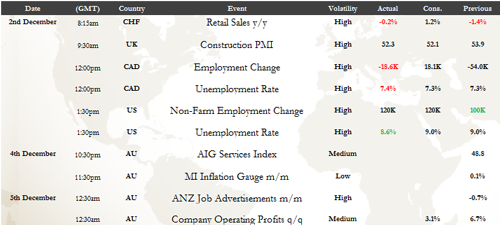

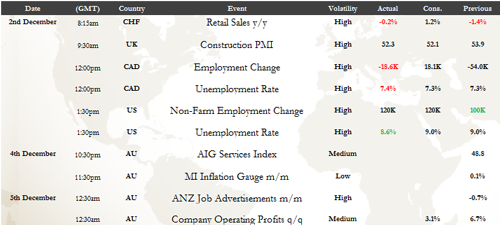

Markets last week were buoyed by coordinated central bank intervention in the overnight swap market to increase liquidity to banks and a strong series of economic data releases out of the US that started with the release of strong Thanksgiving retail sales figures of the previous week. Furthermore, on Friday night there was an unexpected drop in the US unemployment rate from 9% to 8.6% despite a slightly weaker than expected Non-Farm Employment Change Number that came in at 120K against expectations of 126K. The EUR/USD made its first weekly gain in six weeks and opens Asia today at 1.3400 after trading as high as 1.3552 in the final trading session last week.

The Swiss Franc fell as the nation announced that it may consider additional measures to weaken the currency. Speculation that the ECB may funnel loans through the IMF to lend to struggling European nations continued to support investor sentiment. Tomorrow we have the RBA rate decision which is likely to be a close call as the Bank weighs the strength in our local economy with the continuing and intensifying crisis in Europe. Today, we also have the release of the ANZ jobs ad data and the AIG Services Index. The AUD/USD is opening this morning at 1.0250 after having traded as high as 1.0327 on Friday.

Equity markets closed the week on a solid note. European stocks firmed as hopes rose that another European Summit to be held this week would finally enact measures that would address the two year old crisis that started in Greece. The DAX gained 0.74% to 6,081 while the FTSE rose 1.15% to 5,552. The S&P 500 closed the session flat after initially rising on an unexpected fall in the US unemployment rate to the lowest level since March 2009. The index has gained more than 13% since the 2011 low recorded on October 3 with financial shares gaining more than 9% last week.

Commodity prices were subdued closing the session largely unchanged. Crude continued to firm rising 0.76% to $100.96 as tensions rise between Iran, OPEC's second biggest crude producer, and the West. A US Senate bill is being introduced that will make it much harder for companies to pay for oil imports from Iran by increasing curbs on financial institutions that deal with Iran's central bank. Precious metals were mixed with gold higher by 0.66% to $1,751 while silver fell 0.22% to $32.69. Soft commodities were mixed with coffee down almost 3% while wheat rose 2%. Copper prices rose 1.43%. The CRB index closed 0.24% at 313.55.

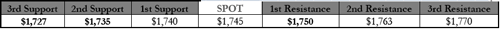

GOLD moved marginally higher in offshore trade as the USD remained under pressure and as copper prices continued to gain as investors increase bullish bets as US data improves. We should see gold remain very well bid in the lead up to the European Summit on the 9th as investors remain cautious about the outcome and any serious resolution the crisis. Gold finished US trade higher by 0.65% at $1,746. Gold was subdued in offshore trade on Friday and after another brief breach of resistance at $1,75/52 and run-up to $1,663 we saw profit taking set-in as equities paired earlier gains and the USD remained directionless. Gold remains very well bid and continues to grind higher as investors push cash holdings into gold as the European crisis continues. Any pullbacks have been short lived and as long as we remain above $1,727 in the short-term we will continue to push higher. Resistance remains at $1,750 and higher at $1,763 and a break of the latter should see accelerated gains targeting $1,800 which is major resistance. We remain a buyer of dips towards $1,727-35 with stops below $1,700. Our target of $1,950-$2,000 remains but we may need till the end of Jan to reach this depending on this weeks outcome in Europe.

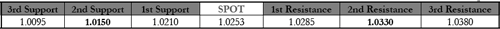

AUD/USD rallied sharply higher during the European morning as the market thin liquidity and reports that the European Central Bank was to lend the IMF $200bio to help fund the weaker Eurozone states. AUD/USD topped out as expected around the weekly high at 1.0330 just as the US Non-Farm Payroll numbers were released slightly above the expected with solid revisions to the last couple of releases. AUD/lUSD was smashed back down to 1.0200 before clos-ing the eventful week at 1.0215. Small inter-bank buying early this morning has the pair now at 1.0250. ANZ Job Advertisements is the only data for the AUD to trade around today but we will be looking for the market to remain on the sidelines until the European open. Sell-ing pressure should start if the pair manages to make the high 1.02’s with last weeks top unlike-ly to be broken during Asia. On the downside the 1.0150 level remains a pivot point and after falling short on Friday’s US session dip it could be too far for today!

The Swiss Franc fell as the nation announced that it may consider additional measures to weaken the currency. Speculation that the ECB may funnel loans through the IMF to lend to struggling European nations continued to support investor sentiment. Tomorrow we have the RBA rate decision which is likely to be a close call as the Bank weighs the strength in our local economy with the continuing and intensifying crisis in Europe. Today, we also have the release of the ANZ jobs ad data and the AIG Services Index. The AUD/USD is opening this morning at 1.0250 after having traded as high as 1.0327 on Friday.

Equity markets closed the week on a solid note. European stocks firmed as hopes rose that another European Summit to be held this week would finally enact measures that would address the two year old crisis that started in Greece. The DAX gained 0.74% to 6,081 while the FTSE rose 1.15% to 5,552. The S&P 500 closed the session flat after initially rising on an unexpected fall in the US unemployment rate to the lowest level since March 2009. The index has gained more than 13% since the 2011 low recorded on October 3 with financial shares gaining more than 9% last week.

Commodity prices were subdued closing the session largely unchanged. Crude continued to firm rising 0.76% to $100.96 as tensions rise between Iran, OPEC's second biggest crude producer, and the West. A US Senate bill is being introduced that will make it much harder for companies to pay for oil imports from Iran by increasing curbs on financial institutions that deal with Iran's central bank. Precious metals were mixed with gold higher by 0.66% to $1,751 while silver fell 0.22% to $32.69. Soft commodities were mixed with coffee down almost 3% while wheat rose 2%. Copper prices rose 1.43%. The CRB index closed 0.24% at 313.55.

GOLD moved marginally higher in offshore trade as the USD remained under pressure and as copper prices continued to gain as investors increase bullish bets as US data improves. We should see gold remain very well bid in the lead up to the European Summit on the 9th as investors remain cautious about the outcome and any serious resolution the crisis. Gold finished US trade higher by 0.65% at $1,746. Gold was subdued in offshore trade on Friday and after another brief breach of resistance at $1,75/52 and run-up to $1,663 we saw profit taking set-in as equities paired earlier gains and the USD remained directionless. Gold remains very well bid and continues to grind higher as investors push cash holdings into gold as the European crisis continues. Any pullbacks have been short lived and as long as we remain above $1,727 in the short-term we will continue to push higher. Resistance remains at $1,750 and higher at $1,763 and a break of the latter should see accelerated gains targeting $1,800 which is major resistance. We remain a buyer of dips towards $1,727-35 with stops below $1,700. Our target of $1,950-$2,000 remains but we may need till the end of Jan to reach this depending on this weeks outcome in Europe.

AUD/USD rallied sharply higher during the European morning as the market thin liquidity and reports that the European Central Bank was to lend the IMF $200bio to help fund the weaker Eurozone states. AUD/USD topped out as expected around the weekly high at 1.0330 just as the US Non-Farm Payroll numbers were released slightly above the expected with solid revisions to the last couple of releases. AUD/lUSD was smashed back down to 1.0200 before clos-ing the eventful week at 1.0215. Small inter-bank buying early this morning has the pair now at 1.0250. ANZ Job Advertisements is the only data for the AUD to trade around today but we will be looking for the market to remain on the sidelines until the European open. Sell-ing pressure should start if the pair manages to make the high 1.02’s with last weeks top unlike-ly to be broken during Asia. On the downside the 1.0150 level remains a pivot point and after falling short on Friday’s US session dip it could be too far for today!