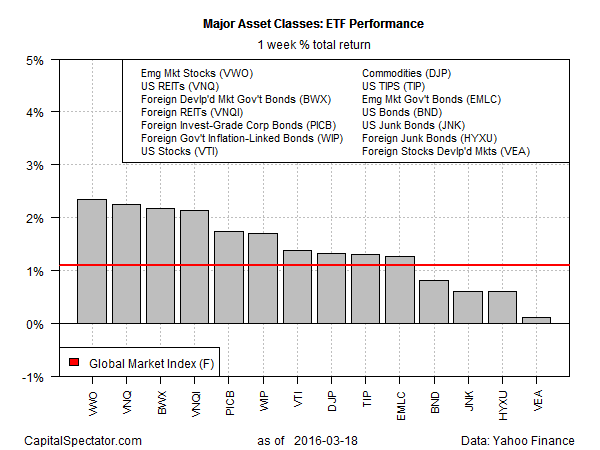

Positive momentum prevailed again last week for the major asset classes, based on a set of proxy ETFs. For the fifth consecutive week through Friday, Mar. 18, the risk-on trade delivered another round of profits across the board. The trailing one-year period still reflects plenty of damage, but the red-ink brigade continued to retreat on this front, leaving the field evenly split among winners and losers.

Emerging-market stocks (NYSE:VWO) led the winners last week through Mar. 18 with a 2.4% total return. The general upside bias also continued to lift an ETF-based version of the Global Market Index (GMI.F)–a passively managed benchmark that holds all the major asset classes in market-value weights. GMI.F climbed 1.1% last week—the fifth straight weekly gain for the index.

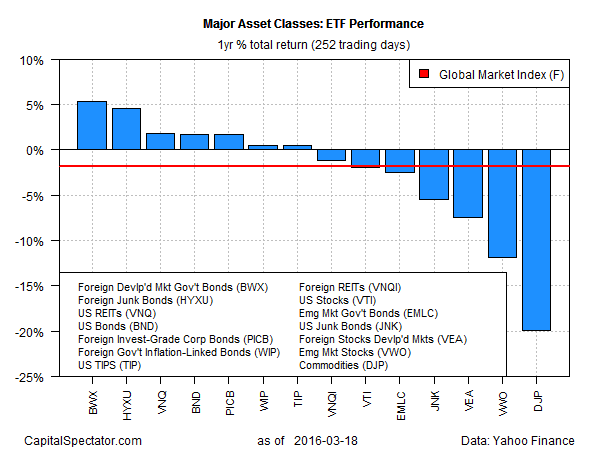

The one-year trailing return is still littered with losses, but repair and recovery rolls on. The current one-year leader: foreign government bonds in developed markets (NYSE:BWX), which is ahead by more than 5% at the moment on a total-return basis. The previous legacy of selling continues to weigh on GMI.F, however, albeit in a diminishing degree these days. The benchmark is now off by a relatively light 1.8% for the trailing 252-trading-day period through last Friday.

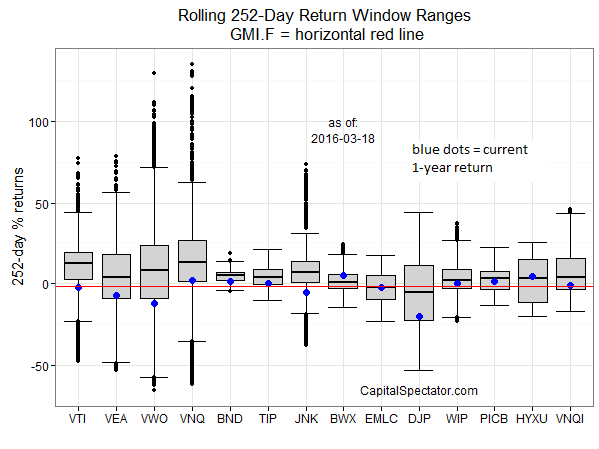

To put the current trailing one-year performance data in perspective, the next chart shows the current one-year total returns (blue dots) for the major asset classes relative to the historical record in recent years. Note that broadly defined commodities (NYSE:DJP) remain dead last in terms of absolute losses at the moment.