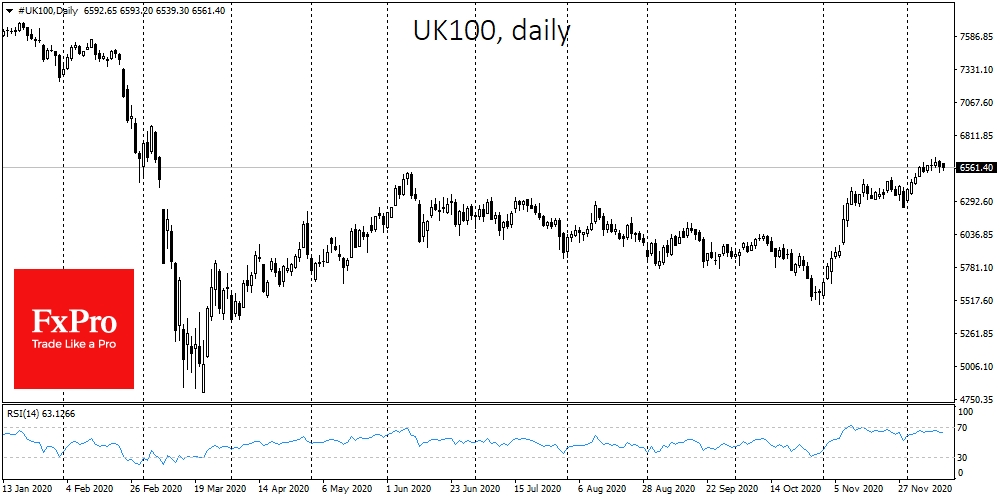

The positive dynamics of the pound and, indirectly the euro, sent global stock markets to test new highs.

However, the FTSE100 and DAX30 are sluggish today on the general optimism because of the negative impact of stronger local currencies on domestic exports. On Monday morning, the German DAX has some decline while FTSE100 is falling for the second session, losing about 1% and mirroring the appreciation of the pound.

The optimistic market sentiment will have to pass an important test this week in the form of a key Fed meeting. Wednesday evening will be the CB's final meeting of 2020 and investors are expecting an extension of monetary support measures.

However, it is worth remembering that participants generally have very high expectations, so the markets could be seriously disappointed if for some reason the Fed is unhappy with the record stock index prices and points to the need to focus on supporting the economy, rather than the markets directly.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Markets Renew Growth On Brexit & US Stimulus Hopes

Published 12/14/2020, 05:03 AM

Markets Renew Growth On Brexit & US Stimulus Hopes

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.