U.S markets were higher as talks to raise the debt ceiling temporarily were discussed as well as a proposal to end the budget standoff in the U.S. Congress. No deal was reached and Congress went home Saturday evening. They will meet again today.

Stocks in China were higher as investors liked a rising inflation report, however other Asian markets were lower as sentiment went sour over the continued deadlock in the United States over the debt ceiling. They have until October 17, in 3 days, to reach an agreement. Dow Jones futures are also down today by over 100 points. Would seem markets are tired of talks and want a solution. Senate leader Harry Reid (D) had “productive” talk with Senate Republican leader Mitch McConnell.

STOCKS

The DJIA was up 111 points to finish at 15,237.11. The day before the DJIA was up 300 points, the second best day for 2013 and was up one percent for the week. The S&P 500 was up 10.64 points to close at 1,703.20. The index was up a marginal 0.75 percent for the week. The Nasdaq Composite rose 31 points to finish at 3,791.87. For the week the NASDAQ was down 0.42 percent. This ended a five week winning streak.

Today, U.S. Bond Markets will be closed for Columbus Day.

The Shanghai Composite extended its gains after rising 2.5 percent last week, Sentiment was helped by a inflation that rose to a seven month high. Also producer prices fell 1.3 percent (annually). Export data was down. That hurt he Australian S&P/ASZ which was off 0.5 percent. The Kospi traded modestly lower on the day and Hong Kong and Japanese markets were closed for a public holiday.

CURRENCIES

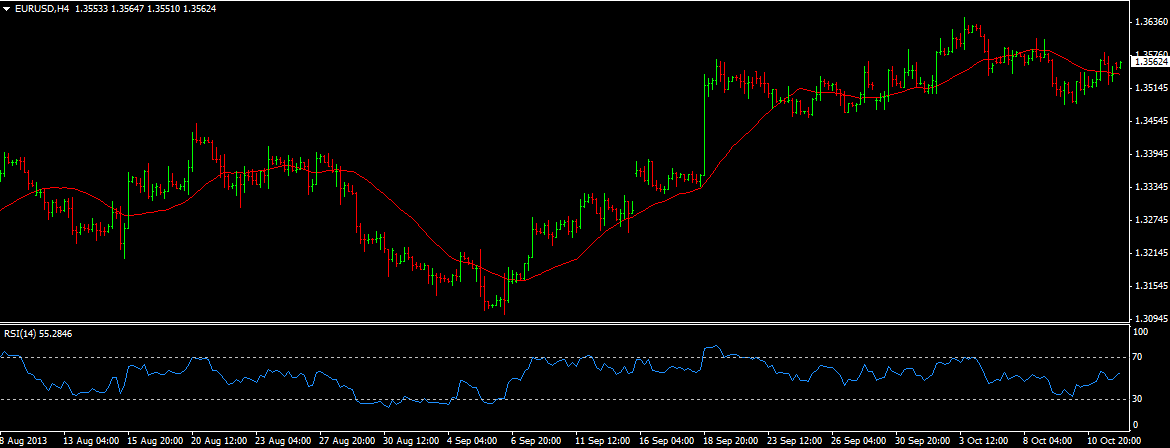

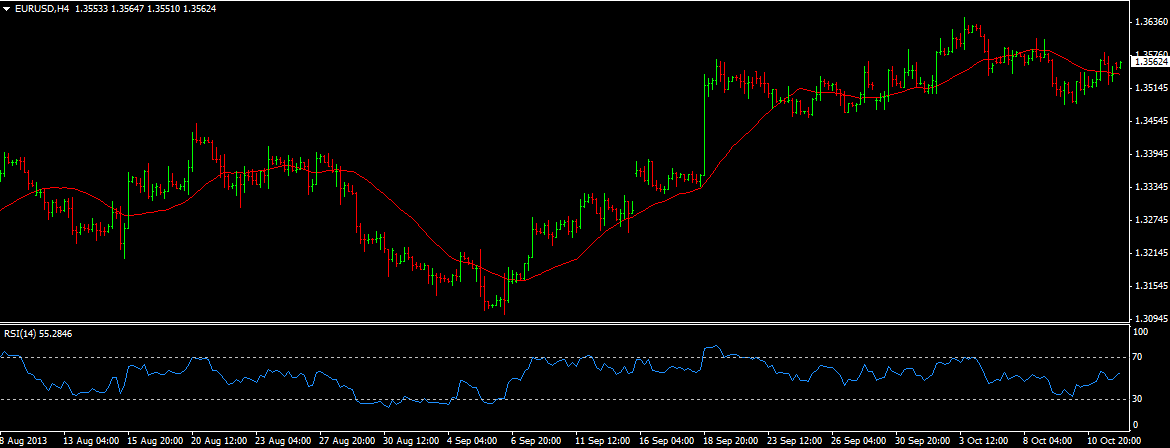

The EUR/USD (1.3563) has moved higher and is now aiming for 1.360 then 1.3700. Bond yields are supporting the euro right now as German to U.S. 2 year spreads have narrowed.

The GBP/USD (1.5982) is trading quietly as support at the rising trend line near 1.5905 is holding. We are aiming for 1.6000 then 1.6050. The USD/JPY (98.274) has moved lower and prepares to test 98.00. If this holds, we can test 99.00 again.

COMMODITIES

Copper (3.2675) is moving higher and is now at a resistance level. If it holds, we can fall back to 3.2500. Gold (1270.20) is below 1275 but we have good support at 1250 which could hold. If it breaks we can see 1225. The Dollar Index has gained, which is weakening the yellow metal.

Silver (21.135) is below 21.500 and about to test 21.00. If that levels holds we can retest 21.50 then move up to 23.00.

TODAY’S OUTLOOK

Eyes are on what Congress does. We need a resolution to the debt ceiling or expect heavy volatility in all financial markets. Today is Columbus Day in the U.S. so banks are closed but the financial markets are open. We expect thin volumes however.

Stocks in China were higher as investors liked a rising inflation report, however other Asian markets were lower as sentiment went sour over the continued deadlock in the United States over the debt ceiling. They have until October 17, in 3 days, to reach an agreement. Dow Jones futures are also down today by over 100 points. Would seem markets are tired of talks and want a solution. Senate leader Harry Reid (D) had “productive” talk with Senate Republican leader Mitch McConnell.

STOCKS

The DJIA was up 111 points to finish at 15,237.11. The day before the DJIA was up 300 points, the second best day for 2013 and was up one percent for the week. The S&P 500 was up 10.64 points to close at 1,703.20. The index was up a marginal 0.75 percent for the week. The Nasdaq Composite rose 31 points to finish at 3,791.87. For the week the NASDAQ was down 0.42 percent. This ended a five week winning streak.

Today, U.S. Bond Markets will be closed for Columbus Day.

The Shanghai Composite extended its gains after rising 2.5 percent last week, Sentiment was helped by a inflation that rose to a seven month high. Also producer prices fell 1.3 percent (annually). Export data was down. That hurt he Australian S&P/ASZ which was off 0.5 percent. The Kospi traded modestly lower on the day and Hong Kong and Japanese markets were closed for a public holiday.

CURRENCIES

The EUR/USD (1.3563) has moved higher and is now aiming for 1.360 then 1.3700. Bond yields are supporting the euro right now as German to U.S. 2 year spreads have narrowed.

The GBP/USD (1.5982) is trading quietly as support at the rising trend line near 1.5905 is holding. We are aiming for 1.6000 then 1.6050. The USD/JPY (98.274) has moved lower and prepares to test 98.00. If this holds, we can test 99.00 again.

COMMODITIES

Copper (3.2675) is moving higher and is now at a resistance level. If it holds, we can fall back to 3.2500. Gold (1270.20) is below 1275 but we have good support at 1250 which could hold. If it breaks we can see 1225. The Dollar Index has gained, which is weakening the yellow metal.

Silver (21.135) is below 21.500 and about to test 21.00. If that levels holds we can retest 21.50 then move up to 23.00.

TODAY’S OUTLOOK

Eyes are on what Congress does. We need a resolution to the debt ceiling or expect heavy volatility in all financial markets. Today is Columbus Day in the U.S. so banks are closed but the financial markets are open. We expect thin volumes however.