One of Wall Street’s famous maxims is that bull markets climb a wall of worry. On that score, there’s no shortage of real and potential hazards lurking. But as recent history suggests, the crowd isn’t intimidated, at least not yet. Quite the opposite, in fact, as investor sentiment seems to have been stoked in favor of buying, according to various trend profiles in markets around the world that point to price strength that highlights risk-on positioning.

As one approach to profiling this behavior, the following review updates CapitalSpectator.com’s periodic look at price-momentum bias via pairs of ETFs. For reference, readers can compare the charts below with this June 26 article. Today’s refresh of data uses prices through yesterday’s close (July 17).

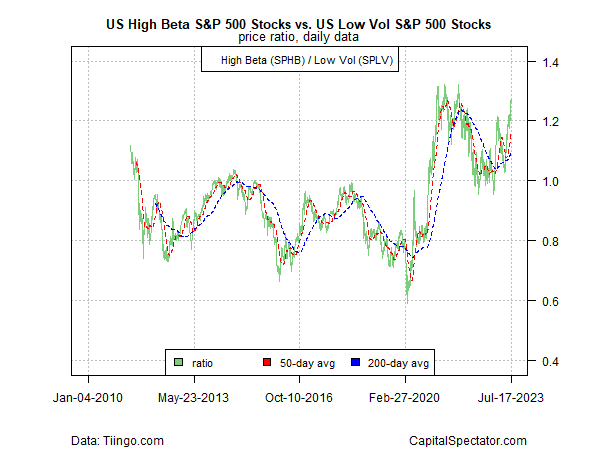

Once again, we begin with so-called high beta (i.e., high-risk) stocks (Invesco S&P 500® High Beta ETF (NYSE:SPHB)) for the US vs. low-volatility (low risk) shares (Invesco S&P 500® Low Volatility ETF (NYSE:SPLV)), a proxy for assessing the appetite for higher/lower risk positioning in US equities. As the chart below indicates, this measure indicates a strong rebound in risk appetite.

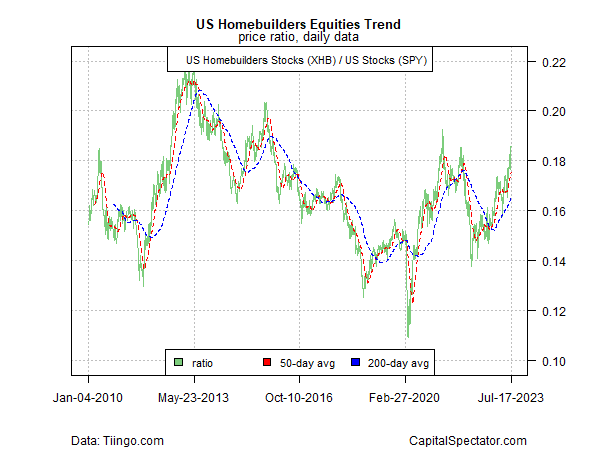

The rally in homebuilder stocks (SPDR® S&P Homebuilders ETF (NYSE:XHB)) is also signaling strength as this cyclically sensitive sector continues to recover in absolute and relative terms vis-à-vis the broad US stock market (SPY).

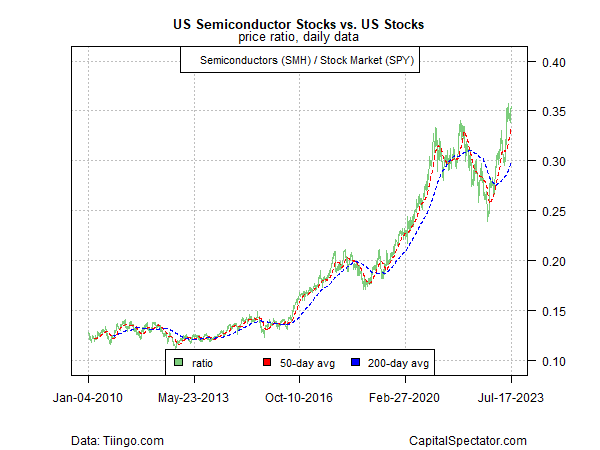

Semiconductor shares (VanEck Semiconductor ETF (NASDAQ:SMH)), which are considered a proxy for the risk appetite and the business cycle, continue to show strength relative to equities generally (SPY).

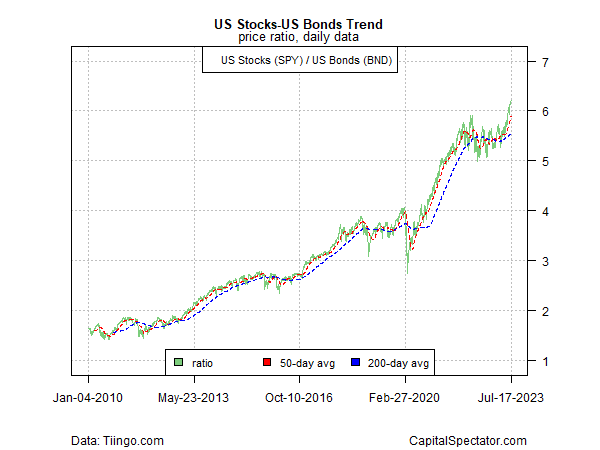

Meanwhile, the price bias that favors stocks (SPY) relative to bonds (Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ:BND)) continues to stay red-hot.

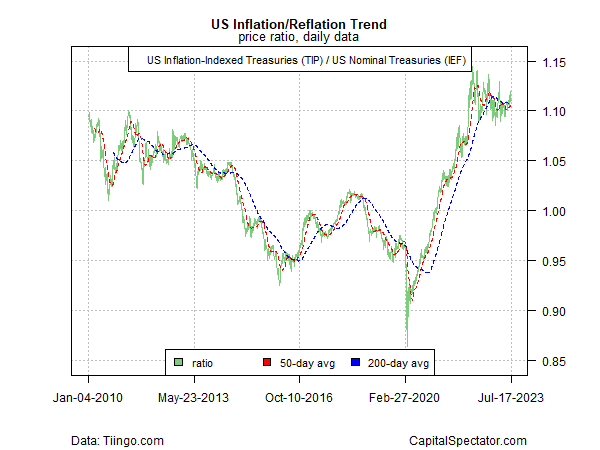

The reflation trade is easing, which helps fuel the risk-on appetite. In particular, the trend that previously favored inflation-indexed Treasuries (TIPS) vs. standard Treasuries (iShares 7-10 Year Treasury Bond (NYSE:IEF) ETF (NASDAQ:IEF)) continues to drift lower after surging in 2022.

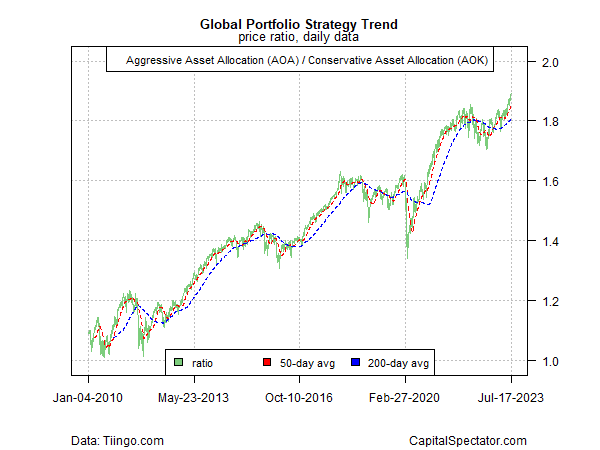

Finally, reviewing the crowd’s risk appetite from a global asset allocation perspective also indicates a strong bull market bias based on the ratio of aggressive asset allocation (iShares Core Aggressive Allocation ETF (NYSE:AOA)) vs. its conservative counterpart (iShares Core Conservative Allocation ETF (NYSE:AOK)) – a proxy that’s reached a new high recently.

What could go wrong to derail the favorable trends? Jeanna Smialek at The New York Times offers a useful summary in an article today that considers how the Federal Reserve’s monetary policy could unfold in the months ahead:

“Risks to the outlook still loom, of course,” she writes. “The economy could still slow more sharply as the effects of higher interest rates add up, cutting into growth and hiring.” Meanwhile, “Inflation could come roaring back because of an escalation of the war in Ukraine or some other unexpected development, prodding central bankers to do more to ensure that price increases come under control quickly. Or price increases could simply prove painfully stubborn.”

For the moment, however, markets appear to be pricing in a new virtuous cycle. How long it lasts is, of course, open for debate… as always. But that doesn’t stop anyone from opining. For instance, Ed Yardeni at Yardeni Research sees more upside ahead for US shares:

“I think the market was kind of overjoyed with a disinflationary soft landing scenario,” he tells CNBC on Monday. “That seems to be what we’re in. I’ve been thinking for quite some time that we’re in a recession, but I argued that it’s a rolling recession, not an economy-wide recession. Now I think we’re in a rolling recovery.” The “bottom line,” he says, “is we’ve been in a bull market since October 12.”