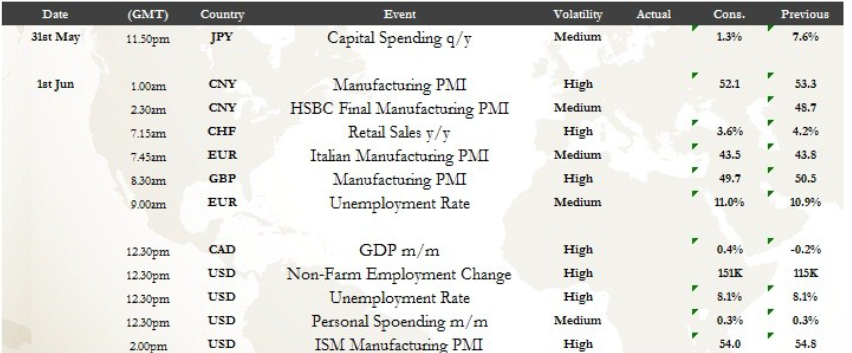

The Wall Street Journal has published an article that reported, “Both the European Union and IMF want to avoid having to bail out Spain at all costs...but early planning is under way given that the country is struggling to raise a €10 billion ($12.4 billion) shortfall in funds to bail out Bankia.” Both the International Monetary Fund and Spain have denied that they are in talks regarding a bailout. However, we are afraid that where there is smoke there is fire. It is entirely implausible that policymakers have not already started making plans for the possibility that Spain will need financial assistance. Meanwhile, both MSCI Inc. and Standard & Poor's have announced the way that they will recalculate various indices should Greece leave the common currency. The EUR remains pressured and opens the morning at 1.2360.

Meanwhile, the pressure on German Chancellor Merkel to act decisively, and soon, to stabilise the eurozone, has intensified as both Italian PM Monti and ECB President Draghi called for Germany to accept the concept of direct official aid for Europe's ailing banks. Monti has also called for a mechanism for common borrowing across the eurozone. However, Germany has once again rejected proposals by the European Commission, only yesterday, for bank recapitalisation using common funds and the introduction of a “eurobond.” Merkel has also lost a strong friend in the defeat of Nicolas Sarkozy. New French President, Francois Hollande, is challenging austerity and calling for a more active ECB in further defiance of Germany's stance. One may well wonder how long Germany will tolerate the squabbling of its dysfunctional "family." The Australian dollar opens the morning at 0.9730.

Greek opinion polls continue to drive the equity markets as the latest poll, which shows New Democracy, a pro-bailout party, leading the anti-bailout party Syriza Party, prompting a late reversal in the S&P 500, after the index traded down more than 1.1% at one stage. The S&P 500 has closed down 0.23% at 1,310. Stocks fell as Americans applying for unemployment benefits rose and business activity grew at the slowest rate in more than two years. Earlier in Europe, shares were mixed with the DAX losing 0.26% while the FTSE gained 0.45%.

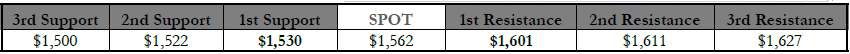

Commodity prices have seen further falls as the CRB index lost 2.08 points to 272.97. WTI continues to lose ground on increasing concerns over global growth and is down another 1.2% $86.80. Precious metals have barely moved with gold trading flat at $1,566 while silver has fallen 0.5% to $27.80. Soft commodities are broadly lower with wheat, coffee and soybean recording the biggest losses. Copper is down 0.62%.

Gold swung in a relatively narrow range of $1552 - $1572 yesterday before opening this morning flat at $1561, posting a 6% loss in May. As we expected fluctuations within the triangle development continued with offers around the upside of $1572 checking further gains. However the bullion was held up by technical bids and weak short exits not far above the critical support zone of $1520-$1530 as most markets fell on a weaker ADP private sector employment in US, increased US news claim of unemployment benefits and ongoing concern about Spain's capacity to raise capital without help. We are

smelling a comeback of some safe haven demand for the precious metal as it outperformed crude and equity markets overnight. But we remain firmly bearish in the medium-term as the possibility of a credit squeeze is looming and room for monetary policy adjustments are limited.

Compass Direction

Short-Term Medium-Term

NEUTRAL BEARISH

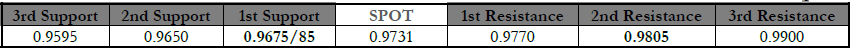

AUD/USD sentiment across the markets seesawed over the last 24 hours as the much weaker

than expected Australian Building numbers started the turmoil with one of the worst results I have

ever seen. AUD broke below the previous 0.9690 lows as stops were triggered down to 0.9670. However,

the overly short markets squeezed shorts as we expected and the momentum is getting overdone.

During Europe and the US session the markets continued to be choppy with the price reaching the mid 0.9700 as reports the IMF are already working out the details of a bailout packages for Spain surfacing. Mixed US numbers caused more grief with the price back towards the lows around 0.9680 before closing now at 0.9730. China Manufacturing PMI and US nonfarm payrolls will be the focus for today until the close and all we can expect is more volatile markets. Play positions close to your chest and don’t chase a

trade if trading at all. We will be selling into rallies towards 0.9800 if seen and buying back dips towards

the recent lows or the low 0.96’s.

Compass Direction

Short-Term Medium-Term

NEUTRAL BEARISH AUD/USD" title="AUD/USD" width="515" height="470">

AUD/USD" title="AUD/USD" width="515" height="470"> AUD/USD1" title="AUD/USD1" width="852" height="50">

AUD/USD1" title="AUD/USD1" width="852" height="50">

Disclosure And Disclaimer

Compass Global Markets Pty Ltd (“Compass Global Markets”) ACN 144 657 885, Authorised Representative No. 377377, is a Corpo-rate Authorised Representative of Calibre Investments Pty Ltd (Australian Financial Services License No. 337927). Please refer to the Financial Services Guide which is available through our website www.compassmarkets.com for more information regarding the financial services that we offer.

All references to prices, amounts and currency are in Australian dollars unless otherwise noted.

This report is provided for Australian residents only and is not intended for use by residents of any other country.

GENERAL ADVICE WARNING: The advice provided in this report has been prepared without taking into account your particular objectives, financial situation or needs. You should, before acting on the advice, consider the appropriateness of the advice having regard to these matters and, if appropriate, seek independent financial, legal and taxation advice before making any financial investment decision.

This report has been prepared for the general use of Compass Global Markets clients and must not be copied, either in whole or in part, or distributed to any other person. This report and its contents are not intended to be construed as a solicitation to buy or sell any security, product or asset, or to engage in or refrain from engaging in any transaction.

Compass Global Markets does not guarantee the performance of any investment discussed or recommended in this report. This report and the information used within may include estimates and projections which constitute a forward looking statement that express an expectation or belief as to future events, results or returns. No guarantee of future events, results or returns is given or implied by Compass Global Markets. Such statements are made in good faith and based on reasonable assumptions at the time of publication. However, such statements are also subject to risks, uncertainties and other factors which could cause actual results to differ substantially from the estimates and projections contained in this report or otherwise provided by Compass Global Markets.

Any information referencing past performance is not indicative of future performance. All information in this report has been obtained from sources believed to be accurate. Compass Global Markets does not give any representation or warranty as to reliability, accuracy or completeness of information contained in this report and therefore all responsibility is expressly disclaimed, whether due to negligence or otherwise. The information presented and opinions expressed in this report are given as of the date hereof and are subject to change without notice. We hereby disclaim any obligation to inform you of any changes after the date hereof in any matter set forth in this report.

Global Compass Markets, its affiliate and their employees may hold positions in the financial products, or securities or derivatives of, in the companies referred to in this report from time to time.

Analyst Certification: The views or opinions expressed in this report accurately reflect the personal views of the analyst(s) and no part of the remuneration of the analyst(s) was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views in this report. Any views or opinions expressed are the author's own and may not reflect the views or opinions of Compass Global Mar-kets unless specified otherwise.