Investing.com’s stocks of the week

The gold price declined sharply late on Friday, with a decline in the headline US unemployment rate encouraging traders to sell gold and move back into equities. Despite the fact that it usually benefits from these “risk on” types of moves, silver was also hit – the price tumbling back from above $34 per ounce towards $33.50. They’ve suffered further losses in trading this morning, but remain above key support levels at $1,700 for gold, and $32.50 for silver.

Though the Greek debt situation still lurks ominously in the background (with many now thinking it inevitable that the country will default by March 20 – the date when €14.5 billion of its debt matures) Friday’s big news was of course the headline US unemployment rate, which fell from 8.5% to 8.3% December to January. Mainstream media is increasingly talking up the “American recovery”, with some starting to speculate that these improvements may force Fed Chairman Ben Bernanke to row back on his commitment to keep interest rates at zero until late 2014.

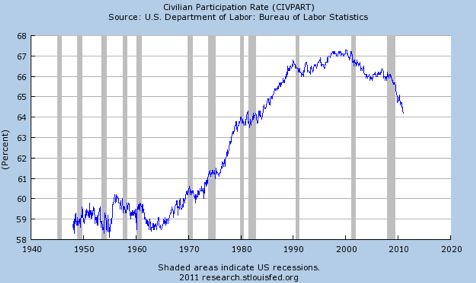

It pays to take these employment figures with a rather large pinch of salt, however. Lost in all the happy talk is the ever-declining “Labor Participation Rate” – the number of working age who form part of the US workforce. This figure is declining because more and more job seekers are deemed by the Bureau of Labor Statistics to have “given up” looking for work, which means that they conveniently aren’t deemed to be a part of the American work force and thus aren’t added to the total number of those counted as unemployed in the headline numbers released each month.

As Jesse comments, it is entirely understandable why the inclusion of new census data should have resulted in a sudden drop in the participation rate from December to January. Less easy to explain away is the longer-term trend, as seen in the St Louis Fed chart below:

Research Affiliates Founder Rob Arnott points out in his latest King World News interview that less than 75% of 20-65 year old men in America have jobs. Back in the 1950s, this figure was 93% – meaning a real unemployment rate among working-age men in today's America of around 18%.

However, though the statistics may be flawed in that they consistently underestimate unemployment, that should not lead people to conclude that the Fed’s money printing effort are not inducing a pickup in economic activity. As seen from private estimates of M3, banks are lending an increasing amount of money, which will encourage gains in asset markets (and will likely lead to higher inflation). This could well lead to talk of a new “boom”, with headline unemployment numbers decreasing further over the coming months.

The trillion-dollar question then of course, would be how the Fed reacts to this increasing inflation.

Though the Greek debt situation still lurks ominously in the background (with many now thinking it inevitable that the country will default by March 20 – the date when €14.5 billion of its debt matures) Friday’s big news was of course the headline US unemployment rate, which fell from 8.5% to 8.3% December to January. Mainstream media is increasingly talking up the “American recovery”, with some starting to speculate that these improvements may force Fed Chairman Ben Bernanke to row back on his commitment to keep interest rates at zero until late 2014.

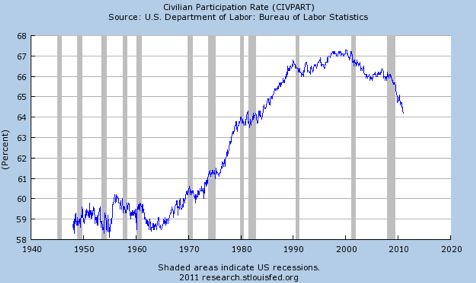

It pays to take these employment figures with a rather large pinch of salt, however. Lost in all the happy talk is the ever-declining “Labor Participation Rate” – the number of working age who form part of the US workforce. This figure is declining because more and more job seekers are deemed by the Bureau of Labor Statistics to have “given up” looking for work, which means that they conveniently aren’t deemed to be a part of the American work force and thus aren’t added to the total number of those counted as unemployed in the headline numbers released each month.

As Jesse comments, it is entirely understandable why the inclusion of new census data should have resulted in a sudden drop in the participation rate from December to January. Less easy to explain away is the longer-term trend, as seen in the St Louis Fed chart below:

Research Affiliates Founder Rob Arnott points out in his latest King World News interview that less than 75% of 20-65 year old men in America have jobs. Back in the 1950s, this figure was 93% – meaning a real unemployment rate among working-age men in today's America of around 18%.

However, though the statistics may be flawed in that they consistently underestimate unemployment, that should not lead people to conclude that the Fed’s money printing effort are not inducing a pickup in economic activity. As seen from private estimates of M3, banks are lending an increasing amount of money, which will encourage gains in asset markets (and will likely lead to higher inflation). This could well lead to talk of a new “boom”, with headline unemployment numbers decreasing further over the coming months.

The trillion-dollar question then of course, would be how the Fed reacts to this increasing inflation.