- Another solid jobs report in December but easing wages raise soft landing hopes

- Wall Street and global equities rally as China reopening adds to optimism

- Commodities climb too as dollar approaches 7-month lows

Markets cheer US data pointing to slowing economy

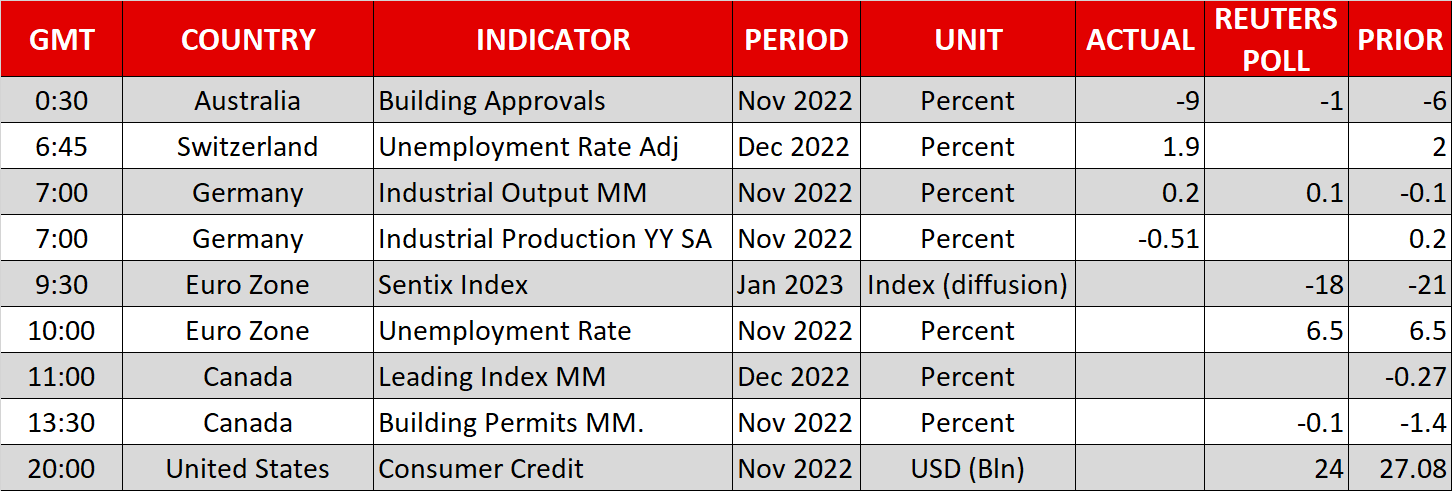

Friday's flurry of data produced a distinguishingly mixed picture on the US economy but for the markets, it was an all-round positive day as traders grew more confident that inflationary pressures are ebbing. The first piece of good news for the bulls came from the December jobs report, which showed another beat in the headline payrolls figure, but average earnings moderated sharply.

Wages rose by a much smaller-than-expected 4.6% annually in December – the slowest since August 2021, while they increased by less than the initial estimates in the prior month. Payrolls for November were also revised lower, further bolstering the view that the US labour market is cooling off.

There was more ‘good’ news later in the session as both the ISM non-manufacturing PMI and factory orders disappointed. The US services sector contracted slightly in December according to the closely watched ISM survey and its prices paid index fell to the lowest since early 2021.

More premature optimism about the Fed going easy?

Investors didn’t waste any time paring back expectations about how aggressively the Federal Reserve will hike rates in 2023. Bets for only a 25-basis-point rate hike in February surged to about 75%, while Treasury yields on both the short- and long-ends of the spectrum tumbled.

However, aside from the Fed’s Bostic and George repeating the case for rates to hit at least 5% this year soon after the data came out, traders overlooked another sign that casts doubt on the claim that the labour market is losing steam. After months of disparity between the unemployment rate and the changes in monthly non-farm payrolls, revisions in the household survey, which the jobless measure is based on, lay the blame for the discrepancy on the former.

According to the survey, household employment jumped by 717,000 jobs in December, more than offsetting the combined losses in October and November, which were less than previously thought. The US jobless rate is now back at a multi-decade low of 3.5%, giving the Fed little reason to pause its tightening campaign.

Wall Street rebounds, but can it last?

Nevertheless, investors are once again feeling upbeat about inflation maintaining its downward course, prompting a timely enough rethink at the Fed to avert a hard landing. They could have more to celebrate on Thursday when the next CPI report is due. With the inflation rate forecast to drop to 6.5% in December, Friday’s rebound on Wall Street may just be the start. But for now, the bulls have gone into lower gear. After surging more than 2% on Friday, S&P 500 futures are currently trading about 0.3% higher.

European and Asian shares have also rallied on the back of the NFP numbers, while pledges by China’s central bank to increase support to households and private firms, as well as signs that the country’s travel and leisure industries are poised for a big comeback following the removal of all Covid curbs further lifted risk appetite.

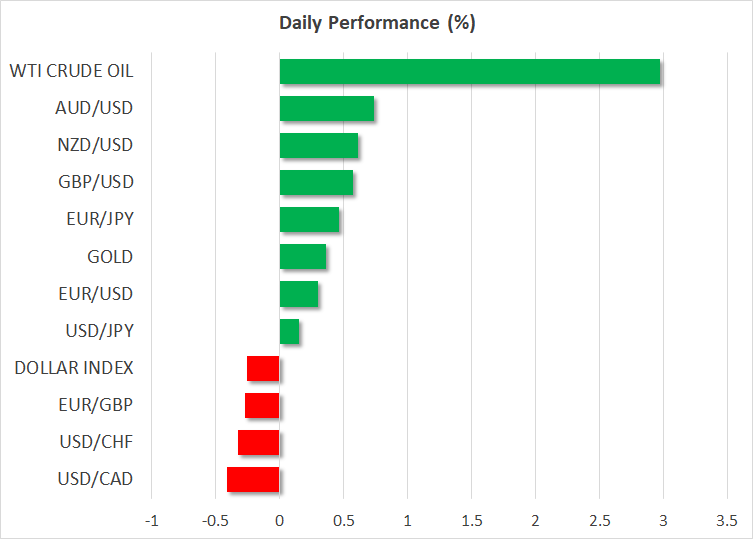

Commodities such as crude oil and copper have surged by between 2% and 3% on Monday on expectations that Chinese demand is making a swift recovery. Gold is also enjoying a revival, extending an uptrend that began in early November to around the $1,875/oz mark.

If traders continue to revel in the hope that the US economy can achieve ‘Goldilocks’ state again and push bond yields lower, it may only be a matter of time before bullion prices are back above $1,900.

Dollar slips as bears eye new lows

In the FX world, the US dollar declined to new lows, coming within a whisker of hitting seven-month lows against a basket of currencies. After Friday’s sharp reversal from one-month highs, the dollar is on the back foot again and its troubles could get worse if this week’s CPI data undershoot expectations once more.

In the meantime, risk-sensitive currencies such as the pound, aussie and kiwi were some of the better performers, though the Canadian dollar continued to lag somewhat despite a very robust Canadian employment report on Friday.