Markets In Holiday Mood

Holidays in both the UK and US later today ensured that activity in Asia was both low-volume and lackluster. Equity markets were generally trading in the red, with US indices based off futures prices drifting between 0.01% and 0.14% lower. China-linked equities fared worse, with the CHINA50 index down 0.86% and the HongKong33 index down 0.51%.

Currencies displayed a slightly different picture, with the risk-beta currencies outperforming. AUD/USD gained 0.05% to 0.6932 while AUD/JPY rose 0.18% to 75.86. The first possible resistance point for AUD/USD could come in at 0.6945, which would be the 23.6% Fibonacci retracement of the April-May drop.

The yen was unwanted as safe haven hedges were unwound, with USD/JPY climbing 0.15% to 109.47, the first positive day in four sessions.

AUD/USD Daily Chart

Source: OANDA fxTrade

China warns investors on the yuan

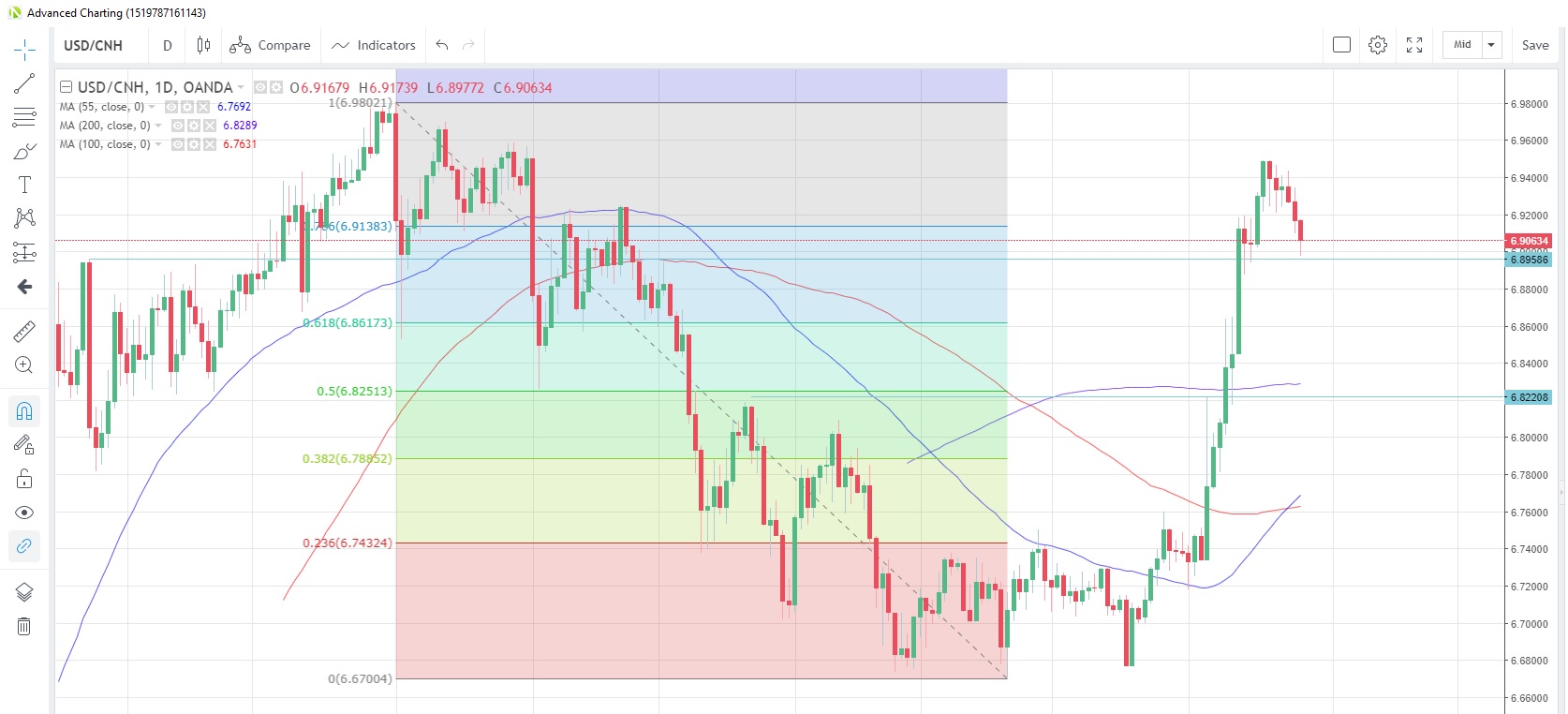

USD/CNH fell for a third consecutive day after one of China’s senior-most economic officials said that speculators who intended to go short the yuan will inevitably suffer from a huge loss. The comments came as US/CNH hit the highest level this year last week, nearing the key 7.0 level. The FX pair is now at 6.9063, down 0.62% from last week’s high.

On May 15 the PBOC launched another one of its CNH-denominated offshore bonds in Hong Kong, the third since November 2018 where it has auctioned 10 billion yuan in each of 3- and 12-month tenors at each offering. This exercise is aimed at draining liquidity from the offshore market, which would lead to higher market rates and thereby increase the cost of funding offshore yuan short positions.

USD/CNH Daily Chart

Source: OANDA fxTrade

Centerist parties lose ground in EU elections

Preliminary results show that Green and Liberal parties gained ground in the European parliamentary elections at the weekend, but the losses were not as dramatic as earlier polls had suggested. The BBC projections for the UK showed the Brexit party to win 29 seats, the Lib Dems 16 seats, Labour Party 10 seats, Green Party 7 seats, and the ruling Conservatives Party 4 seats. In Greece, PM Tsipras call a snap general election, probably for June 30, following the election results.

A blank data slate

The holidays have wiped out the data calendar for the major economies, so market direction will likely be driven by headlines on tweets on the significant events that are overhanging markets at the moment, namely the US-China trade negotiations, US-Japan trade negotiations, UK politics and the weekend European elections.