The markets have clearly decided to ignore all the unresolved problems in the eurozone. The main U.S. and Canadian exchanges have risen 4.57% and 3.05%, respectively, since the beginning of the year. The most recent scramble towards risk was spurred by the U.S. Federal Reserve, which last Wednesday used their new meeting format for the first time. Ben Bernanke and the other members will now be more transparent about the expectations of each Committee member regarding changes in interest rates and their inflation targets. In fact, they committed to keeping their key interest rate in the 0%-0.25% range for an additional year, to late 2014. Please refer to the Loonie section for a more in-depth analysis on this commitment. With the USD/CAD at its lowest level since October, it is a good time for buyers of the greenback to begin hedging at least part of their needs for 2012. Here follows some highlights of the economic news expected this week.

Canada

Little news is expected from Canada this week, but it will all be important. On Tuesday data will be released on Canadian GDP; analysts expect 0.2% growth in November. Friday will certainly be a volatile day with the release of employment data in both Canada and the U.S. The Canadian figures will be available at 7:00 am. The market is forecasting that 24,500 jobs were created in January (compared to 17,500 new jobs in December), and the unemployment rate is expected to remain unchanged, at 7.5%.

United States

In the U.S., a wave of economic data begins today with the release of Personal Spending data. On Tuesday we are expecting the Consumer Confidence index. Wednesday will bring the ISM Manufacturing Index, which is expected to come in at 54.5 (a figure above 50 indicates economic expansion). As in Canada, Friday will be the most important day of the week with the release of employment data. Economists are expecting that less jobs were created in January than in December (150,000 vs. 200,000, respectively), while the unemployment rate should be unchanged at 8.5%.

International

The week begins with a bang with a European summit and with Italy trying to issue 8 billion euros with varying maturities at favourable rates to hungry investors. This will be the first time that Italy has floated a bond issue since the European Central Bank began the LTRO in December last year. The goal of the operation was to inject some liquidity into the European financial system. As for the eurozone, we are expecting the Consumer Confidence Index on Monday, the Purchasing Managers’ Index on Wednesday and the Producer Price Index on Thursday. Have a great week!

The Loonie

“Adapt or perish, now as ever, is nature's inexorable imperative.” - H. G. Wells

This week we want to focus on the most important economic event last week; the Federal Reserve’s announcement that it will continue to maintain its key interest rate at rock-bottom levels. Apparently one of the main reasons for this move by the members of the Federal Open Market Committee (FOMC) is the general drop in economic growth expectations for the U.S. On Wednesday we learned that the Fed is now forecasting growth in 2012 to fall in the 2.2% to 2.7% range, while the previous estimate was for a range of 2.5% to 2.9%, a decline of almost 10%. The 2013 estimate suffered a similar fate, dropping from an initial range of between 3.0% and 3.5% to between 2.8% and 3.2%. This represents a decline of slightly over 7.25%. In short, despite the “optimistic” response seen in the markets, from a strictly economic point of view this is not good news.

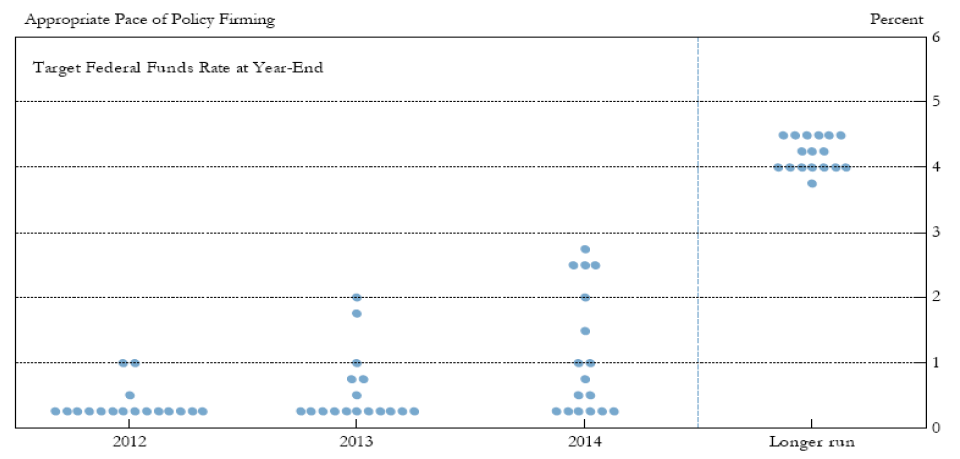

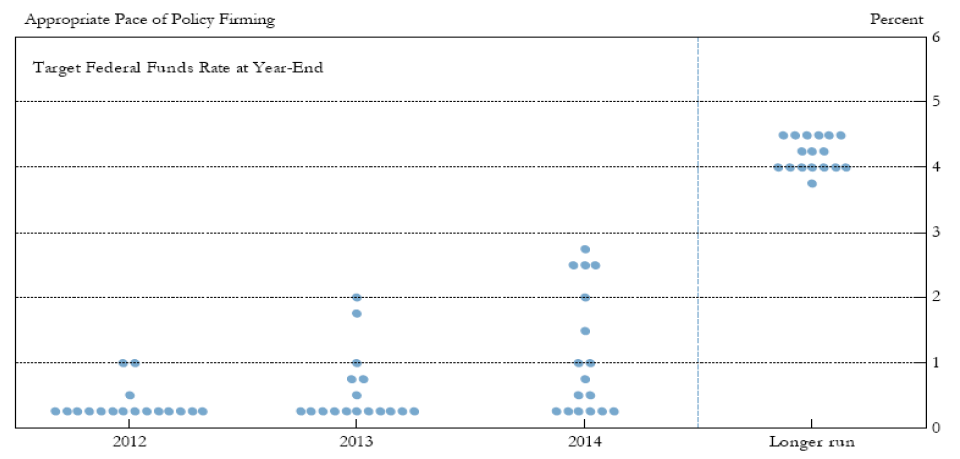

Over the last few days investors have shown enthusiasm for risky assets such as the Canadian dollar. This was due to the Fed’s publication of the expectations of the 17 voting members who make up the FOMC. Previously, FOMC members expected to maintain an expansionist monetary policy until the end of 2013. As the above graph shows, 11 of the 17 members (in the red circle) now expect that they will need to keep the federal funds rate under 1.00% until the end of 2014. What is more, Ben Bernanke, the Chairman of the Fed, clearly stated that the central bank is fully prepared to use all the tools at its disposal (read: monetary easing) to support the economic recovery. As far as Canada is concerned, a drawn-out recovery south of the border is far from an ideal scenario. In this context it is not surprising that our central banker and our prime minister are driving home the need to diversify our trading partners. The strength of the Canadian dollar could eventually depend more directly on the ability of Canadian businesses to forge new business ties and develop new markets.

Last Week at a Glance

Canada – Retail sales rose 0.3% in November, topping consensus expectations. Excluding autos, sales were still up 0.3%. Gains in sales of gasoline, clothing, health/personal care more than offset declines elsewhere. The gasoline share of total retail sales jumped to 12.8%. However, this did not hinder sales of discretionary items (i.e., total retail sales excluding groceries, health/personal care products, and gasoline), which increased 0.4% for a fourth consecutive monthly advance. In real terms, retail sales grew a solid 0.5%. With two months in, Q4 retail volumes are tracking at 5.1% annualized growth, their best showing since 2010, indicating that consumption spending accelerated sharply in the quarter (Chart). The Teranet–National Bank National Composite House Price Index decreased 0.2% in November after being flat the two previous months. Prices dropped in 8 of the 11 metropolitan areas covered. They were down markedly in Calgary (-1.6%) and Victoria (-0.9%) and moderately in Hamilton (-0.3%), Vancouver, Toronto, Ottawa-Gatineau, Quebec City (all four at -0.2%) and Winnipeg (-0.1%). Prices were up 0.5% in Halifax, 0.4% in Montreal and 0.1% in Edmonton. On a y/y basis, home price inflation reached 7.2% in November. The current period of softness in house prices follows a few months of above-normal increases. This is the same pattern as occurred from April 2010 to November 2010, which ended in a limited price correction. Canada's Survey of employment, payrolls and hours (SEPH) painted a slightly better picture of Canadian employment than did the Labour Force Survey. The SEPH data for November showed that Canada added 12,260 jobs. Average weekly earnings were flat in the month, bringing the year-on-year change to +2.2%. Hours worked fell 0.3% in the month, which means an offset in higher wages was necessary to keep earnings level.

Statcan revised its Labour Force Survey data to reflect updated seasonal adjustment factors. The new series shows an extra 10K jobs created over the period from 2009 to 2011, all of which in the services sector (mostly full-time and in the private sector). As a result, the job losses registered in Q4 turn out to be less severe than in the old series. The new LFS series show a net loss of 37K jobs in the quarter, which is roughly 20K better than first estimated. Still, downward revisions to the first half of the year resulted in the tally for 2011 as a whole being trimmed from 199K to 190K. Employment in both 2009 and 2010 was revised up. Regarding the bleak situation of the labour market in Quebec, the revisions do not alter the picture much. The survey now indicates a loss of 72K jobs (instead of 78K) over the past seven months, which arguably remains inconsistent with the healthy consumption and housing data released for the province in Q4. In the coming months, we can expect either LFS employment to shoot up (particularly in Quebec) or consumption-related data (e.g., retail sales) to plunge. Let’s hope for the former. The Institut de la statistique du Québec (ISQ) reported that Quebec real GDP at basic prices held steady in October after progressing 0.4% in September. Goods production contracted 0.2% on lower output in the utilities, construction and mining segments. Services output eked up 0.1%, as advances in professional, scientific and technical services and in finance, insurance and real estate services more than offset a third straight monthly pullback in wholesale trade. The ISQ also reported that Quebec’s trade deficit widened $472 million in November to $1.71 billion. The value of exports sank $263 million (or 4.6%) to $5.4 billion on a large decrease in aerospace products. Imports sprang $209 million (or 3.0%), with much of the impetus coming from crude oil. In constant dollars, the trade deficit widened $380 million to $1.93 billion. With two months in, the Q4 real trade deficit is on track to narrow, meaning that international trade is contributing to economic growth.

United States – The advance estimate for Q4 GDP growth came in at 2.8% annualized, just below the 3% expected by consensus. The prior quarter was left unrevised at 1.8%. Domestic demand rose only 0.9% in Q4, versus 2.7% the prior quarter. Final sales (i.e., GDP excluding inventories) swelled only 0.8% after expanding a solid 3.2% in Q3. Support came from consumption spending (+2%), exports (+4.7%), and business non-residential fixed investment (which moderated as expected to 5.2%). Government spending was again a drag on growth, shaving off 0.9%. After detracting from GDP in the prior two quarters, inventories contributed massively to growth in Q4, adding 1.9 percentage points. Residential construction grew 10.9% and thus contributed to GDP as well. The GDP report was a bit softer than expected because much of the growth came from inventory accumulation rather than final sales (Chart). That said, the vigorous restocking activity broke a string of two successive quarters of drag from inventories and suggests that businesses are confident that demand will return. The fact that consumers have their mojo back is very promising, as they constitute the primary engine of the U.S. economy (accounting for over 70% of GDP). The moderation in the pace of business investment spending in Q4 has to be placed into perspective, coming as it did on the heels of a white-hot Q3 increase of 16.2%. This component of GDP should remain in decent shape given the stockpile of cash that corporations seem to be sitting on. The comeback in residential construction (third straight quarter of growth) is encouraging and in line with the better fundamentals witnessed in recent months (e.g., low supply, high affordability and improving job market). New home sales slumped 2.2% in December to 307K, wiping out most of November's gains. The supply of homes ticked up to 6.1 months (though this remained close to multi-year lows). Durable goods orders rose 3% in December topping consensus expectations for a 2% increase. Transportation orders sprang 5.5% thanks to Boeing’s strong order book in the month. Orders of vehicles and parts (+0.6%) also buoyed the transportation category. Ex-transportation, the numbers were more than double consensus expectations, with orders growing 2.1%.

Non-defence capital goods orders excluding aircraft, a gauge of future investment spending, climbed 2.9%, almost three times what consensus expected. This reversed the losses recorded by this key category in the previous two months. Total shipments of durable goods rose 2.1% overall and 2.4% excluding transportation. The Chicago Fed National Activity Index, which synthesizes 85 monthly economic indicators into a single number, rose to +0.17 in December from -0.46 the month before. This was its highest reading since Q1 of 2011 and shows that the U.S. economy picked up speed again in December after taking a breather in November. Last but not least, the Fed announced it is keeping its target rate unchanged but now sees that economic conditions are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014. There were no other hints at new initiatives or QE3. However, the Fed has decided to be clear about the inflation part of its dual mandate by stating that 2% inflation is most consistent over the long run with its statutory mandate. The Fed also downgraded its growth forecasts for the US with the central tendency forecast (Q4/Q4) now showing 2.2-2.7% in 2012 (versus 2.5-2.9% previously). The estimate for 2013 is 2.8-3.2% (versus 3.0-3.5% previously). Interestingly, despite the lower growth forecasts, the projection for the unemployment rate was revised lower:

8.2-8.5% for 2012 (versus 8.5-8.7% previously) and to 7.4-8.1% for 2013 (7.8-8.2% previously). The downward changes to the inflation projections (both PCE and core) were very minor. For the first time, the FOMC presented information about how participants feel about the pace of policy firming going forward (although there's no information about voting and non-voting members' views). Three of the 17 participants thought that rate hikes were appropriate this year and three more saw higher rates as appropriate in 2013. Eleven of seventeen viewed rate hikes as appropriate by 2014. Yet, of those eleven, five saw rates at or lower than 1.0% by year end 2014 and six participants thought rates should still be unchanged by that time. This explains the extension of the low rate projection at least through late 2014. FOMC members view that the fed funds rate should be in the 4-4.5% range over the longer run. Last year the dissenter in the FOMC was Charles Evans who wanted more stimulus (but who doesn’t vote this year), but this year the dissenter is the incoming member Jeffrey Lacker who tended to be more hawkish in his prior stints at the FOMC. Lacker is already showing his hawkish colours, dissenting against the decision to specify a time period over which federal funds rate will remain exceptionally low.

Technical Analysis:

Gold: In the wake of the Federal Reserve speech, the trend line mentioned last week was broken and we are approaching the 1,755 objective.

EUR/CAD: For now the rate is stuck at around 1.3200; this should continue to be a sellers’ market.

USD/CAD: All the support levels have been broken: 1.0072, 1.0050 and parity. The next lower level is the 200-day moving average, at 0.9950. Buyers have begun an aggressive return to this market, posting orders around 0.9960 and 0.9850.

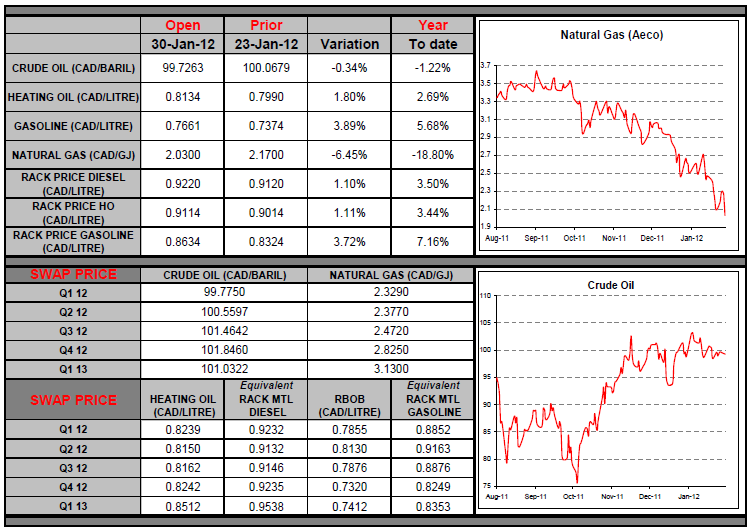

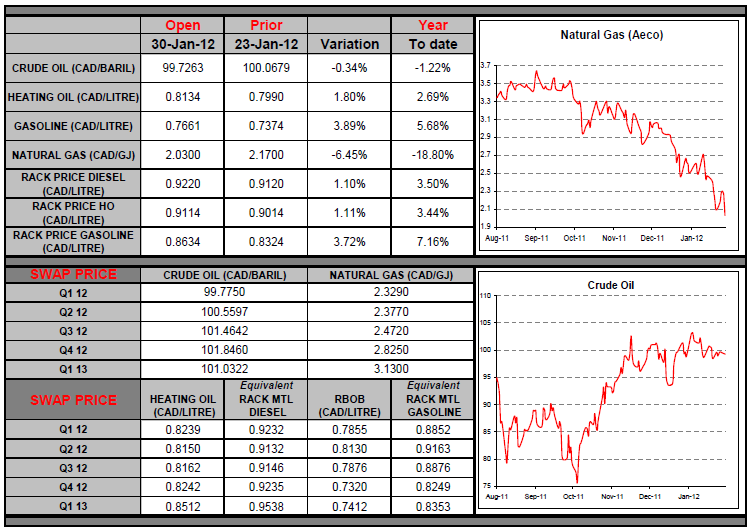

Oil: See the following graph; it shows a double top at $103.50 and a net bearish divergence with the MACD, showing less momentum in oil’s rise, at least for the moment. Should there be a correction, the support levels will be: $98.28 (50-day moving average), $97.7 and $96.69. Heading upward, it will be important to break through the short-term downward trend at $100 (the green line) and, above all, to break through $103.50.

Commodities

Last week the price of oil almost touched the USD $100/barrel level. This movement was mostly driven by rising gasoline prices, as well as signals that Greece and its creditors were close to an agreement. The European Union decided to impose an embargo on oil imports from Iran starting on July 1st. It remains to be seen how this will affect the market.

A very interesting study by Bloomberg shows that over 70% of investors believe that an attack on Iran’s nuclear facilities will result in a short-term disruption of oil markets. One third of investors believe that this attack could create an oil shock and a global recession. Heating oil is still trading around the CAD $0.81/litre level. It is a good time for diesel consumers to hedge their 2012 needs.

Fixed Income

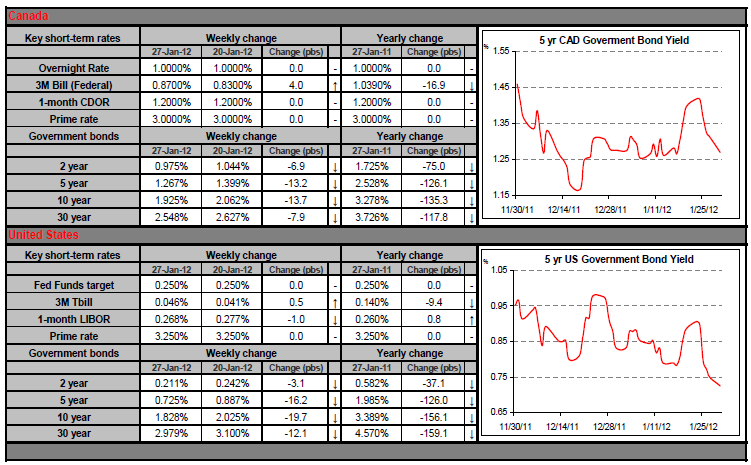

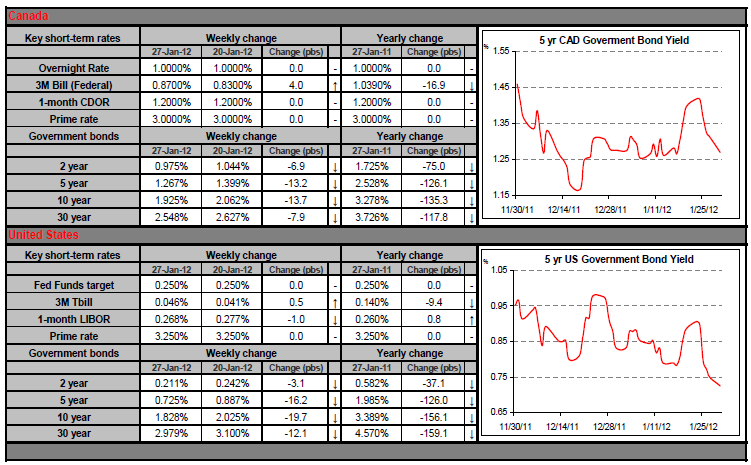

Once again, long-term rates have shifted in negative territory last week, particularly in the US following the speech of the Federal Reserve.

The U.S. monetary authority has announced the extension of its policy of maintaining interest rates to the floor until the end of 2014. US mid-term Treasuries yields (5 year) fell heavily Wednesday on the news The discussions over the refinancing of the Greek debt are advancing, but they continue to support the demand for safe Canadian assets. Rich countries continue their pressure on those more indebted nations. On one side, poorer members fight to preserve some form of fiscal sovereignty, while on the other, investors including France and Germany, seek more control and discipline to increase their commitments.

For the week ahead, investors will focus particularly on those debt issues in Europe, as well as North American employment numbers scheduled for Friday morning.

Canada

Little news is expected from Canada this week, but it will all be important. On Tuesday data will be released on Canadian GDP; analysts expect 0.2% growth in November. Friday will certainly be a volatile day with the release of employment data in both Canada and the U.S. The Canadian figures will be available at 7:00 am. The market is forecasting that 24,500 jobs were created in January (compared to 17,500 new jobs in December), and the unemployment rate is expected to remain unchanged, at 7.5%.

United States

In the U.S., a wave of economic data begins today with the release of Personal Spending data. On Tuesday we are expecting the Consumer Confidence index. Wednesday will bring the ISM Manufacturing Index, which is expected to come in at 54.5 (a figure above 50 indicates economic expansion). As in Canada, Friday will be the most important day of the week with the release of employment data. Economists are expecting that less jobs were created in January than in December (150,000 vs. 200,000, respectively), while the unemployment rate should be unchanged at 8.5%.

International

The week begins with a bang with a European summit and with Italy trying to issue 8 billion euros with varying maturities at favourable rates to hungry investors. This will be the first time that Italy has floated a bond issue since the European Central Bank began the LTRO in December last year. The goal of the operation was to inject some liquidity into the European financial system. As for the eurozone, we are expecting the Consumer Confidence Index on Monday, the Purchasing Managers’ Index on Wednesday and the Producer Price Index on Thursday. Have a great week!

The Loonie

“Adapt or perish, now as ever, is nature's inexorable imperative.” - H. G. Wells

This week we want to focus on the most important economic event last week; the Federal Reserve’s announcement that it will continue to maintain its key interest rate at rock-bottom levels. Apparently one of the main reasons for this move by the members of the Federal Open Market Committee (FOMC) is the general drop in economic growth expectations for the U.S. On Wednesday we learned that the Fed is now forecasting growth in 2012 to fall in the 2.2% to 2.7% range, while the previous estimate was for a range of 2.5% to 2.9%, a decline of almost 10%. The 2013 estimate suffered a similar fate, dropping from an initial range of between 3.0% and 3.5% to between 2.8% and 3.2%. This represents a decline of slightly over 7.25%. In short, despite the “optimistic” response seen in the markets, from a strictly economic point of view this is not good news.

Over the last few days investors have shown enthusiasm for risky assets such as the Canadian dollar. This was due to the Fed’s publication of the expectations of the 17 voting members who make up the FOMC. Previously, FOMC members expected to maintain an expansionist monetary policy until the end of 2013. As the above graph shows, 11 of the 17 members (in the red circle) now expect that they will need to keep the federal funds rate under 1.00% until the end of 2014. What is more, Ben Bernanke, the Chairman of the Fed, clearly stated that the central bank is fully prepared to use all the tools at its disposal (read: monetary easing) to support the economic recovery. As far as Canada is concerned, a drawn-out recovery south of the border is far from an ideal scenario. In this context it is not surprising that our central banker and our prime minister are driving home the need to diversify our trading partners. The strength of the Canadian dollar could eventually depend more directly on the ability of Canadian businesses to forge new business ties and develop new markets.

Last Week at a Glance

Canada – Retail sales rose 0.3% in November, topping consensus expectations. Excluding autos, sales were still up 0.3%. Gains in sales of gasoline, clothing, health/personal care more than offset declines elsewhere. The gasoline share of total retail sales jumped to 12.8%. However, this did not hinder sales of discretionary items (i.e., total retail sales excluding groceries, health/personal care products, and gasoline), which increased 0.4% for a fourth consecutive monthly advance. In real terms, retail sales grew a solid 0.5%. With two months in, Q4 retail volumes are tracking at 5.1% annualized growth, their best showing since 2010, indicating that consumption spending accelerated sharply in the quarter (Chart). The Teranet–National Bank National Composite House Price Index decreased 0.2% in November after being flat the two previous months. Prices dropped in 8 of the 11 metropolitan areas covered. They were down markedly in Calgary (-1.6%) and Victoria (-0.9%) and moderately in Hamilton (-0.3%), Vancouver, Toronto, Ottawa-Gatineau, Quebec City (all four at -0.2%) and Winnipeg (-0.1%). Prices were up 0.5% in Halifax, 0.4% in Montreal and 0.1% in Edmonton. On a y/y basis, home price inflation reached 7.2% in November. The current period of softness in house prices follows a few months of above-normal increases. This is the same pattern as occurred from April 2010 to November 2010, which ended in a limited price correction. Canada's Survey of employment, payrolls and hours (SEPH) painted a slightly better picture of Canadian employment than did the Labour Force Survey. The SEPH data for November showed that Canada added 12,260 jobs. Average weekly earnings were flat in the month, bringing the year-on-year change to +2.2%. Hours worked fell 0.3% in the month, which means an offset in higher wages was necessary to keep earnings level.

Statcan revised its Labour Force Survey data to reflect updated seasonal adjustment factors. The new series shows an extra 10K jobs created over the period from 2009 to 2011, all of which in the services sector (mostly full-time and in the private sector). As a result, the job losses registered in Q4 turn out to be less severe than in the old series. The new LFS series show a net loss of 37K jobs in the quarter, which is roughly 20K better than first estimated. Still, downward revisions to the first half of the year resulted in the tally for 2011 as a whole being trimmed from 199K to 190K. Employment in both 2009 and 2010 was revised up. Regarding the bleak situation of the labour market in Quebec, the revisions do not alter the picture much. The survey now indicates a loss of 72K jobs (instead of 78K) over the past seven months, which arguably remains inconsistent with the healthy consumption and housing data released for the province in Q4. In the coming months, we can expect either LFS employment to shoot up (particularly in Quebec) or consumption-related data (e.g., retail sales) to plunge. Let’s hope for the former. The Institut de la statistique du Québec (ISQ) reported that Quebec real GDP at basic prices held steady in October after progressing 0.4% in September. Goods production contracted 0.2% on lower output in the utilities, construction and mining segments. Services output eked up 0.1%, as advances in professional, scientific and technical services and in finance, insurance and real estate services more than offset a third straight monthly pullback in wholesale trade. The ISQ also reported that Quebec’s trade deficit widened $472 million in November to $1.71 billion. The value of exports sank $263 million (or 4.6%) to $5.4 billion on a large decrease in aerospace products. Imports sprang $209 million (or 3.0%), with much of the impetus coming from crude oil. In constant dollars, the trade deficit widened $380 million to $1.93 billion. With two months in, the Q4 real trade deficit is on track to narrow, meaning that international trade is contributing to economic growth.

United States – The advance estimate for Q4 GDP growth came in at 2.8% annualized, just below the 3% expected by consensus. The prior quarter was left unrevised at 1.8%. Domestic demand rose only 0.9% in Q4, versus 2.7% the prior quarter. Final sales (i.e., GDP excluding inventories) swelled only 0.8% after expanding a solid 3.2% in Q3. Support came from consumption spending (+2%), exports (+4.7%), and business non-residential fixed investment (which moderated as expected to 5.2%). Government spending was again a drag on growth, shaving off 0.9%. After detracting from GDP in the prior two quarters, inventories contributed massively to growth in Q4, adding 1.9 percentage points. Residential construction grew 10.9% and thus contributed to GDP as well. The GDP report was a bit softer than expected because much of the growth came from inventory accumulation rather than final sales (Chart). That said, the vigorous restocking activity broke a string of two successive quarters of drag from inventories and suggests that businesses are confident that demand will return. The fact that consumers have their mojo back is very promising, as they constitute the primary engine of the U.S. economy (accounting for over 70% of GDP). The moderation in the pace of business investment spending in Q4 has to be placed into perspective, coming as it did on the heels of a white-hot Q3 increase of 16.2%. This component of GDP should remain in decent shape given the stockpile of cash that corporations seem to be sitting on. The comeback in residential construction (third straight quarter of growth) is encouraging and in line with the better fundamentals witnessed in recent months (e.g., low supply, high affordability and improving job market). New home sales slumped 2.2% in December to 307K, wiping out most of November's gains. The supply of homes ticked up to 6.1 months (though this remained close to multi-year lows). Durable goods orders rose 3% in December topping consensus expectations for a 2% increase. Transportation orders sprang 5.5% thanks to Boeing’s strong order book in the month. Orders of vehicles and parts (+0.6%) also buoyed the transportation category. Ex-transportation, the numbers were more than double consensus expectations, with orders growing 2.1%.

Non-defence capital goods orders excluding aircraft, a gauge of future investment spending, climbed 2.9%, almost three times what consensus expected. This reversed the losses recorded by this key category in the previous two months. Total shipments of durable goods rose 2.1% overall and 2.4% excluding transportation. The Chicago Fed National Activity Index, which synthesizes 85 monthly economic indicators into a single number, rose to +0.17 in December from -0.46 the month before. This was its highest reading since Q1 of 2011 and shows that the U.S. economy picked up speed again in December after taking a breather in November. Last but not least, the Fed announced it is keeping its target rate unchanged but now sees that economic conditions are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014. There were no other hints at new initiatives or QE3. However, the Fed has decided to be clear about the inflation part of its dual mandate by stating that 2% inflation is most consistent over the long run with its statutory mandate. The Fed also downgraded its growth forecasts for the US with the central tendency forecast (Q4/Q4) now showing 2.2-2.7% in 2012 (versus 2.5-2.9% previously). The estimate for 2013 is 2.8-3.2% (versus 3.0-3.5% previously). Interestingly, despite the lower growth forecasts, the projection for the unemployment rate was revised lower:

8.2-8.5% for 2012 (versus 8.5-8.7% previously) and to 7.4-8.1% for 2013 (7.8-8.2% previously). The downward changes to the inflation projections (both PCE and core) were very minor. For the first time, the FOMC presented information about how participants feel about the pace of policy firming going forward (although there's no information about voting and non-voting members' views). Three of the 17 participants thought that rate hikes were appropriate this year and three more saw higher rates as appropriate in 2013. Eleven of seventeen viewed rate hikes as appropriate by 2014. Yet, of those eleven, five saw rates at or lower than 1.0% by year end 2014 and six participants thought rates should still be unchanged by that time. This explains the extension of the low rate projection at least through late 2014. FOMC members view that the fed funds rate should be in the 4-4.5% range over the longer run. Last year the dissenter in the FOMC was Charles Evans who wanted more stimulus (but who doesn’t vote this year), but this year the dissenter is the incoming member Jeffrey Lacker who tended to be more hawkish in his prior stints at the FOMC. Lacker is already showing his hawkish colours, dissenting against the decision to specify a time period over which federal funds rate will remain exceptionally low.

Technical Analysis:

Gold: In the wake of the Federal Reserve speech, the trend line mentioned last week was broken and we are approaching the 1,755 objective.

EUR/CAD: For now the rate is stuck at around 1.3200; this should continue to be a sellers’ market.

USD/CAD: All the support levels have been broken: 1.0072, 1.0050 and parity. The next lower level is the 200-day moving average, at 0.9950. Buyers have begun an aggressive return to this market, posting orders around 0.9960 and 0.9850.

Oil: See the following graph; it shows a double top at $103.50 and a net bearish divergence with the MACD, showing less momentum in oil’s rise, at least for the moment. Should there be a correction, the support levels will be: $98.28 (50-day moving average), $97.7 and $96.69. Heading upward, it will be important to break through the short-term downward trend at $100 (the green line) and, above all, to break through $103.50.

Commodities

Last week the price of oil almost touched the USD $100/barrel level. This movement was mostly driven by rising gasoline prices, as well as signals that Greece and its creditors were close to an agreement. The European Union decided to impose an embargo on oil imports from Iran starting on July 1st. It remains to be seen how this will affect the market.

A very interesting study by Bloomberg shows that over 70% of investors believe that an attack on Iran’s nuclear facilities will result in a short-term disruption of oil markets. One third of investors believe that this attack could create an oil shock and a global recession. Heating oil is still trading around the CAD $0.81/litre level. It is a good time for diesel consumers to hedge their 2012 needs.

Fixed Income

Once again, long-term rates have shifted in negative territory last week, particularly in the US following the speech of the Federal Reserve.

The U.S. monetary authority has announced the extension of its policy of maintaining interest rates to the floor until the end of 2014. US mid-term Treasuries yields (5 year) fell heavily Wednesday on the news The discussions over the refinancing of the Greek debt are advancing, but they continue to support the demand for safe Canadian assets. Rich countries continue their pressure on those more indebted nations. On one side, poorer members fight to preserve some form of fiscal sovereignty, while on the other, investors including France and Germany, seek more control and discipline to increase their commitments.

For the week ahead, investors will focus particularly on those debt issues in Europe, as well as North American employment numbers scheduled for Friday morning.