- Dollar continues to be driven by tariff headlines

- Nonfarm Payrolls to reshape Fed expectations

- BoE to cut by 25bps; focus to fall on forward guidance

- Canadian jobs report key for BoC’s next move

In the Mercy of Tariffs

The US dollar has staged a recovery this week, corroborating the notion that the latest pullback on news that Trump may adopt a softer stance on tariffs than his pre-inauguration rhetoric suggested, was just a corrective phase.

Tariffs remained the main driver, with Wednesday’s Fed decision adding some extra fuel to the rebound. After Colombia succumbed to Trump’s threats, investors’ concerns were amplified again, with many perhaps thinking that the US President may harden his rhetoric to get what he wants from the rest of the world. And indeed, Trump himself confirmed that view after he rejected reports that US Treasury secretary Scott Bessent is pushing for only 2.5% tariffs that would be gradually lifted to 20%, saying that tariffs would be “much bigger.”

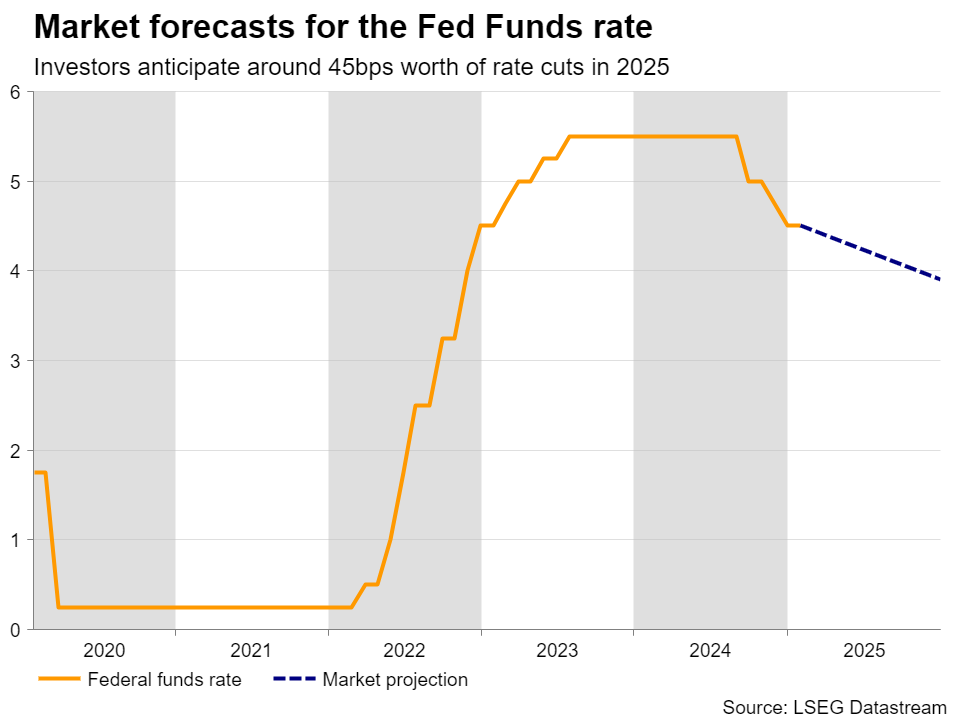

In the shadows of the first imposition of 25% tariffs on Canadian and Mexican imports on February 1, the Fed decided on Wednesday to keep interest rates unchanged. At the press conference following the decision, Fed Chair Powell acknowledged signs of progress in reducing inflation, adding that “non-market” prices remain stubbornly high and stressing that they are in no hurry to make further adjustments. They will wait for more clarity on the economic front as well as on government policy.

From around 50bps worth of rate reductions for this year, Fed fund futures are now pointing to 45bps as investors lifted only slightly the implied rate path. The next quarter-point reduction is still nearly fully priced in by June.

Nonfarm Payrolls Enter the Limelight

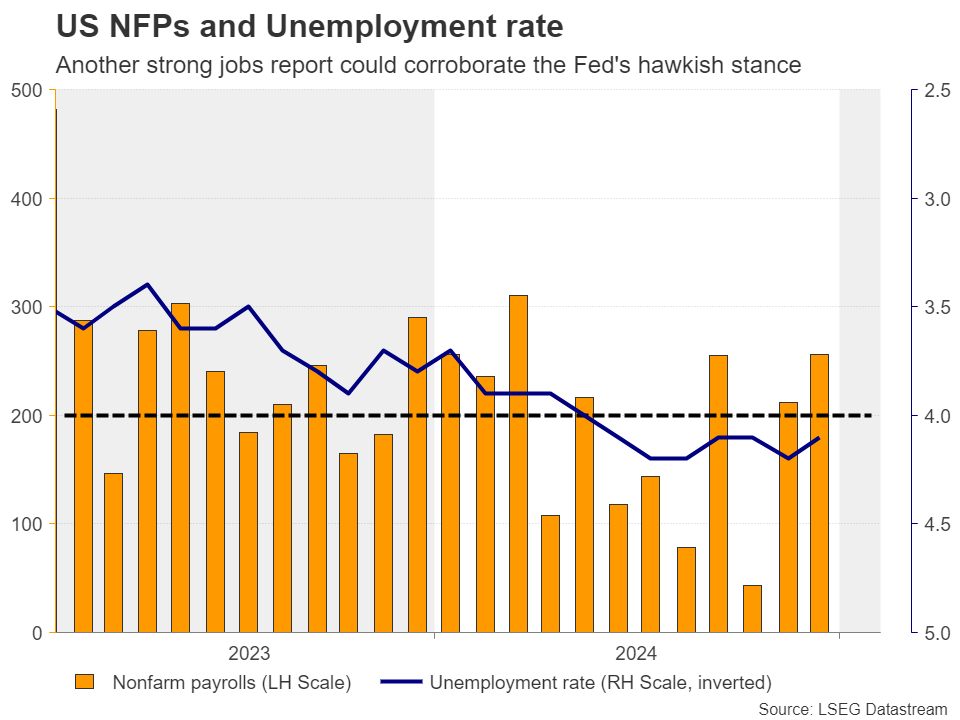

With all that in mind, attention next week is likely to fall on the NFP employment report for January. Powell noted that further labor market weakening is not needed for the inflation target to be met as the path for continued disinflation remains intact. However, he did not mention what will happen in the case of unexpected labor market tightening.

In December, the economy added 256k jobs, with average hourly earnings ticking down, but remaining elevated close to 4.0% y/y. Another round of strong employment and wage growth could intensify concerns about a resurgence of inflation in the months to come, especially if Trump kicks off the tariff game on February 1. Market participants are likely to start doubting again whether two rate cuts will be needed this year, which could allow the US dollar to extend its latest recovery.

The ISM manufacturing and non-manufacturing PMIs on Monday and Wednesday, as well as the ADP private employment report on Wednesday, will also be closely monitored ahead of Friday’s NFP data.

Will the BoE Opt for a Hawkish Cut?

After the BoJ, the Fed, the ECB and the BoC, it will be the BoE’s turn to hold its first policy decision for 2025. Following the concerns over the sustainability of the new government’s fiscal plans, where UK bonds and the pound tumbled on fears of a Truss 2.0 budget crisis, investors became more convinced that a rate cut would be appropriate at this gathering.

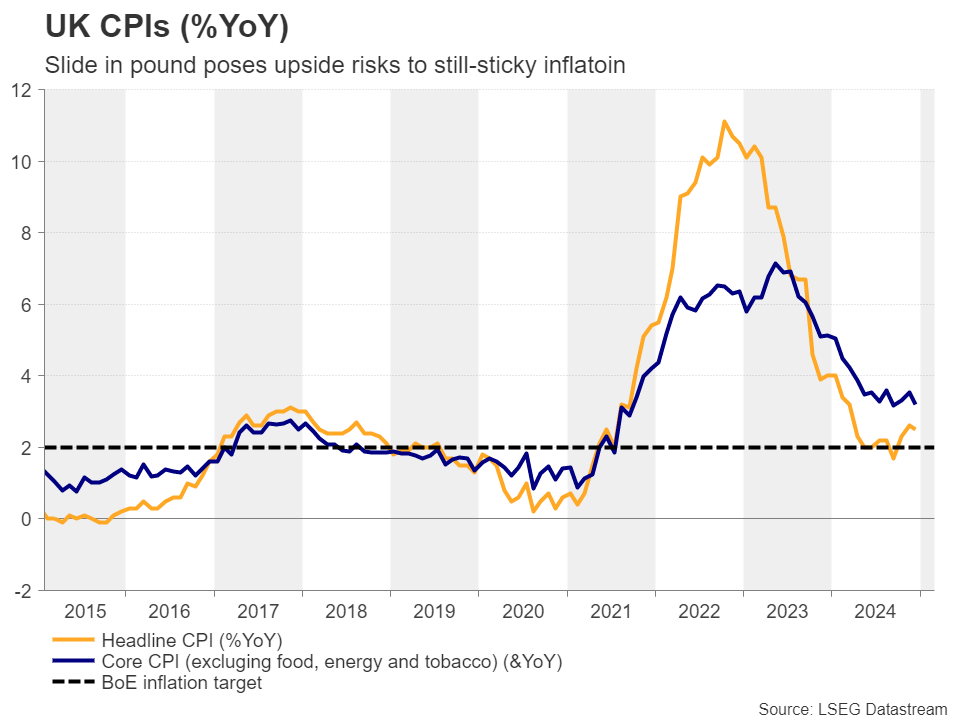

Taking also into account the cooler-than-expected CPI numbers for December and the sluggish UK growth, investors are now penciling in around a 90% chance of a quarter-point rate cut at this gathering, while anticipating nearly another two by the end of the year.

That said, both the headline and the core inflation rates remain above the Bank’s objective of 2%, with the latter standing at 3.2% y/y. What’s more, although the surge in bold yields was largely reversed, the pound recovered only a portion of its losses. It is actually the worst-performing major currency so far this year, posing upside risks to UK inflation.

Therefore, even if the well-anticipated rate cut is delivered, it may be a hawkish cut, with the Bank revising up its inflation projections, especially with rent inflation remaining stagnant at 7.6% y/y and services inflation still above 4.0% y/y. Officials may signal that they will take their decisions meeting by meeting, avoiding to pre-commit to any future rate cuts. This may disappoint those expecting another two reductions this year and thereby allow the pound to gain some more ground.

Will the Jobs Data Allow the BoC to Take the Sidelines?

At the same time with the US jobs data, Canada releases its own employment report for January.

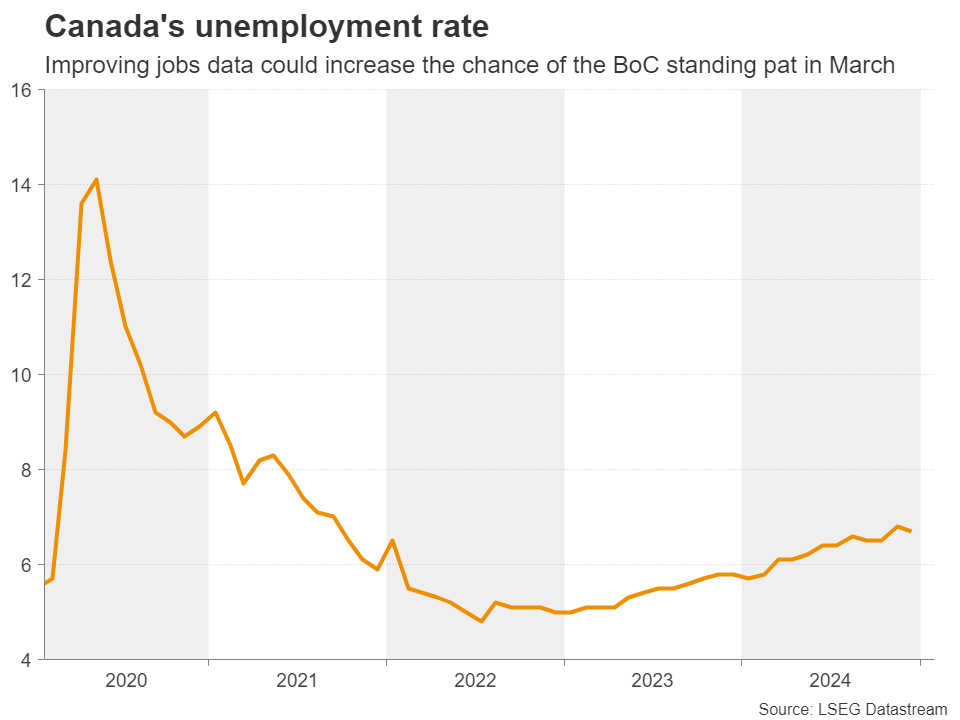

This week, the Bank of Canada trimmed interest rates by another 25bps and revised down its growth forecasts, noting that they are concerned about US tariffs.

However, they also added that tariffs could also stoke persistently high inflation, which led market participants to pencil in around a 50% probability for policymakers to take the sidelines at the next policy gathering in March.

In other words, the BoC will find itself between a rock and a hard place and Friday’s jobs report may help tilt the scale towards a pause or another rate cut, depending on whether it will come in strong or soft.

Eurozone CPIs, NZ Employment and Japan’s Wages

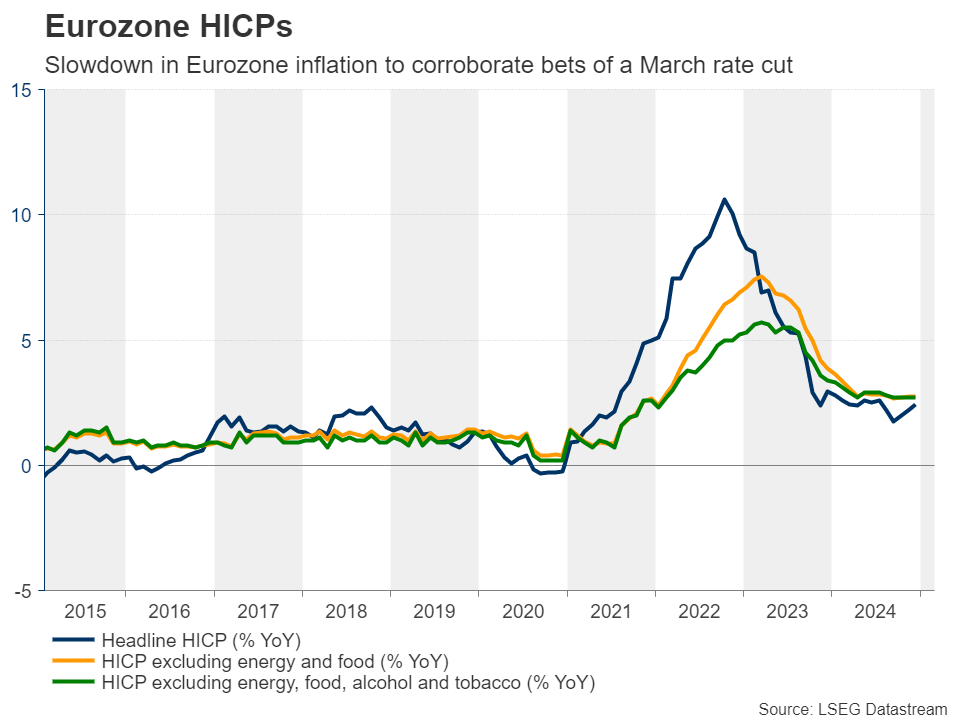

Flying from Canada to the Eurozone, the ECB also decided to reduce interest rates this week, noting that the disinflationary process is well on track and that the economy is still facing headwinds. In the statement, it was noted that the Bank is still not pre-committing to a particular rate path. At the post-decision conference, President Lagarde said that interest rates are still in restrictive territory and that there was no discussion on whether it's time to stop reducing rates.

The market was quick to price in around an 85% chance for another quarter-point cut in March and should Monday’s flash CPI data reveal cooling inflation, that probability could go even higher, thereby weighing on the euro. Eurozone’s retail sales are also on next week’s agenda.

Elsewhere, during Tuesday’s Asian session, New Zealand’s employment report for Q4 could prove crucial on whether the RBNZ will cut by 25 or 50bps, while the following day, Japan’s wage data for December could shape expectations about the BoJ’s next rate increase.

On the earnings front, the tech-related reporting continues with Alphabet (NASDAQ:GOOGL) and AMD (NASDAQ:AMD) on Tuesday, and Amazon (NASDAQ:AMZN) on Thursday.