Risky assets have been clattered overnight as once again the noises from Greece have become more and more fraught. For a day on which EU Finance Ministers were meant to ratify and agree upon what Greek politicians had already decided, the ball of string has unravelled very quickly. We knew on Tuesday that the meeting had been postponed until Monday but the substitute conference call yielded no news apart from rumour.

According to EU sources yesterday, European Finance Ministers are said to be discussing delaying all or part of the Greek bailout while avoiding a default. What this means to us is that money to make sure that the bond repayment goes ahead will be paid, but nothing more and this has got to be as a result that whichever party takes over following April’s election, they will look to renegotiate. The EU has asked for written agreements from party leaders that they won’t renege but they have not been forthcoming yet. And we wonder why they find themselves in this mess.

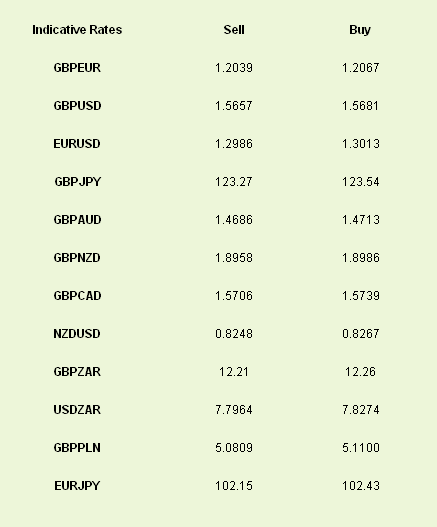

Asian markets have slipped slower overnight as a result and the euro is back towards the 1.30 level in EURUSD and above 1.20 in GBPEUR. Conditions weren’t helped by the news that Moody’s last night put 114 financial institutions’ ratings on review following its similar moves in sovereigns earlier on in the week.

Problems like these can only be solved one way, and that is via growth. Unfortunately, that is not forthcoming in the Eurozone as shown in yesterday’s Q4 GDP reading. EZ GDP fell by 0.3% in the last 3 months of the year with Italy and the Netherlands contributing largely to move lower while Germany also contracted. This was the first negative reading since Q2 2009 and comes amid a real trough in business confidence. Since Q4 we have seen some indicators indicate expansion but fiscal consolidation in order to reduce deficits will keep growth depressed for a fair while. Unless we see a major kick back by the “core” nations in Q1, this will not be the only negative GDP release from the Eurozone.

On growth, the Bank of England’s Quarterly Inflation Report was everything that was to be expected. The Bank emphasised the risks to the economy, the main one being the on-going issues in the Eurozone, and said that due to one-off factors this year’s growth projections would be difficult to predict. All in all they expect GDP to remain as a “zigzag” bouncing around the 0% level through the year. They did appraise their inflation outlook higher which has caused some analysts to moderate their views on further quantitative easing. We would not be so quick to judge given the on-going tensions across the Channel and the insulating effect that further QE could have if the worst comes to the worst.

Despite yesterday’s poor unemployment numbers consumer confidence has risen to the highest since August of last year. This, we believe, is mainly due to consumers feeling the effects of inflation slipping whilst catastrophic headlines from financial markets were at a minimum during the survey period. Whether this trend lasts through the year will have to remain to be seen. This number helped the pound onwards versus its basket but most movement is down to the travails of the single currency at the moment.

Overnight, the Federal Reserve minutes from the latest meeting showed that members remain divided over whether further asset purchases are needed, mainly as a result of the increase in prospects for the US economy since the previous meeting. It does seem that they are ready to pounce if the economy starts to lose steam.

News will still have a Hellenic tinge to it today, as we get closer to Monday’s meeting. Data comes mainly from the US with initial jobless claims expected to remain around the “new normal” of 365k.

Latest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Markets Have Enough of Greek Indecision

Published 02/16/2012, 05:16 AM

Updated 07/09/2023, 06:31 AM

Markets Have Enough of Greek Indecision

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.