Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

U.S. Dollar Trading (USD)

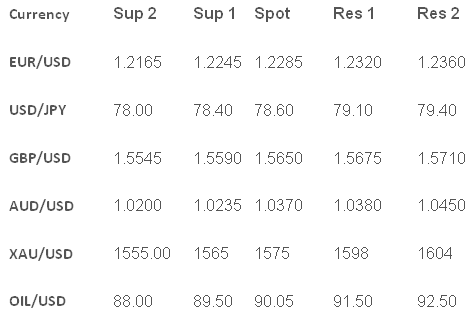

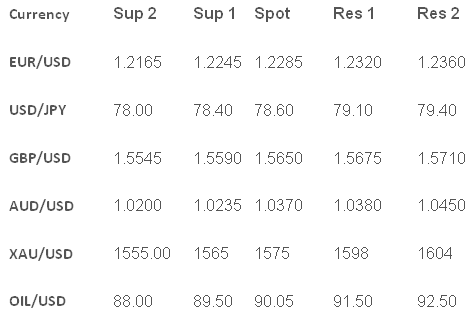

Those looking for weakness in the market yesterday were sorely mistaken with US stocks once again rallying and risk currencies gaining against the greenback. Oil moved higher to $90 a barrel and helped the commodity currencies in the CAD and AUD outperform. Looking ahead, Weekly Jobless Claims are forecast at 365k vs. 350k previously. Also, June Philly Fed is forecast -8 vs. -16.6 previously.

The Euro (EUR)

The EUR/USD was once again the laggard overnight with the other currencies all surging higher whilst the single currency failed to break above 1.2300 and we will need to see some positive eurozone news to spark a more substantial short covering rally. EUR/GBP and EUR/AUD are trending lower and capping the EUR/USD gains.

The Sterling (GBP)

Sterling closed at opening levels but was well supported on a pullback in the European session. The MPC minutes from the last bank of England interest rate meeting where a surprise to the market with a 7-2 split. The two dissenters did not agree that expanding the QE was needed and that other measures announced were sufficient. Looking ahead, May EU Current Account forecast at 5.3bn vs. 3.6bn previously. Also June Retail Sales forecast at 0.6% vs. 1.4% previously.

The Japanese Yen (JPY)

USD/JPY is still very weak as the USD remained on the sell side and yen crosses fail to hold onto gains. EUR/JPY is still below Y97 and looking heavy. Longer term traders watch US 2-year bond yields when trying to predict whether USD/JPY will rally or not and these yields are still remaining near historic lows while the US monetary policy future is debated.

Australian Dollar (AUD)

The AUD/USD broke higher above 1.0330 towards 1.0380 as stocks rallied and oil gained. EUR/AUD fell to a new record low and GBP/AUD is back towards 1.5000. The Australian currency is defying gravity lately shrugging off the weakness from China and instead tracking the US stock market rally.

Oil And Gold (XAU)

Gold fell overnight bucking the trend of oil and weak USD and is trading in a well-established range for the last few weeks between $1600 and $1560. OIL/USD pushed higher to $90 a barrel with traders tracking stocks higher continuing the recent rally from below $80 last month.

Pairs To Watch

EUR/USD - Are we going to test 1.2300 today?

Oil/USD will $90 break or prove a good sell level.

Technical Commentary

Those looking for weakness in the market yesterday were sorely mistaken with US stocks once again rallying and risk currencies gaining against the greenback. Oil moved higher to $90 a barrel and helped the commodity currencies in the CAD and AUD outperform. Looking ahead, Weekly Jobless Claims are forecast at 365k vs. 350k previously. Also, June Philly Fed is forecast -8 vs. -16.6 previously.

The Euro (EUR)

The EUR/USD was once again the laggard overnight with the other currencies all surging higher whilst the single currency failed to break above 1.2300 and we will need to see some positive eurozone news to spark a more substantial short covering rally. EUR/GBP and EUR/AUD are trending lower and capping the EUR/USD gains.

The Sterling (GBP)

Sterling closed at opening levels but was well supported on a pullback in the European session. The MPC minutes from the last bank of England interest rate meeting where a surprise to the market with a 7-2 split. The two dissenters did not agree that expanding the QE was needed and that other measures announced were sufficient. Looking ahead, May EU Current Account forecast at 5.3bn vs. 3.6bn previously. Also June Retail Sales forecast at 0.6% vs. 1.4% previously.

The Japanese Yen (JPY)

USD/JPY is still very weak as the USD remained on the sell side and yen crosses fail to hold onto gains. EUR/JPY is still below Y97 and looking heavy. Longer term traders watch US 2-year bond yields when trying to predict whether USD/JPY will rally or not and these yields are still remaining near historic lows while the US monetary policy future is debated.

Australian Dollar (AUD)

The AUD/USD broke higher above 1.0330 towards 1.0380 as stocks rallied and oil gained. EUR/AUD fell to a new record low and GBP/AUD is back towards 1.5000. The Australian currency is defying gravity lately shrugging off the weakness from China and instead tracking the US stock market rally.

Oil And Gold (XAU)

Gold fell overnight bucking the trend of oil and weak USD and is trading in a well-established range for the last few weeks between $1600 and $1560. OIL/USD pushed higher to $90 a barrel with traders tracking stocks higher continuing the recent rally from below $80 last month.

Pairs To Watch

EUR/USD - Are we going to test 1.2300 today?

Oil/USD will $90 break or prove a good sell level.

Technical Commentary