Forecast

Stocks: The European debt contagion remains front and center. Spain and Italy bond yields remain high, but are off their worst levels after the EU Summit produced a vague pan-European banking supervisor and other ways to lower periperhal European bond yields. This is positive in the short-term, but will only provide a respite to lower stock prices. Also, China remains on a growth deceleration curve, with growing concerns of a very hard landing — various estimates are centering in on the 7.0% level and even lower.Strategy: The S&P 500 remains above long-term support at the 160-wma at 1200 which delineates bull/bear markets. However, the 200-dma support zone at 1266-to-1278 remains the bulls “Maginot Line,” while overhead resistance at 1340-to-1360 has also proven itself as resistance. After 6-down days in which very little was accomplished price wise, sentiment may be sufficiently bearish for a rally to materialize.

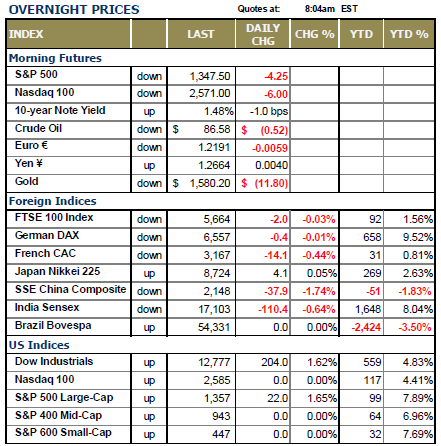

World markets are mixed overnight as concern abounds in Europe, with China’s weakness starting to enter into the trading conversation. Last week, we noted that China’s GDP fell below 8.0%, which is the level that once broached – has led to stimulus measures. In fact, Chinese Premier Wen confirmed that further steps to boost the economy would be enacted in the second half of this year…which began 16 days ago. Outside of this, we’ll note that Spanish 10-year bond yields are higher by +8 bps to 6.75%, while Italian bond yields are higher by +2 bps to 6.08%. And lastly, we’ll state the markets will await the semi-annual testimony by Fed Chair Bernanke to Congress regarding the economy…stay tuned on Tuesday and Wednesday.

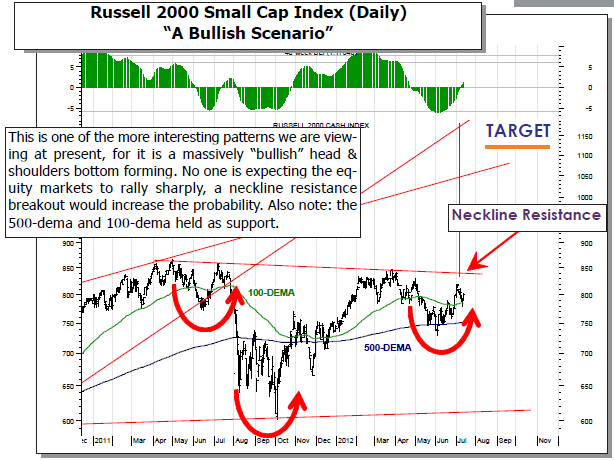

Trading Strategy: We’ll keep it short. Friday’s sharp rally held many support levels, and puts on the table a surprise move higher by the equity markets. We’ve included a chart of the Russell 2000 and the “potential,” and we stress “potential” head and shoulders bottom forming. This pattern isn’t confirmed, but if we see the Russell 2000 break out above the 840- 850 zone, then a potential “melt-up” could ensue. However, if last Thursday’s low at 778 is violated – the probability favors a decline is getting underway. We wish we could be more definitive, but we deal in probabilities, not certainties – and we remain flexible and bullish for the time being.

To Read the Entire Report Please Click on the pdf File Below.