The NASDAQ 100 (QQQ) closed the week at new all-time highs, +1.65%, while the Dow Industrials (NYSE:DIA) was down -.2%. In fact, YTD, the Dow is down -9.36% while the Nasdaq 100 is up 18.62%, certainly a tale of two markets.

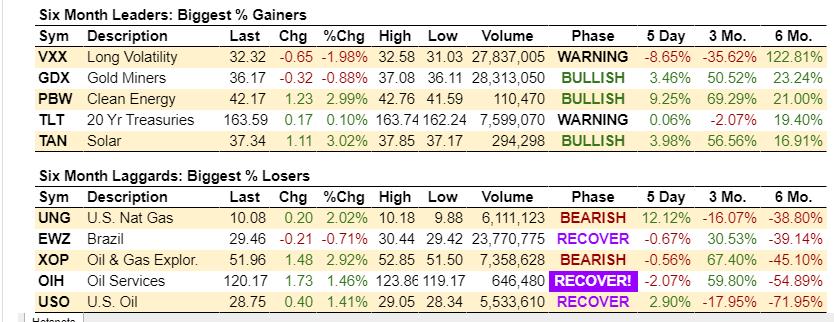

Of course, the Fed stepped up its intervention yet again after last week's attempt to sell-off. Stepping back and looking at the big themes with half the year in the rear-view mirror is that the Fed will now do anything to keep any asset class up if deemed necessary by the powers that be. One thing that seems to be running on its own fuel is Clean energy and that is glowing despite the terrible performance of fossil fuels, even with support Fed. This theme is certainly counter-intuitive and a divergence from the classic price patterns.

The fed’s balance sheet is out of control, has tripled since the beginning of the year and at historic levels. This leaves the dollar very vulnerable longer term. We could wake up one morning and find out that there are weak bids on US Treasuries and a dollar that it is not worth the paper it is printed on. So, it is not surprising that Gold Miners is a leading sector on our trip to Stagflation.

This Past Weeks Highlights

- Risk Gauges are still in showing risk-off in the broad market despite the rally to new highs in the NASDAQ 100

- Market Internals improved but still look heavy despite good overall price performance this week

- Emerging Markets broke out above its 200 DMA and is showing leadership on a short-term basis

- Soft Commodities are bottoming on a long-term basis

- Momentum is signaling that Technology (NYSE:XLK) Semi’s (NYSE:SMH) and Growth Stocks (NYSE:VUG) are looking tired on its daily charts

- Clean Energy (NYSE:PBW) and Solar (NYSE:TAN) have been top market performers

- Soft Commodities (NYSE:DBA)) are bottoming on a longer-term basis

- The euro is coiling on the weekly chart

Momentum often precedes price and one of the key themes underway is that our proprietary momo indicator is showing some divergences and overbought readings on leading sectors. For more about Marketgauge’ s proprietary real Motion Indicator press here

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI