Investing.com’s stocks of the week

Before signing off for the Thanksgiving holiday, the US jobs market posted yet another strong number, prompting further encouragement in the recovery. Claims fell to a 2 month low and signals to us certainly that they are back on trend with where they were before the US government shutdown and debt ceiling battle. The key week for the US jobs market definitely starts Monday with employment components from the manufacturing ISM followed by its non-manufacturing counterpart on Wednesday. ADP is also Wednesday, Thursday sees jobless claims and Friday is payrolls day – if we do not have a clear view of US job market strength from those releases then the Dectaper argument will have been dealt a heavy blow.

Another US indicator – durable goods orders – was not as strong as had been expected, dropping in October and signalling that the government shutdown did have some effect on business confidence.

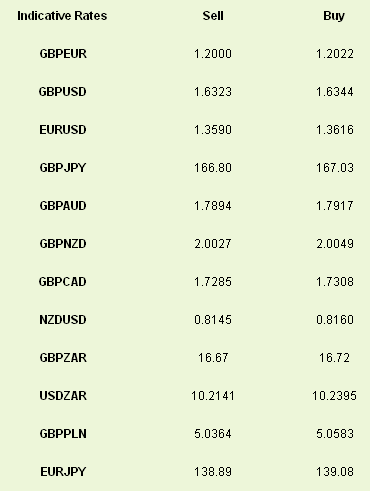

Dollar started the day on the back foot and broke to 4 week lows against both GBP and EUR. Sterling’s gains were not strictly as a result of the latest GDP release; there was a definite delay when normally there is none. That being said GDP in the UK once again hit expectations, the 2nd reading for Q3 coming out as expected at 0.8% on the quarter, matching the previous figure.

Growth in the UK continues to be driven onwards by private consumption, house building and investment; making up for a violent slip in exports. UK goods and services sold abroad fell to the lowest level since Q2 2011 as GBP gained in value and economic and political matters flared up in Europe – Britain’s largest customer – once again. The momentum in UK growth still sits with the UK consumer and we see this at risk as we head into 2014, given the continual and persistent divergence between wages and prices despite recent falls in CPI.

Despite the recent strong data, this will do little to move the needle as far as changes to any timeline of Bank of England rate increases. The unemployment level remains well above the 7% threshold and UK businesses will continue to draw down spare capacity into 2014 before elevating recruitment efforts. This will keep wage inflation muted in the short term and weigh further on the prospects for household spending; something that is currently running at the fastest pace in 3yrs.

Euro is off this morning as the spectre of deflation continues to haunt the Eurozone. Germany reported its latest batch of import prices; slipping back below the zero bound to -0.7%, more than the -0.5% that had been expected. Further moves lower in oil markets will continue this trend. Wider Eurozone inflation numbers are due tomorrow morning.

What is being lost with no US data calendar, the Europeans are making up for today. German unemployment kicks us off at 8.55am with no change expected on the previous month, followed by M3 money supply, a key barometer of the ongoing credit crunch at 9am. Consumer confidence is due at 10am and the latest round of German CPI at 1pm. Given recent moves you would expect tighter credit conditions, falling inflation and wobbly confidence; a recipe for a lower single currency.

Another day brings another Bank of England report, this time in the form of the BOE’s Financial Stability Report. This semi-annual report, which includes the housing market, will be delivered at 10.30am GMT.