Gold Non-Commercial Speculator Positions:

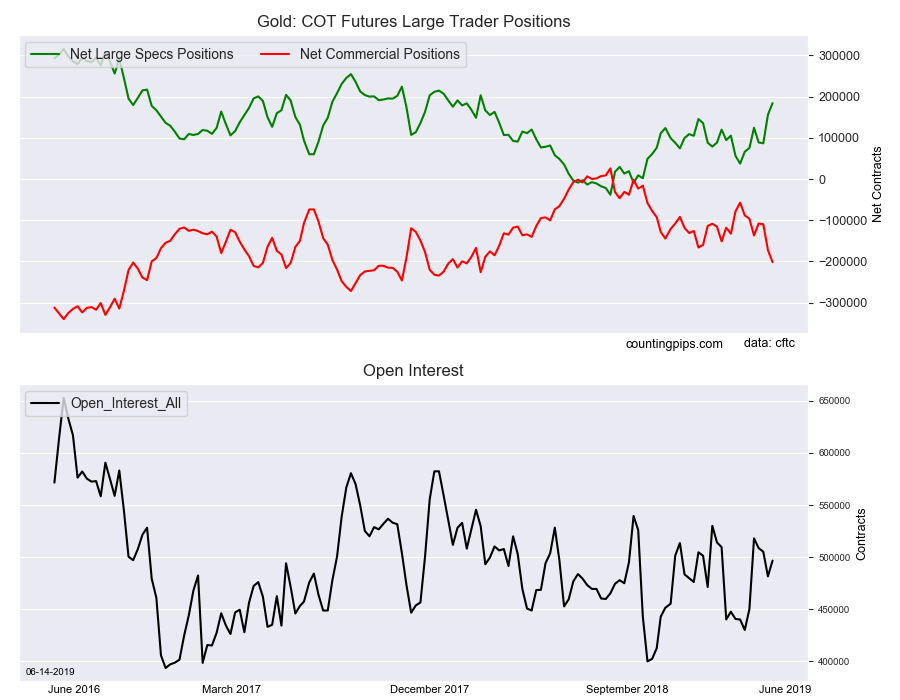

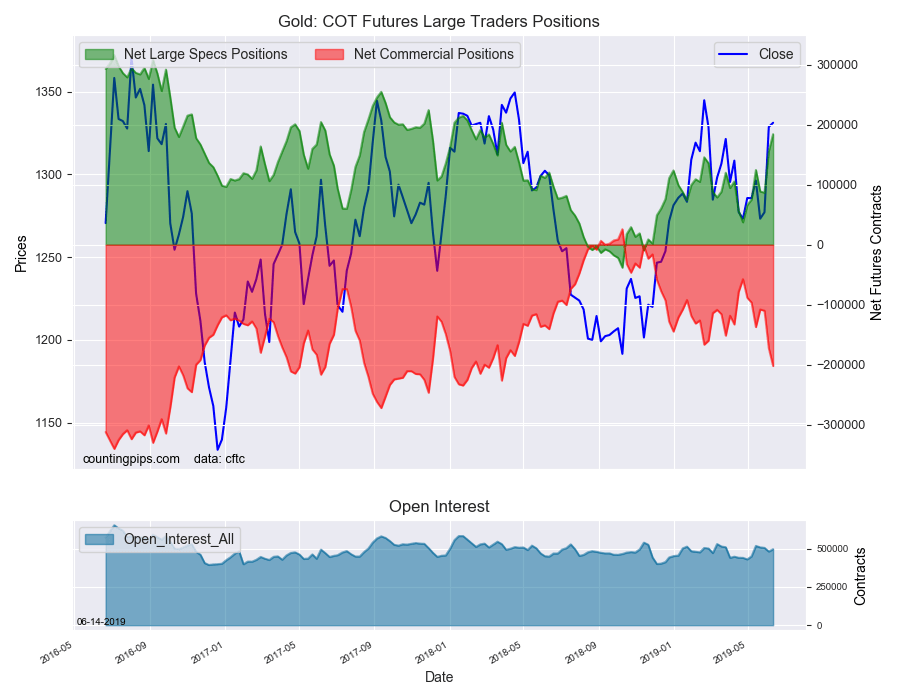

Large precious metals speculators once again sharply advanced their bullish net positions in the Gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 184,238 contracts in the data reported through Tuesday, June 11th. This was a weekly gain of 28,123 net contracts from the previous week which had a total of 156,115 net contracts.

The week’s net position was the result of the gross bullish position (longs) advancing by 9,637 contracts (to a weekly total of 250,114 contracts) while the gross bearish position (shorts) declined by -18,486 contracts for the week (to a total of 65,876 contracts).

The net speculator positions rose strongly for a second week after rising by a record weekly high last week (+69,427 contracts). This week was not as strongly bullish as last week because the net change saw twice as many short positions abandon their positions this week compared to the longs initiating bullish bets (it was the opposite last week).

Gold net positions have now jumped by 97,550 contracts in just the past two weeks and currently, the bullish level has moved up to the highest point since March 27th of 2018, a span of 64 weeks.

Gold Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -202,027 contracts on the week. This was a weekly drop of -29,451 contracts from the total net of -172,576 contracts reported the previous week.

Gold Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold Futures (Front Month) closed at approximately $1331.20 which was an increase of $2.50 from the previous close of $1328.70, according to unofficial market data.