Today's UK inflation report will drop clues about the outlook for monetary policy as the economy struggles in Q4, followed by the final read on US retail sales ahead of Christmas and the mood among US homebuilders.

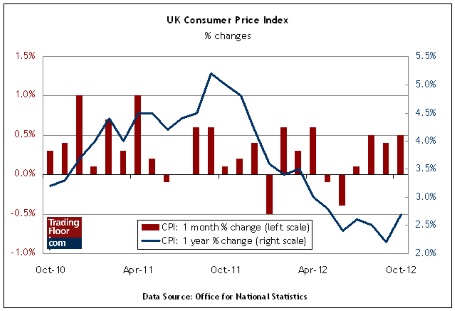

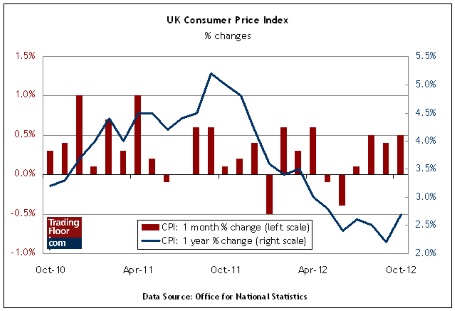

UK CPI (09:30 GMT) Inflation in Britain is above the Bank of England's target, while economic growth in the fourth quarter seems to be slowing—the macro equivalent of life between the rock and the hard place. Today's inflation report will provide fresh context for deciding how tight of a squeeze awaits for the UK generally, and the Bank of England specifically.

The UK officially emerged from recession only recently (in Q3), but rising price pressures are probably keeping the BOE from doing more to juice the economy. That may change with the incoming BOE chief Mark Carney, who caught everyone's attention last week with his remarks on the perceived virtues of so-called GDP targeting, which he seems inclined to use as a replacement for the BOE's current inflation-targeting policy. But Carney doesn't formally join the bank until next spring, which means that today's CPI report for November may drop hints about what to expect for monetary policy in the immediate future, namely: Is an interest-rate cut likely if the economy weakens further?

In the previous update, the annual pace of consumer inflation jumped to 2.7% in October from 2.2% in September. That's well above the BOE's 2.0% target, but in some respects that's old news--inflation hasn't been under 2% since November 2009, and it's a safe bet that we won't see anything close to the 2.0% mark in today's update. But is the annual pace rising?

I anticipate that October's 2.7% rate will more or less hold, perhaps even slip a bit, which implies that the BOE won't change its 0.5% target rate any time soon. The central bank's next scheduled rate announcement is January 10. A big move in today's CPI number could influence that meeting, but the odds look good for expecting November's inflation to echo October's rate.

Looking further out in time is another matter. “The stickiness in inflation is likely to continue and the rate may rise to around 3 percent next year,” an economist told Bloomberg last week. “If inflation starts rising above 3 percent it’s going to become more difficult for [the BOE] to justify doing more QE and keep their credibility.”

The case for doing more, however, is likely to grow if, as another economist warns, the odds are rising for a triple dip recession. "Early data suggest the UK is heading for a 'treble dip,' with GDP shrinking again in the fourth quarter of 2012." If so, the key question is whether the BOE will have any monetary room to maneuver. Today's report will deliver the first installment on an answer.

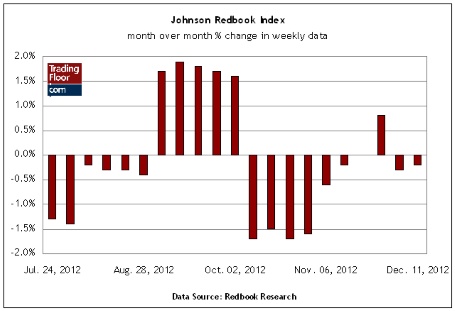

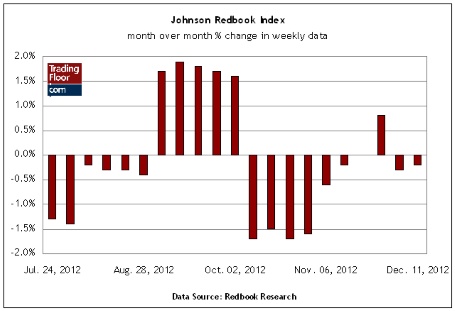

Redbook Index (13:55 GMT) The US holiday shopping season is in high gear and so retail sales numbers receive more attention than usual in the final weeks of year. With Christmas just a week away, today's weekly release of the Johnson Redbook Index is the last December data point for the retail sector before Santa climbs into his sled, which means that analysts and investors will be sure to give this report the once over.

In the previous update, national chain store sales fell 0.2% for the first two weeks of December compared with the same period in November, according to Redbook. That's the second decline in a row this month for this metric. Another weak report wouldn't do much to raise holiday cheer. On the other hand, last week's modestly upbeat retail sales report for November suggests that there's some tolerance for a bit of statistical humbug as we wind down the remaining numbers for 2012.

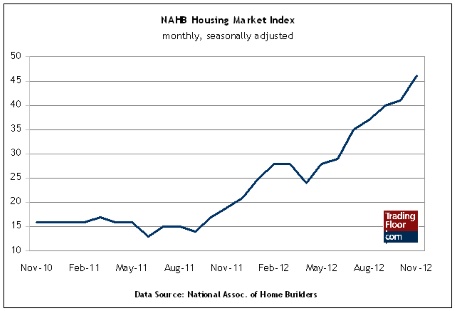

NAHB Housing Index (15:00 GMT) The rebound in the housing market has been a critical source of economic support this year for the US economy, so today's update on sentiment among homebuilders will be closely watched for guidance on where we go from here. To put it bluntly, the economy can't afford to lose this key source of growth when there's still so much uncertainty hanging over the macro outlook generally.

On that point, there's still concern over the deadlocked debate in Washington over the fiscal cliff. Economists warn that the failure to soften the scheduled tax hikes and spending cuts that start next month are the wrong medicine at the wrong time for an economy that's still growing modestly at best.

A big slump in the NAHB Housing Market Index (HMI) would certainly feed into those worries. But if there's cause for concern, the crowd is discounting the risks. The consensus forecast tells us that today's HMI update will tick up from last month's reading, which hit a six-year high.

As a quick check on that outlook, I ran HMI's 27 years of historical data through a pair of econometric forecasting models (ARIMA and exponential smoothing applications) in R. The result: these December point forecasts are also unchanged to slightly higher vs. November. If HMI can hold steady, the case will strengthen for thinking positively for real estate's contribution for growth, including tomorrow's report on November housing starts.

UK CPI (09:30 GMT) Inflation in Britain is above the Bank of England's target, while economic growth in the fourth quarter seems to be slowing—the macro equivalent of life between the rock and the hard place. Today's inflation report will provide fresh context for deciding how tight of a squeeze awaits for the UK generally, and the Bank of England specifically.

The UK officially emerged from recession only recently (in Q3), but rising price pressures are probably keeping the BOE from doing more to juice the economy. That may change with the incoming BOE chief Mark Carney, who caught everyone's attention last week with his remarks on the perceived virtues of so-called GDP targeting, which he seems inclined to use as a replacement for the BOE's current inflation-targeting policy. But Carney doesn't formally join the bank until next spring, which means that today's CPI report for November may drop hints about what to expect for monetary policy in the immediate future, namely: Is an interest-rate cut likely if the economy weakens further?

In the previous update, the annual pace of consumer inflation jumped to 2.7% in October from 2.2% in September. That's well above the BOE's 2.0% target, but in some respects that's old news--inflation hasn't been under 2% since November 2009, and it's a safe bet that we won't see anything close to the 2.0% mark in today's update. But is the annual pace rising?

I anticipate that October's 2.7% rate will more or less hold, perhaps even slip a bit, which implies that the BOE won't change its 0.5% target rate any time soon. The central bank's next scheduled rate announcement is January 10. A big move in today's CPI number could influence that meeting, but the odds look good for expecting November's inflation to echo October's rate.

Looking further out in time is another matter. “The stickiness in inflation is likely to continue and the rate may rise to around 3 percent next year,” an economist told Bloomberg last week. “If inflation starts rising above 3 percent it’s going to become more difficult for [the BOE] to justify doing more QE and keep their credibility.”

The case for doing more, however, is likely to grow if, as another economist warns, the odds are rising for a triple dip recession. "Early data suggest the UK is heading for a 'treble dip,' with GDP shrinking again in the fourth quarter of 2012." If so, the key question is whether the BOE will have any monetary room to maneuver. Today's report will deliver the first installment on an answer.

Redbook Index (13:55 GMT) The US holiday shopping season is in high gear and so retail sales numbers receive more attention than usual in the final weeks of year. With Christmas just a week away, today's weekly release of the Johnson Redbook Index is the last December data point for the retail sector before Santa climbs into his sled, which means that analysts and investors will be sure to give this report the once over.

In the previous update, national chain store sales fell 0.2% for the first two weeks of December compared with the same period in November, according to Redbook. That's the second decline in a row this month for this metric. Another weak report wouldn't do much to raise holiday cheer. On the other hand, last week's modestly upbeat retail sales report for November suggests that there's some tolerance for a bit of statistical humbug as we wind down the remaining numbers for 2012.

NAHB Housing Index (15:00 GMT) The rebound in the housing market has been a critical source of economic support this year for the US economy, so today's update on sentiment among homebuilders will be closely watched for guidance on where we go from here. To put it bluntly, the economy can't afford to lose this key source of growth when there's still so much uncertainty hanging over the macro outlook generally.

On that point, there's still concern over the deadlocked debate in Washington over the fiscal cliff. Economists warn that the failure to soften the scheduled tax hikes and spending cuts that start next month are the wrong medicine at the wrong time for an economy that's still growing modestly at best.

A big slump in the NAHB Housing Market Index (HMI) would certainly feed into those worries. But if there's cause for concern, the crowd is discounting the risks. The consensus forecast tells us that today's HMI update will tick up from last month's reading, which hit a six-year high.

As a quick check on that outlook, I ran HMI's 27 years of historical data through a pair of econometric forecasting models (ARIMA and exponential smoothing applications) in R. The result: these December point forecasts are also unchanged to slightly higher vs. November. If HMI can hold steady, the case will strengthen for thinking positively for real estate's contribution for growth, including tomorrow's report on November housing starts.