Investing.com’s stocks of the week

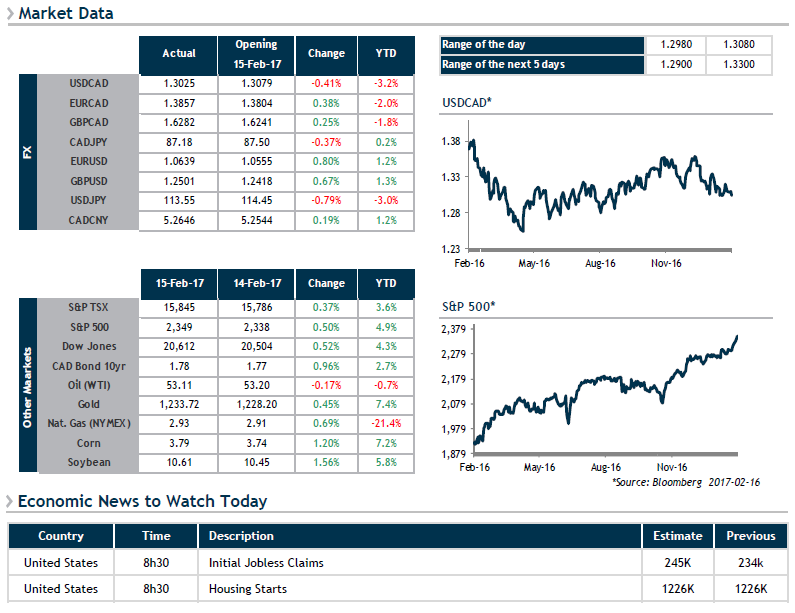

Data released yesterday showed a rise in inflation in the United States, which was well received by investors, who drove North American stock markets to new highs. It is impressive to see that since the start of the year, the S&P500, Nasdaq and S&P TSX Index in Toronto are up 4.9%, 8.1% and 3.6% respectively.

After a number of years of inflation below the target set by central banks, the current context is positive and suggests a normalization of interest rates. Since President Trump’s inauguration, the outlook for inflation is up sharply in the United States and in several regions around the world. The anticipated implicit U.S. inflation rate over the next five years according to bond markets is now close to 2%, the highest since 2011. The trend is similar in Canada and the eurozone countries, albeit to a lesser extent.

It also should be noted that the European Parliament has approved CETA, the free trade agreement between Canada and the European Union. Although its impact will be marginal, the treaty is favourable in a context of renegotiating NAFTA.