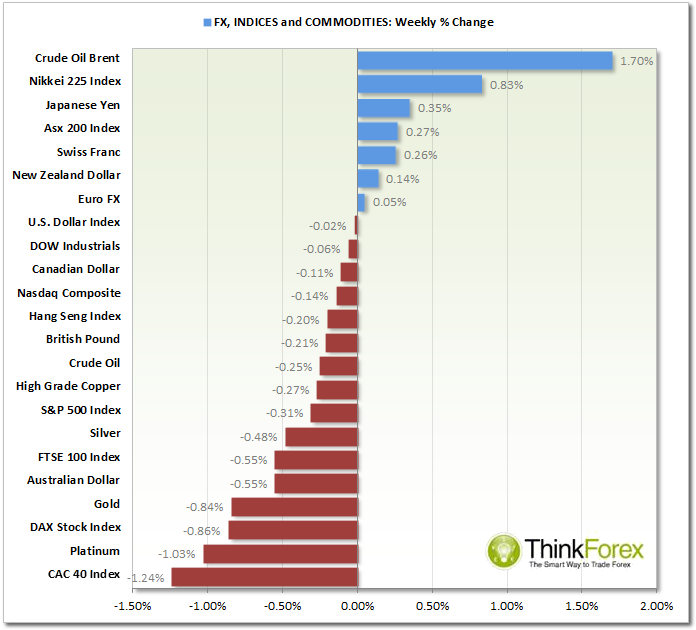

Market Snapshot:

- US Indices holding above key support levels.

- With the USD currently resting around the 80 level a break below here opens up 79.80, 79.50 and 79.00.

- Metals correcting but breakouts could follow after tomorrow

- AUS200 looks vulnerable for further losses

The markets are relatively quiet in the lead up to Bernanke's speech, when he will announce whether or not the Fed will taper the Bond Purchasing Program. The general consensus is it is too soon to taper, despite the stream of positive figures released form the US over the past few weeks.

Another belief is that if and when tapering does begin it will be in the region of only $10bn-$15bn at most off of the $85bn the bond-buying program currently is.

So really it is a question of how much of this information is already priced in to see how Indices and USD reacts.

My own view is that the USD will take a hit if no tapering is announced 07:00 GMT Wednesday.

GBP/CAD: Holding above key support at 1.7200

Yesterday produced a small tailed Doji above 1.720 - however volatility across the board was seen lower yesterday as we await the tapering decision.

1.7200 is a level to watch as the support zone comprises of pivotal S/R, 38.2% fibs and 20eMA.

Should price break below this level we also have suitable support at 1.710 (50% fibs and Monthly Pivot)

1.700 (Round number, 61.8% and lower channel line)  GBP/CAD Daily Chart" title="GBP/CAD Daily Chart" height="630" width="696">

GBP/CAD Daily Chart" title="GBP/CAD Daily Chart" height="630" width="696">

GOLD: A trend-traders's nightmare!

If you like indecisive, whipsawing price action then this is the place to be.

However despite it's seemingly directionless action I've managed to get some sort of directional plan together. 1240 is the key level to decide for intraday bullish or bearish trades in my own opinion.

1240 is a pivotal S/R level; Beneath the Weekly Pivot and the 50 and 200eMA's are beneath this zone pointing downwards. Therefore short positions would be the preference beneath 1240 and to target suitable support levels.

If we break above 1240 then using the same approach to target resistance levels, bullish setups near support would be the preference.

Ultimately trend on the higher timeframes is bearish but until we break above 1268 or below 1210 then technically we are within a complex correction, so intraday trading would be the safer option. XAU/USD Hour Chart" title="XAU/USD Hour Chart" height="630" width="696">

XAU/USD Hour Chart" title="XAU/USD Hour Chart" height="630" width="696">